The Federal Reserve's Gambit

the U.S central bank's global expansion is not only its next logical move but the only conceivable option

The Federal Reserve has initiated the ultimate rug pull, yet trillions in excess liquidity have stemmed any major financial turmoil. Eventually, however, the Fed will not only need to intervene once again but expand its operations globally to preserve the status quo.

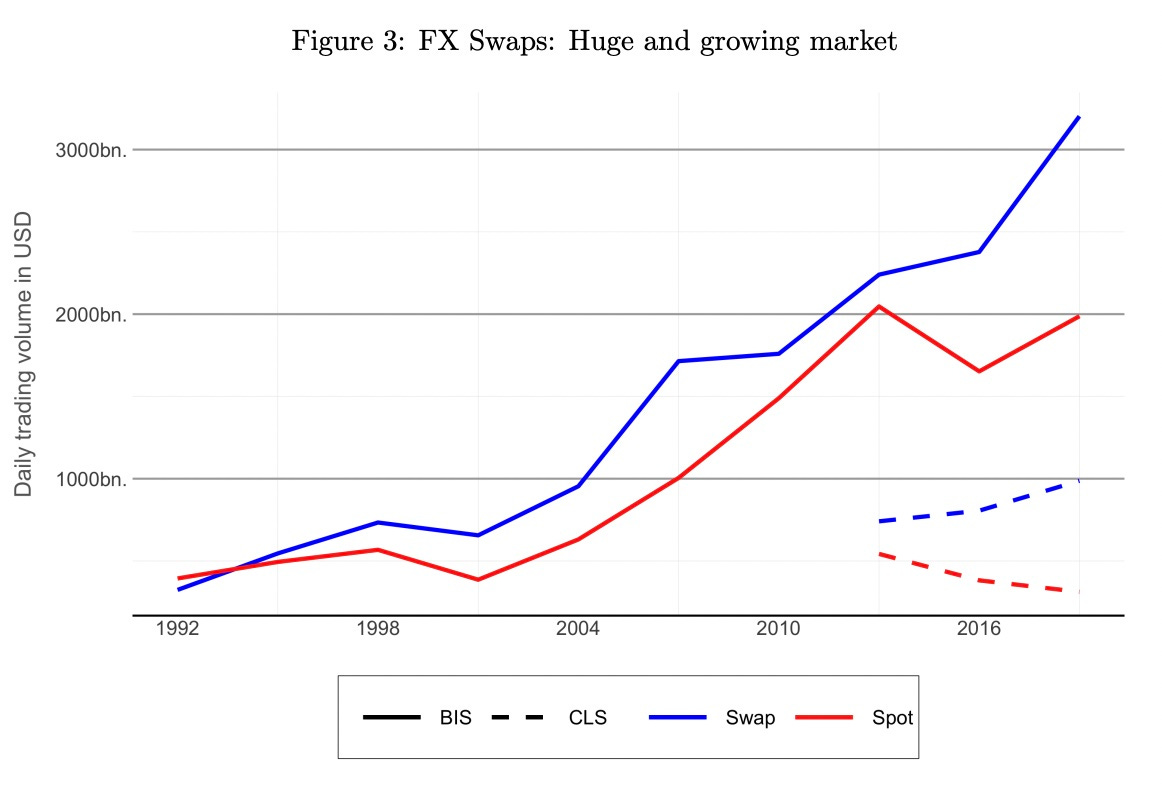

It became clear during the COVID market meltdown in early 2020 that the Fed’s dominance over global markets was not only going to prevail but prosper. As one of the most epic financial panics in history unfolded, the world’s insatiable demand for U.S. dollars exposed itself. Everyone rushed to exchange their assets for dollars, causing an immense surge in borrowing costs in all major funding markets, from the Eurodollar system to money market funds. Even foreign exchange (FX) swaps, the most liquid market globally, suffered enormous stress.

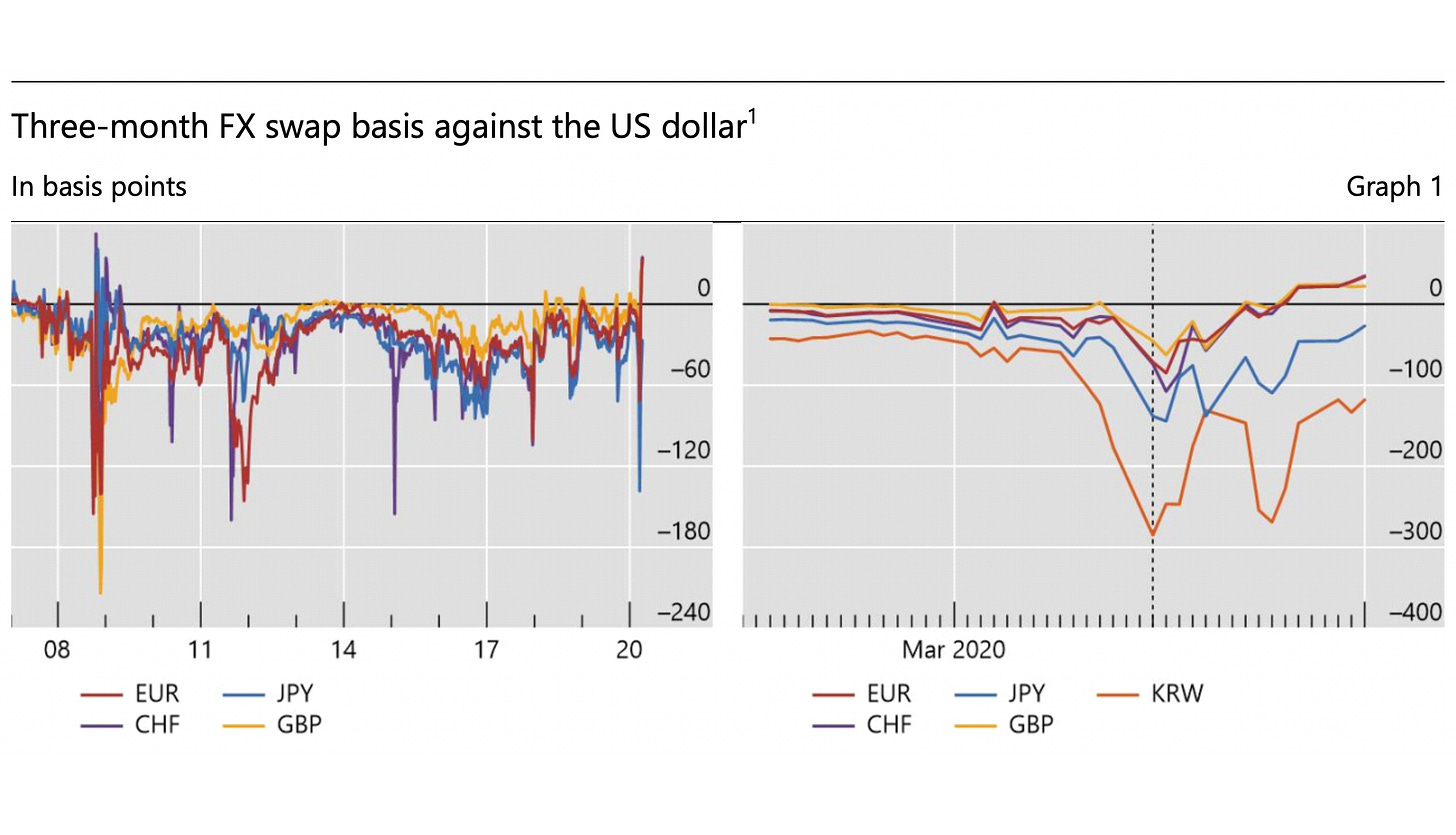

Contrary to popular belief, the FX swaps market had grown larger and more liquid than actual (spot) FX. So when the largest market makers began to pull out of FX swaps during the COVID crisis, the resulting illiquidity and volatility spilled over into traditional foreign exchange. During the height of stress, the FX swap “basis” (now the most reliable indicator of a global dollar shortage) grew increasingly negative, revealing that dollars were becoming scarce. The hoarding of the world’s global reserve currency had reached alarming levels.

It was only after America’s monetary leaders fired up their liquidity cannon that global markets started to recover. Using an arsenal of credit facilities and swap lines, officials pumped enough bucks into onshore, offshore, and shadow financial systems to stem the contagion.

Yet the currency markets were only one of the numerous systems that needed Fed intervention to regain stability. The panic-induced dollar shortage had caused the market that many believed to be invincible to fragment. The U.S. sovereign bond market was becoming illiquid…

Conks’ renowned Illiquidity Spiral™ had emerged in the most systemically important market worldwide. The doom loop of volatility creating illiquidity creating more volatility (and so forth) had reached a point where traders could no longer turn their bonds into cold, hard U.S. dollars.

The weakest parts of the Treasury market had grown too unstable. Spreads in “off-the-run” Treasuries (all bonds issued after the latest auction of a particular maturity) had skyrocketed. Investors hoping to hold these bonds till maturity had to liquidate them to raise cash.

The 30-year bond, one of the most illiquid maturities available, experienced the most disruption. Spreads exploded, resulting in investors having to accept lower prices when selling and higher prices when trying to obtain (what the world deemed) the most pristine collateral.

The secondary Treasury market tried to handle rising volatility and illiquidity during outright hysteria, but no matter what dealers tried, the market failed to recover. Spreads grew so wide and prices so erratic that the market broke down. Fed intervention was inevitable. The idea that monetary leaders could simply sit back and wait for an equilibrium, where every malinvestment and profitless outfit vanished into oblivion, dropped dead quickly. By then, global finance had become so interconnected that non-intervention would ensure total collapse.

It became clear that not even the asset backing the U.S.’s global hegemony was sacred. Treasuries were no longer risk-free, until their backer came to the rescue. Eventually, the Fed’s inaction would have led to a doom cascade, one that left every U.S. citizen unable to transact.

It’s not well known that U.S. dollars are also named “Federal Reserve Notes” by the American government. In a fiat system, the issuing power dictates what backs its currency, and with America, that’s U.S. Treasuries. These not only collateralize physical cash but bank deposits. And not just bank deposits but “bank reserves”, interbank money used by commercial banks to settle transfers of customer deposits and payments between themselves.

Using their Fed master accounts, banks settle payments via their reserve balances. Meanwhile, they debit your account and credit your friend's account. This mechanism, though, relies on banks’ faith in reserves and the Treasuries backing them. No faith in bonds? Panic then ensues.

Without trust in the central bank’s liabilities and FedWire (America’s national payment system), the mechanism to transfer money in the U.S. economy breaks down. Banks like Signature, who have been trying to ditch crypto deposits after “recent events”, may decide to hoard resources instead.

This is why any Treasury market turmoil must be subdued by the Federal Reserve, who must also avert stress in all other dollar funding markets to stop market participants from mass-monetizing Treasuries. The Fed has become a volatility suppressor, but now in more ways than one.

After pumping trillions of dollars into the system during COVID-19, in what was likely hysteria and panic more than outright malice, the U.S. government along with the Fed has taken the concept of serving the private sector too far. Over the last few decades, the Fed has become so increasingly entrenched in the financial system that envisioning one without the U.S. central bank has become unthinkable. And ever since the COVID-19 binge, this has grown even more true.

The financial behemoths, whatever they might say about free markets, now love to feast on assets issued by the government, not just from auctions, but from the Fed’s balance sheet. By lending bonds from its vast portfolio of assets, the Fed has bolstered its liquidity machine further.

Out of the enormous ~$5 trillion in Treasuries sitting on its balance sheet, the Fed loans out billions in specific issues daily (to primary dealers like Goldman Sachs and Nomura) through its Securities Lending™ facility.

When primary dealers find an opportunity worth paying an extra 0.05% “lending fee” to the Fed, they will borrow Treasuries from its SOMA (system open market account) portfolio. This usually involves charging a higher spread to hedge funds looking to obtain specific securities.

Today, the Fed knows that if market participants withdraw from all these exotic markets, this will threaten the liquidity abundance machine it’s assembled. In the complex system that the Fed’s monetary alchemists have built, mass liquidity injections are the go-to crisis solution.

According to the BIS, the next use of the Fed’s “volatility suppressor” may come when a large number of derivatives roll over in the coming year. But this appears to be another silly (and hilarious) warning over “notional” derivative exposures producing financial crises. “Notional” in derivatives has multiple meanings, and parties involved in these “hidden debt” transactions rarely exchange the “notional” figure.

With interest rate swaps, the most common derivative, the “notional” amount is part of a larger equation to calculate cash flows. An interest rate swap with a (totally unrealistic) $1 trillion notional will only incur a double-digit, billion-dollar loss if short-term rates rose 5%, a colossal move exceeding even the COVID-19 blowup.

As friend of Conks Brett Johnson points out, quadrillions in notional derivatives exposure only become an issue when paired with extreme volatility. But as we now know, the Fed, the only entity that can quell such financial turmoil, stands ready to neutralize these threats more than ever.

What’s more, since 2008, extra safeguards have been enforced. Central clearing and margin requirements are just some measures implemented to prevent blowups. COVID-19 also wiped out any excessive stupidity — like selling exotic volatility derivatives that could incur 50,000% losses.

Even so, someone will eventually channel their inner Bill Hwang and devise the next monetary timebomb. Though it will likely take many years for someone to develop a taste for creating extremely risky products. Humanity has apparently learned its lesson, at least, for now. The world of finance has realized, especially over the last few years, that it’s not only much safer to lend against assets they’ll obtain if a borrower defaults. But also assets that the Fed will do anything to preserve when a crisis emerges.

The next blowup, though, may take time to surface. Like other periods, the post-COVID era is unique: Growth is slowing and liquidity has been declining, yet a gigantic amount of monetary injections has provided a large buffer against volatility. Recently, after the borrowing costs surged in a “dollar squeeze” (the sudden drop in the right-hand chart below), funding costs remained elevated. Yet, no major upset emerged. The dollar even began to weaken after recent CPI readings eased inflation fears.

Right now, billions in excess cash and securities lie on the balance sheets of U.S corporates, while trillions in excess dollars remain parked at the Fed’s reverse repo facility, paying a juicy “risk-free” 4.40%. This money has yet to jump into riskier assets.

Then, there’s the trillions in consumer bank deposits that were pumped into the system during the pandemic. This has provided yet another huge cushion, even after accounting for credit card debt. Markets are sinking, albeit slowly, because there’s always a cash-rich bidder.

And when it comes to actually settling payments between banks, the Fed will need to remove trillions in bank reserves through its QT program before any major interbank issues emerge. In the last month, reserves have risen while the Fed is supposedly meant to be “fully” tightening.

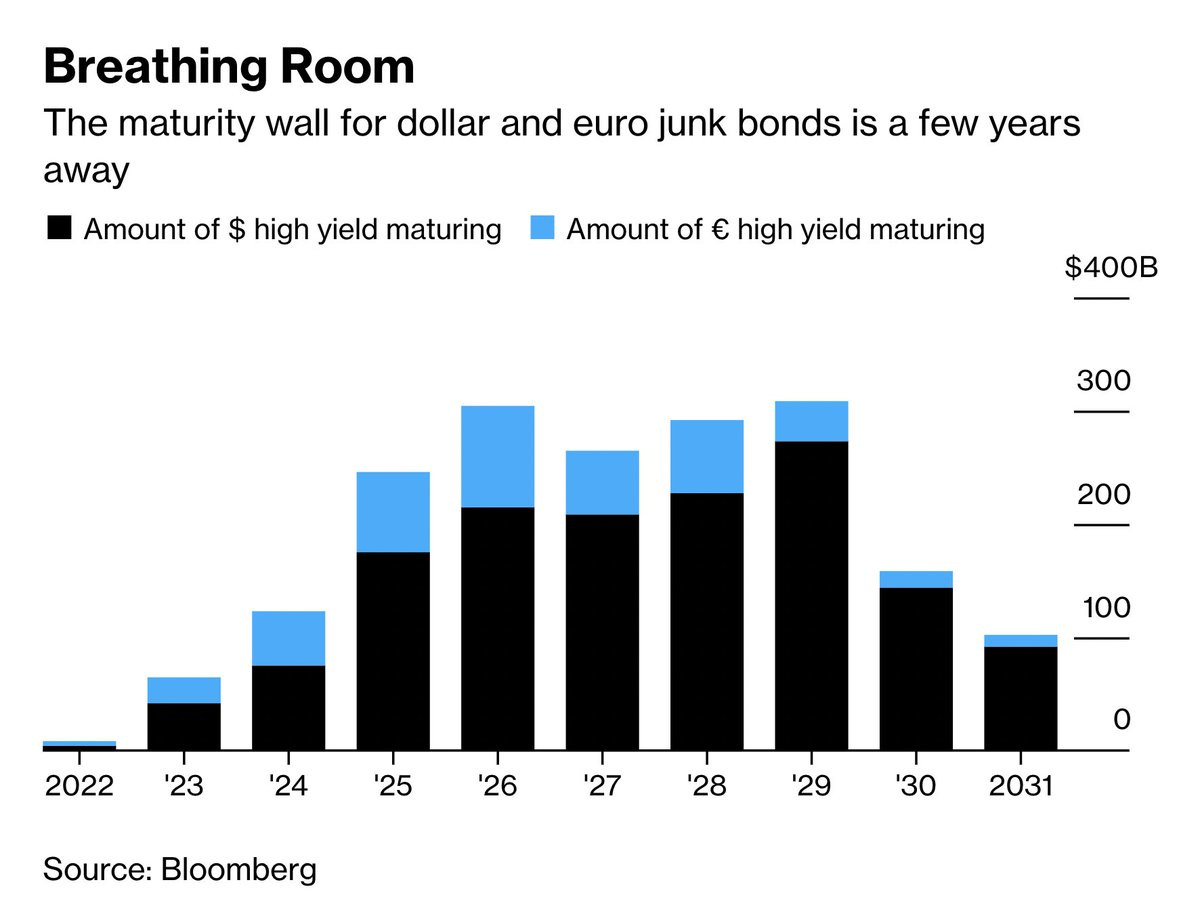

What’s more, the ever-expanding sovereign debt load issued by governments worldwide has mostly been financed at low, if not rock-bottom, rates. As for riskier corporate debt, the amount of high-yield junk bonds needing to be rolled over remains trivial, until 2025…

Eventually, though, liquidity in the global financial system will dry up once again, and monetary officials must execute their master plan: suppress volatility at all costs by turning on the liquidity taps to the maximum.

Global financial behemoths are already well hedged via interest rate and currency swaps. But if these derivatives go sour, the Fed will bail them out accordingly. Its liquidity backstop stands ready to suppress volatility (and provide dollars to almost anyone) globally.

The financial behemoths of the world will implore not only the Federal Reserve but foreign central banks, which have become part of a vast web of dollar liabilities, to fire up their liquidity engines once again. Foreign banks with no direct access to the Fed’s facilities will turn to their central bank, who’ll demand the Fed to ramp up dollar lending via swap lines. Knowing what could be at stake, they will have no hesitation to provide the goods.

The mass liquidity injections of COVID-19 will not only repeat but become conventional monetary policy. A global “QE”. We already live in the age of “refinancing at all costs”, but this will be the point of no return. Every U.S. ally, with no other option, will jump on board. And for countries like China which are not in America’s good books — but whose financial health is key to preserving global economic stability — the Fed’s FIMA (Foreign and International Monetary Authorities) Facility will offer unlimited dollar loans in return for U.S Treasuries.

Calls for a clean slate, a Great Reset™ are no longer viable in the overly interconnected system the U.S. empire has built. It’s either provide liquidity or let the global system unwind until extinction. Inevitably, the majority will choose the Fed’s liquidity engine.

Even though calls to decentralize the global financial system have grown in recent years, history shows it’s antithetical to financial stability. We’ll repeat our strong tendency to build ever greater power structures and do little to contain them.

With the U.S. firmly in power, the Fed increasing its global monetary dominance appears inevitable. The American hegemon can offer an endless supply of carrots on sticks, and everyone will bite. The Dollar’s dominance over global finance will not only survive longer than anticipated, but the U.S. won’t stop until every threat has been negated. Next, they’ll come for the shadow banks, trying to gain more authority and control over opaque offshore markets. And when those blindspots evaporate, the Fed will have fulfilled its ultimate goal of becoming the world’s cashier.

If you enjoyed this, feel free to smash that like button and share a link via social media. Thanks for supporting macro journalism!

You are, without a doubt, the most learned and intelligent financial writer I have ever read. The articles I read from you are masterpieces. Major props to you.

A commonality in many previous civilisational collapses was the debasement of their currencies and collapse of the complexity of the societal systems.

There has never been such a complex system as these junkies have created. Cross Contagion from all these trillion-dollar speculations is almost certain. Just like in Hollywood, the movie always comes to a dramatic end, and we are circling the drain now.