Money Market Update

while broader markets grow volatile, dollar funding markets remain calm. funding stress signals, such as wider cross-currency bases, have barely reacted. though, one rate benchmark has gone rogue

In case you missed it — or you’ve just joined us — our latest piece, the Great Flattening, went live recently.

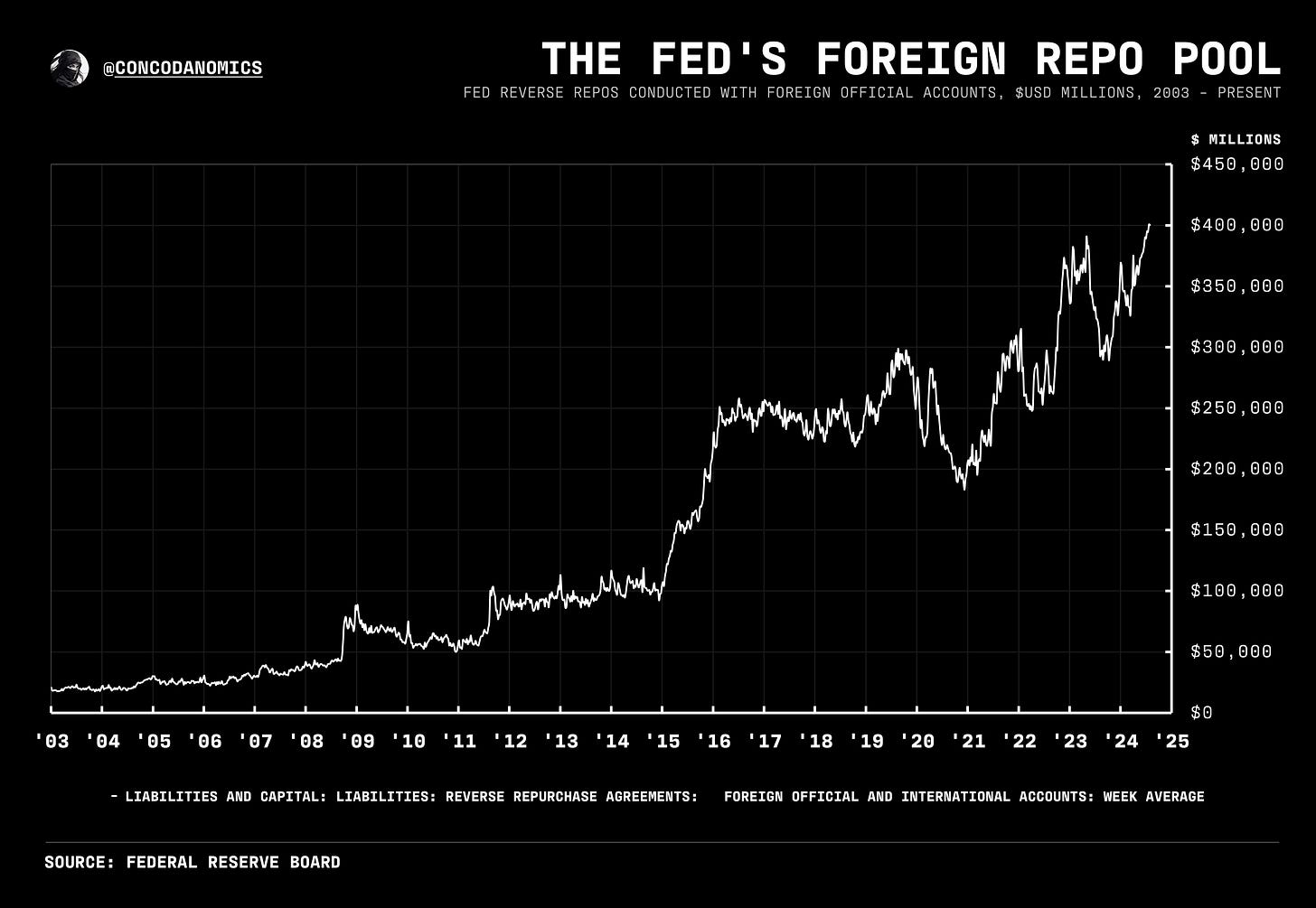

Next up, we’ll try to debunk a bizarre money market rate dislocation, plus the Fed’s upcoming changes to its most crucial benchmark, while intertwining a few other plumbing topics. Upcoming works include the Fed’s global defense mechanism, mapping out China’s “hidden dollar hoard,” and some infographics/primers in between. Stay tuned…

But first, a money market update…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

I thought it was a little odd that triparty rates had fallen below the RRP rate..