Glossary (Adding As We Go)

Regular terms and phrases will be posted here…

A

ACS

the FICC’s Agency Clearing Service for triparty (GC) and DVP

Agency Debt

agency debt a.k.a "Agencies" are bonds issued by GSEs (government-sponsored enterprises) or federal agencies. These securities are backed but not guaranteed by the U.S. government. Issuers include the Federal Home Loan Banks (FHLBs), Fannie Mae, and Freddie Mac.

B

Basis Trades

this refers to the cash-futures basis trade, unless otherwise stated

Bilateral Repos

another term for specific collateral (SC) or DVP repos

BHCs

short for Bank Holding Companies

Big Six

the six biggest U.S. banks: Bank of America, Citi, Goldman Sachs, JPMorgan, Morgan Stanley, and Wells Fargo

BNY (BoNY)

Bank of New York, previously the Bank of New York Mellon (BNYM)

C

Clearing

arranging settlement (the actual transfer of cash and securities)

CME

Chicago Mercantile Exchange

CME Calendar Codes

January=F

February=G

March=H

April=J

May=K

June=M

July=N

August=Q

September=U

October=V

November=X

December=Z

Central Counterparty (a.k.a CCP/Central Clearing Provider)

becomes the counterparty to both buyer and seller, absorbing losses from defaults in exchange for members posting margin to a collective fund (a.k.a clearing fund), while enabling trades to “net” (i.e. does not count toward balance sheet size or leverage ratios like the SLR). find out more in this CCP guide

CIA (Conks Intelligence Agency)

market color and intel obtained by Conks.

CMOs (Ceiling Management Operations)

bill purchases by the Fed, explicitly or covertly designed to lower rates within its target band

CTD (Cheapest to Deliver)

the security that’s cheapest to deliver (within a delivery basket) into a futures contract

E

Ex-month-end dates

days not including the last of the month, when banks aren’t reporting

D

Dealer Banks

bank holding companies (BHCs) with a dealer subsidiary. each big banking name, like JPM and Citi, is structured as a bank holding company, sometimes containing hundreds of subsidiaries with different operations, such as a dealer business

Delivery Basket

basket of securities eligible for delivery in an expiring futures contract

F

FBOs (Foreign Banking Organizations)

foreign banks with U.S. banking operations (e.g. New York branches and agencies)

o/n Fed Funds

unsecured interbank rates in the Fed Funds (o/n FF) market, measured by EFFR (the Effective Federal Funds Rate), the Fed’s benchmark for unsecured interbank market rates

FHLBs

The Federal Home Loan Banks (FHLBs) are government-sponsored enterprises (GSEs) created to support mortgage lending and other community-based investments. They are highly active participants in money markets and fund various money-market trades, mostly arbitrage.

FHLB Discount Notes

Short-term debt issued by Federal Home Loans Banks (FHLBs)

FV

Five-Year Note Future

G

GC

repos where the cash lender doesn’t require a specific security to be pledged to them, since they are only concerned about earning yield and not trading the security. these securities are deemed general collateral and trade at similar (GC) rates. the opposite of GC is special (a.k.a specific collateral or “SC”) rates

G-SIBs

global systemically important banks

G-SIB Surcharge

an extra capital requirement for banks that qualify as G-SIBs, which are then separated into five buckets — “Bucket 4” being the most systemically important and “Bucket 0” being the least — based on bank size, complexity, interconnectedness, flexibility, and cross-border activity.

Great Compression

a Conks term for the suppression of ultra-short-end rates in early ‘25 and ‘26

Great Rebalancing

a Conks term for the Fed’s rebalancing of its SOMA portfolio

H

HQLA

high-quality liquid assets as defined by Basel III

I

IDBs (Interdealer Brokers)

An interdealer broker (IDB) acts as an intermediary, facilitating transactions between major institutions such as investment banks and broker-dealers.

IORB (interest on reserve balances)

the rate the Fed pays on banks’ reserve balances to anchor rates within its jaws (see below)

IORB-EFFR

the spread between the rate the Fed pays on banks’ reserve balances (IORB) and the average overnight unsecured interbank rate in the Fed Funds market (EFFR)

J

Jaws

a Conks term for the Fed’s target range

Upper Jaw = Top of the Target Range

Lower Jaw = Bottom of the Target Range

L

LCR (Liquidity Coverage Ratio)

qualifying banks must hold enough high-quality liquid assets (HQLA) to cover their (net) cash outflows over a 30-day period

M

Matched Books

a repo and a reverse repo (RRP) that use the same collateral in both trades. a dealer lends cash and receives a security as collateral (the reverse repo leg) and pledges it to receive cash (the repo leg), earning the spread between the two trades when they unwind

note: matched book trades are irregular. different securities, terms, and sizes are used etc.

Balance Sheet

↑REPO | ↑RRP

Money Funds

Shorthand for Money Market Funds (MMFs)

Month-ends

Last business day of the month (usually involving regulatory reporting dates)

Morning Fed Repos

overnight (o/n) Fed repos with morning settlement = the opening leg of the repo (where cash and collateral change hands) settles in the morning. then, after one night (i.e. the next day), the repo unwinds (where cash and collateral return to their original owners + repo interest). bank reserves are created by the Fed in the process

N

Netting

Banks pair opposing trades, which under certain scenarios, don’t require capital.

O

Overnight Fed Repos

overnight (o/n) repos with the Fed = cash borrowing from the Fed secured against collateral. when it’s evident that the Fed is the counterparty, Conks will use “o/n repos”, which is generally a shorthand for overnight repos, regardless of the Fed being the counterparty or not. bank reserves are created by the Fed in the process

OMOs

open market operations by the Fed, such as RRPs and repos

Overnight Fed RRPs (reverse repos)

overnight (o/n) reverse repos with the Fed = cash lending to the Fed secured against collateral from its asset portfolio (the SOMA). Conks refers to these also as “o/n Fed RRPs” or, in some cases, when it’s evident that the Fed is the counterparty, simply “o/n RRPs” — which is generally a shorthand for overnight reverse repos, regardless of the Fed being the counterparty or not. moreover, “the Fed’s RRP” is a shorthand for its o/n RRP facility

o/n FF (a.k.a Overnight Fed Funds)

the average interbank lending rate in the Fed(eral) Funds market, measured by EFFR (the Effective Federal Funds Rate), the Fed’s benchmark for unsecured interbank market rates

o/n NCCBR (Overnight NCCBR)

the average overnight rate in the uncleared DVP repo market

o/n SRPs (a.k.a Overnight Fed Repos)

repos conducted with the Fed

o/n TPR (Overnight Triparty)

the average overnight rate in the triparty repo market

o/n GC (Overnight GC)

a.k.a o/n GCF

the average overnight rate in the GCF repo market (interdealer GC)

o/n DVP (Overnight DVP)

the average overnight rate in the cleared DVP repo market

o/n RRP (Overnight RRPs)

the overnight rate the Fed pays on its reverse repos (RRPs)

P

POMOs

permanent open market operations

Q

“Quants” (jokingly)

definitely not real quants

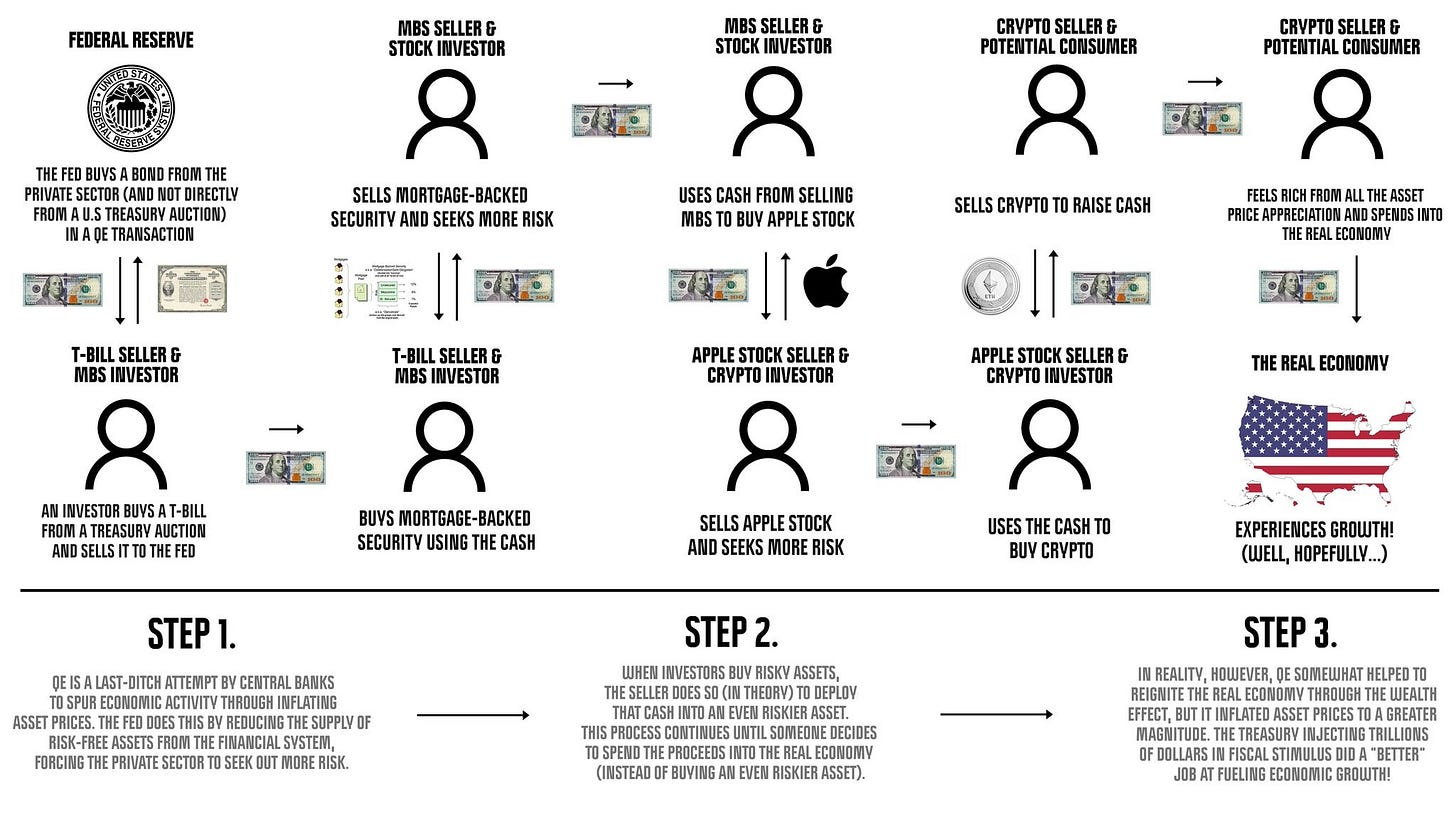

QE - Quantitative Easing

the Fed expands its balance sheet (↑ASSETS, ↑RESERVES), buying safe assets to absorb interest rate risk and stimulate risk assets/economy

QT - Quantitative Tightening

the Fed reduces its balance sheet (↓ASSETS, ↓RESERVES) by rolling off existing asset purchases, duration absorbed

R

Relative Value Trading

betting on the outperformance of one asset versus another

Repos (Repurchase Agreements)

For the uninitiated, a repo (short for repurchase agreement) is a cash loan secured against collateral. The cash borrower sells the security and repurchases it at a higher price at a later date. The difference in price, which is converted into a standardized repo rate, is the interest earned and the cost of borrowing cash. Trades are known as a reverse repo (RRP) from the perspective of the cash lender, and a repo from the perspective of the cash borrower, so reverse repos and repos are part of the same transaction, but the terminology is used to define which side of the repo trade someone is on. Even so, everybody calls it the repo market — not the RRP (reverse repo) market. In the opening “leg”, cash and collateral swap hands. In the closing leg, which occurs after the agreed loan period (such as o/n — overnight), cash and collateral are returned to their original owners, along with any repo interest owed by the cash borrower to the cash lender. Voila! A repo transaction.

Reverse Repos (Reverse Repurchase Agreements)

a repo (a sale of a security that’s repurchased sometime in the future for a higher price - thus paying interest) from the perspective of the securities borrower (cash lender)

RoE (Return on Equity)

banks raise equity capital to comply with capital regulation, where expanding bank balance sheets require more equity capital. moreover, different exposures incur different capital costs

banks thus allocate capital to trades that will turn a decent profit relative to the amount of capital required to enter a position, hence return on equity (RoE)

example:

JPM accepts a retail deposit and pays the customer 0.00% interest while receiving interest from the Fed on the reserves it receives from the depositors’ old bank as settlement

JPM must maintain an equity buffer to satisfy the Fed’s SLR, say 5%, to earn 0.20%* from the Fed. Thus, the return on equity (0.20/0.05) equals 4%.

*0.25% from the Fed (IORB) minus FDIC insurance fees of 0.05%

banks usually target a 15% RoE and will try to avoid low RoE activities unless it helps them satisfy regulation (holding retail deposits boosts banks’ liquidity scores, for example, improving their LCRs, unlike flightier institutional deposits, which have been pushed out by banks and turned into money market fund (MMF) shares

Balance Sheet

[↓DEPOSITS|↑MMF SHARES]

Risk-Weighted Assets

a bank’s assets (loans, securities, etc.) adjusted for risk factors

RWAs (Risk-Weighted Assets)

a shorthand for Basel’s III RWA (Risk-Weighted Assets) standard, where banks must hold more capital against riskier exposures and vice versa

RMOs

reserve management operations (covered here)

also known as: RMPs (reserve management purchases)

S

Securities Lenders

Securities lending involves owners transferring shares or bonds temporarily to borrowers, who provide collateral and pay a fee in return. These have different structures from repos.

Settlement

the actual transfer of cash and securities in a trade

SERFF

Most STIR desks will call the SOFR-FF basis simply “SERFF” (sir-eff-eff or serf). This is the Bloomberg code for SOFR-FF (inverted spread because futures are quoted as 100-implied rate), i.e. SOFR minus Fed Funds, the basis (difference) between SOFR (the Fed’s repo rate benchmark) and FF (a.k.a EFFR, the Fed’s policy rate and a measure of interbank lending rates) as implied by the futures market. SOFR (CME ticker: SR1) and FF (CME ticker: ZQ) futures are quoted at 100 minus the rate implied by the futures market, meaning a positive SOFR-FF futures spread implies easier conditions. In comparison, a positive “realized spread”, the actual SOFR-EFFR spread of rates published by the Fed, means tighter conditions. futures pricing for the basis in March 26 is viewable by typing “CME:SR1H2026-CBOT:ZQH2026” on TradingView or SERFFH6 on Bloomberg. note: “H” is the CME calendar code for March.

SLR (Supplementary Leverage Ratio)

a non-risk weighted ratio designed to prevent a build-up of leverage that risk-based capital ratios (RWAs - risk-weighted assets) can’t detect. See The Fed’s Relief Valve for more info

SOFR

Secured Overnight Financing Rate (the Fed’s overnight Treasury repo benchmark)

SOFR Flattener

Expecting more cuts or fewer hikes to be priced in a certain period.

Example:

Z is the CME (calendar) code for December

SFRZ6Z7 = SOFR 3-month futures Dec‘26 - SOFR 3-month futures Dec’27 = number of cuts or hikes priced in 2027, -1.00 pricing four 25bps cuts and +1.00 pricing four 25bps hikes. A more negative number means more cuts and vice versa. Flatteners mean you expect more cuts (a more negative number) or fewer hikes (a less positive number)

SOFR Steepener

Expecting fewer cuts or more hikes to be priced in during a certain period.

Example:

M is the CME (calendar) code for June

SFRM6M7 = SOFR 3-month futures Jun‘26 - SOFR 3-month futures Jun’27 = number of cuts or hikes priced in between Q2 ‘26 and Q2’ 27, -1.00 pricing four 25bps cuts and +1.00 pricing four 25bps hikes. A more negative number means more cuts and vice versa. Steepeners mean you expect fewer cuts (a less negative number) or more hikes (a more positive number)

SOFR-FF BASIS

SOFR minus Fed Funds, the basis (i.e. difference) between SOFR (the Fed’s repo rate benchmark) and FF (a.k.a EFFR, the Fed’s policy rate and a measure of interbank lending rates)

SOFR-FF BASIS SPREAD

SOFR-FF basis spreads show the relative narrowing/widening of the SOFR-FF basis curve. The spread rises (or becomes less negative), say from -2 to -0, when traders believe the basis will become narrower at one point in time compared to another.

SOFR-FF BASIS SPREAD STEEPENER

A bet on SOFR-FF basis spreads (see above) rising/widening (or becomes less negative). Commonly called a X/Y SERFF steepener, such as Jan/Mar’26 SERFF steepener

SOFR-FF BASIS SPREAD FLATTENER

A bet on SOFR-FF basis spreads (see above) falling/narrowing (or becoming more negative). Commonly called a X/Y SERFF flattener, such as Jan/Mar’26 SERFF flattener

SOMA

the SOMA (System Open Market Account) is the Fed’s asset portfolio, which it uses when engaging in open market operations (OMOs)

Sovereign Debt

Debt issued by a nation’s governing body, such as the U.S. govt.

Specials

issues of bonds with repo rates trading significantly below other similar issues due to being in high demand (such as a bond that’s cheapest to deliver (CTD) into a futures contract)

Sponsored Repo

the FICC’s Sponsored Repo service

SRF (now SRP - see below)

The Fed’s (former) Standing Repo Facility

SRP

the Fed's Standing Repurchase Agreement, or Standing Repo (SRP), operations

SRPR

The Fed’s Standing Repo Rate. The rate the Fed offers on overnight repos.

SRFR (deprecated)

The Standing Repo Facility Rate. The minimum bid the Fed used to offer at its former, now defunct, Standing Repo Facility

STIR

Short-Term Interest Rates

(UST) Swap Spreads

the difference between the fixed rate of an interest rate (SOFR or EFFR, but mostly SOFR) swap and the yield on U.S. Treasuries at the same maturity, which captures the difference in regulatory costs to intermediate SOFR swaps versus the cost to intermediate U.S. Treasuries

T

Target Band

another way to describe the Fed’s target range for EFFR

Target Range

the Fed’s target range for EFFR (Effective Federal Funds Rate)

TBAC

Treasury Borrowing Advisory Committee

Term Trades

Repo trades that last longer than an overnight (o/n) period

TGA

the Treasury General Account (TGA), the U.S. government’s bank account, which is stored inside the Federal Reserve System

Triparty-Fed (TGCR-SRFR) Spread

Shows the relative cost of borrowing between the Fed’s cheapest lending rate at the SRF (SRFR) and repo rates in the triparty market

Triparty

the triparty repo market

TU

Two-Year Note Future

TY

Ten-Year Note Future

TOMOs

temporary open market operations

U

Uncleared

Shorthand for Non-Centrally Cleared

UST

U.S. Treasury Security

US (Future)

T-Bond Future

W

WN (Future)

Ultra T-Bond Future

X

XCCY (Cross-Currency)

short hand for cross-currency

XCCY Basis (Cross-Currency Basis)

the difference between the rate to borrow currency in unsecured markets versus the rate to borrow currency in FX swap markets

Y

Year-end Turn

The year-end turn is the period between the last business day of the year and the first business day in the following year. For example, the period between 31st Dec 2024 and 2nd Jan 2025.