Money Market Update

Increased volatility has reduced repo activity and increased fails. Money market rates, however, remain stable. Meanwhile, the bear steepener hinders risk assets, as the coming QRA may provide relief

In case you missed it — or you’ve just joined us — part two of The Repo Market Exodus went live…

Next, we’ll publish the last in our repo market series, in which we’ll take an extensive look at the plumbing of the dealer-to-customer markets, the largest and most obscure segments. This time, the word count will be slightly larger to ensure everything is explained and the jargon is debunked. This is the most complex part of the financial system, so if you understand it, you’re winning.

But first, a money market update…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

What is the significance of treasury & agency fails? The latter seems to have increased a lot this month.

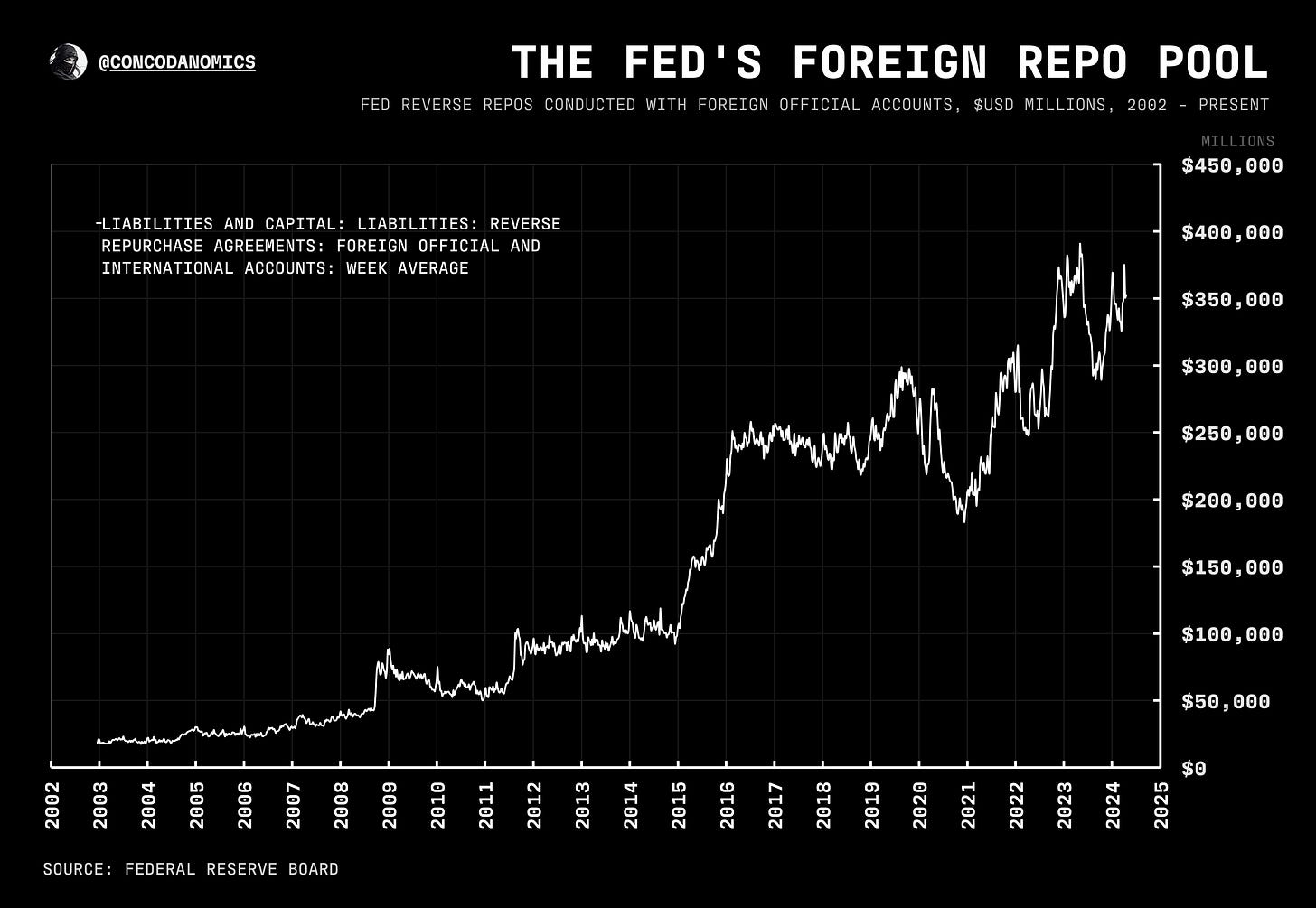

Wouldn't it be better to start the rrp chart from 2021?