Money Market Update

money markets return to normal after a rockier-than-usual year-end, with repo rates, fails, and treasury volatility falling. meanwhile, the Fed's RRP continues its descent to the zero bound

In case you missed it — or you’ve just joined us — our primer on the coming changes to the Treasury market went live recently (link below)…

In Demystifying the Repo Market Part One, we looked at triparty repo, the “base layer” of repo markets. Next, we’ll delve into the “upper layers”, the first being the dealer-to-dealer segment, showing how prominent players trade the most sophisticated market in the dollar funding ecosystem:

But first, a money market update…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

I have a question about the "jaws of the Fed" and how they compete with macroeconomic and fiscal forces. As I understand it, largely from your work (thank you), the Fed uses FIMA, RRP, FRP, etc. to set a lower bound for credit rates, and IORB for the upper bound.

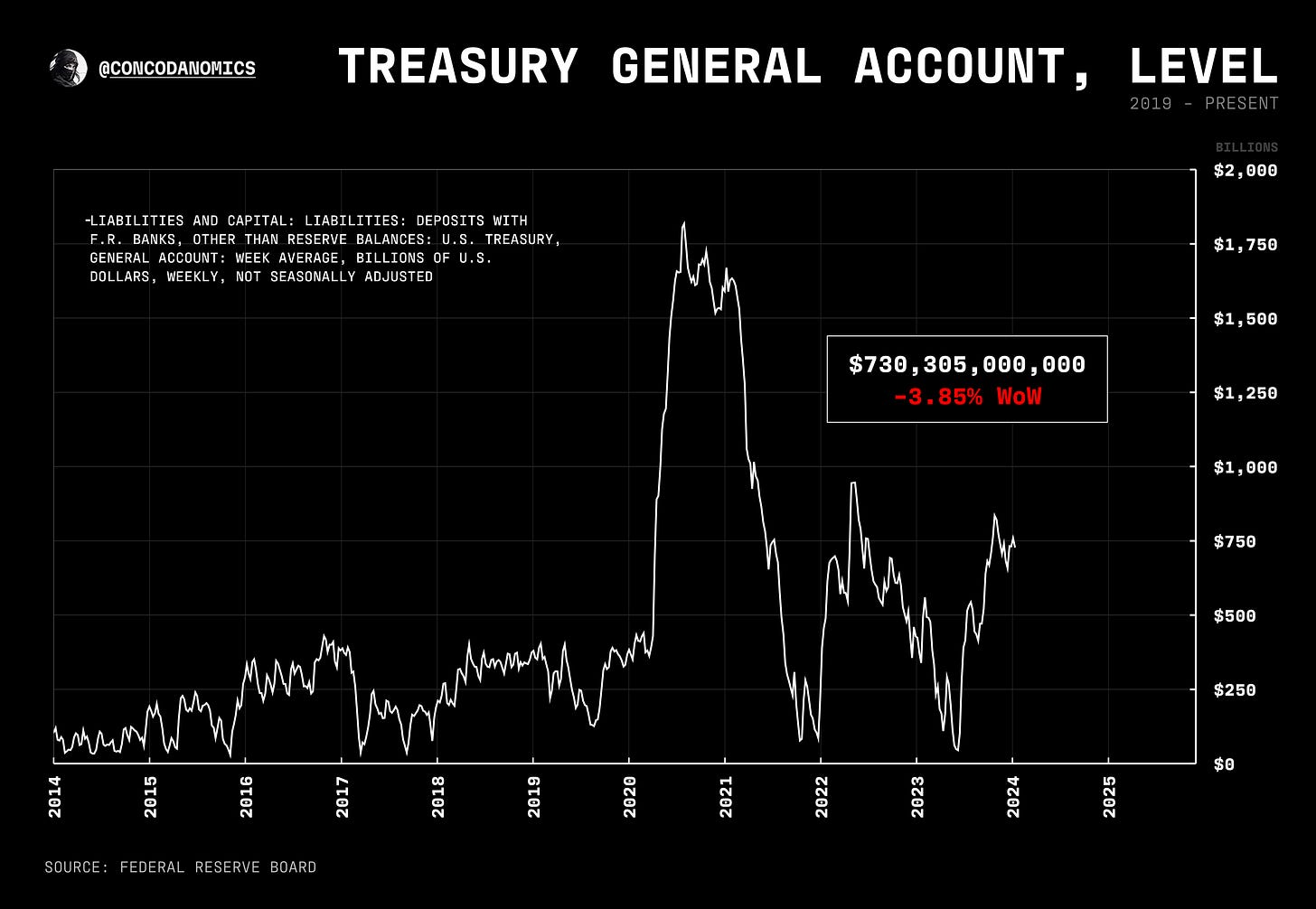

Let us speculate that the Fed will use these facilities to cut rates by 100bp in 2024. On the fiscal side, however, Treasury is issuing literally trillions of dollars to finance public debt and deficits. Once-reliable foreign investors are drying up, and the hedge funds stepping in to soak up T-bills are demanding much higher rates, pushing the 10-year to 5.5%.

What happens to the cost of credit in the crosswinds? Which forces prevail?