Money Market Update

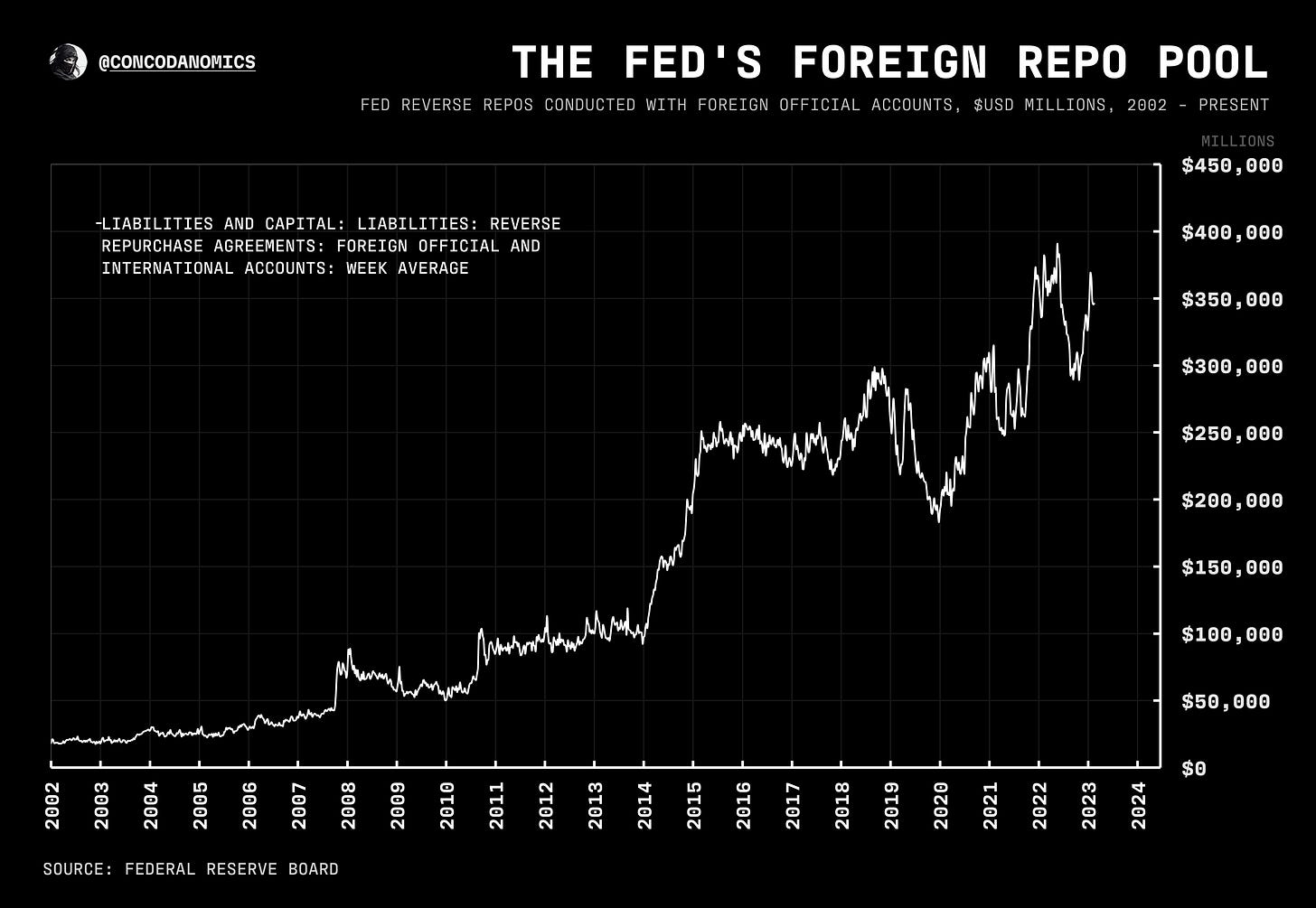

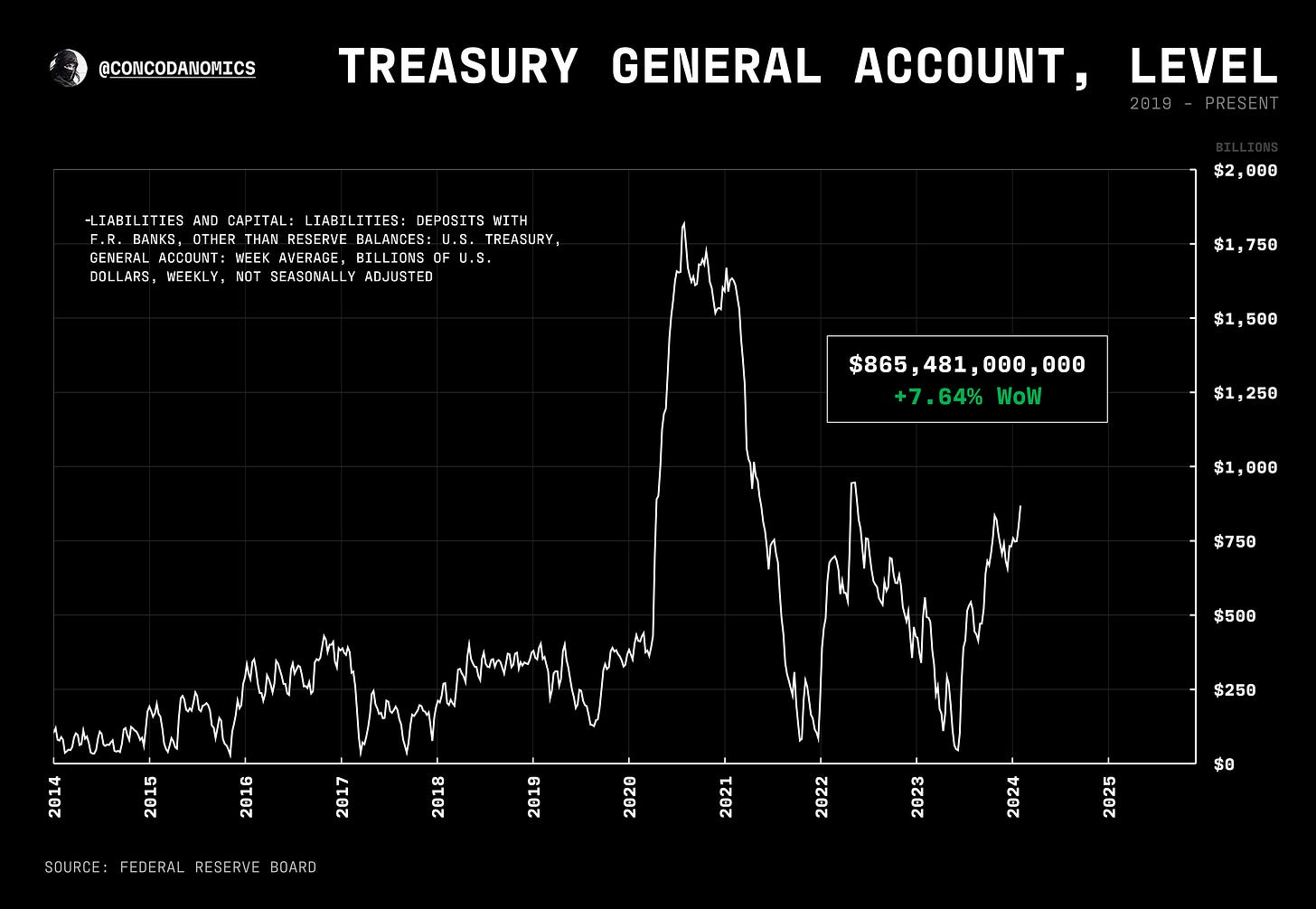

the Treasury & Fed create small headwinds for risk, with a mild increase in duration issuance and Powell's dovish(ish) speech. meanwhile, with fewer bills issued, the RRP decline should slow its pace

In case you missed it — or you’ve just joined us — part two of our repo market deep dive went live recently (links to part two and one below)…

For a recap on how increased duration issuance affects asset prices, see the post beneath detailing the mechanics…

Coming soon, we’ll look at some more upcoming market evolutions: the future of the repo market, and the Fed’s discount window. A small taster:

But first, a money market update…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

For the curves, are they zero curves?