The Fed's Hidden Put

Deep inside the repo market, another round of "Not-QE" awaits

The liquidity drain has begun, with hundreds of billions in reserves expected to be removed from the financial system. But this reduction could not only fail to subdue risk assets. A squeeze in a relatively obscure, covert market will allow the Fed to stimulate again without a pivot. The Repo Market Put™ lies in waiting.

Recently, we’ve witnessed the full effect of the Transitory Pause, where the Fed’s silence and inaction to tighten has caused the financial machine to send risk assets soaring. The “TGA refill” has failed to bring down the most hated rally in history. Now, more tightening is needed. The U.S. government is restocking its bank account (the TGA) to pay its bills while reducing the Fed’s balance sheet via QT (quantitative tightening). If the subsequent drain of reserves is too severe, the Fed may encounter a welcome surprise in the most crucial funding market.

The repo (repurchase agreements) market is the wheel greaser of the U.S. empire’s financial engine. Without it, U.S. dollar liquidity would be lackluster. Binding the Treasury cash and futures market together through arbitrage trades like the “futures basis” is only one of its many functions.

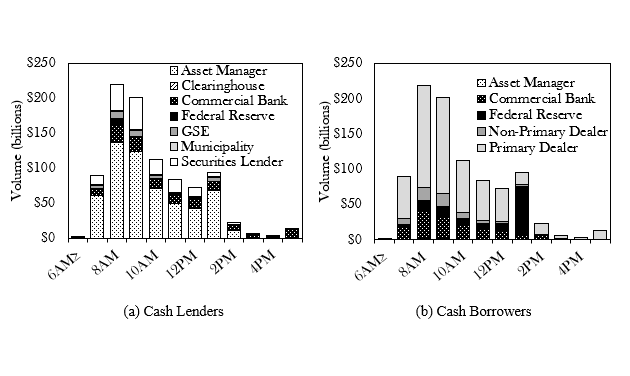

But above all else, repo enables “secured” lending of U.S. dollars to proliferate globally. The repo market may appear complex but it’s simply a market for connecting cash lenders like money market funds (MMFs), who must earn a yield on plain U.S. dollars, with cash borrowers like hedge funds, who need to fund leveraged positions.

It becomes clear when the Conks Repo Conga™ is revealed. The repo market is a chain of market participants looking to profit from charging a spread on top of their funding costs. Cash lenders lend to “sophisticated” borrowers through dealers, who charge a spread to intermediate. In a typical conga, money market funds lend to the Fed’s primary dealers, who then lend to other securities dealers, who then lend to commercial banks and hedge funds. Repo’s end goal is to supply an endless ocean of liquidity to the financial world, and it succeeds in spectacular fashion.

The repo market contains multiple segments, each playing a unique role in providing liquidity. On top, triparty repo allows cash lenders, mainly asset managers like MMFs, to lend mostly to the Fed’s primary dealers, whose job is to distribute cash to other parts of the repo market. Primary dealers then attempt to make a profit by lending these funds into “interdealer” (dealer-to-dealer) markets and charging a higher spread. Smaller securities dealers receiving these funds will then lend them on to end customers in the “bilateral” (dealer-to-customer) market for an even bigger fee. After every party’s funding needs have been met, the repo conga is complete.

At least, that’s how repo markets are supposed to operate. After recent events, its inner workings have transformed, seemingly forever. Increased market complexity and even excess liquidity have become problematic. But ironically, this will provide leaders with a concrete “Not-QE” tool to stimulate markets: the repo market put.