The Great Winter Gas Panic

A sea of doom-filled headlines has heightened our expectations of a full-blown energy crisis in Europe, but a calamity is still not off the table

Much has been made in the media about Germany’s impending gas crisis this winter. Following the announcement by Russia’s majority state-owned energy giant Gazprom that an “oil leakage” threatened the safety of its Nord Stream 1 pipeline — the major artery supplying natural gas to the European mainland — there are now concerns that Germans won’t be able to heat their houses.

But these worries of a heightened energy crisis have become overblown. Germany has come better prepared for winter than the headlines infer. To sustain itself this winter, Europe’s biggest gas import-heavy economy will need to obtain above-average levels of gas storage, cut back slightly on energy usage (or “flatten the curve” as Ursula von der Leyen described it), then maintain a continual flow of imports, all while it reduces its dependence on Putin’s prime exports.

When it comes to storage, Germany has already succeeded. After striving for 75% storage levels by the start of September, German Economy Minister Robert Habeck revealed his country had reached its targets, ahead of schedule. This month, the European powerhouse has achieved an ~86% gas fill level, according to the latest release from Germany’s Federal Network Agency. Come the peak of winter, Germany will have hit a full häus.

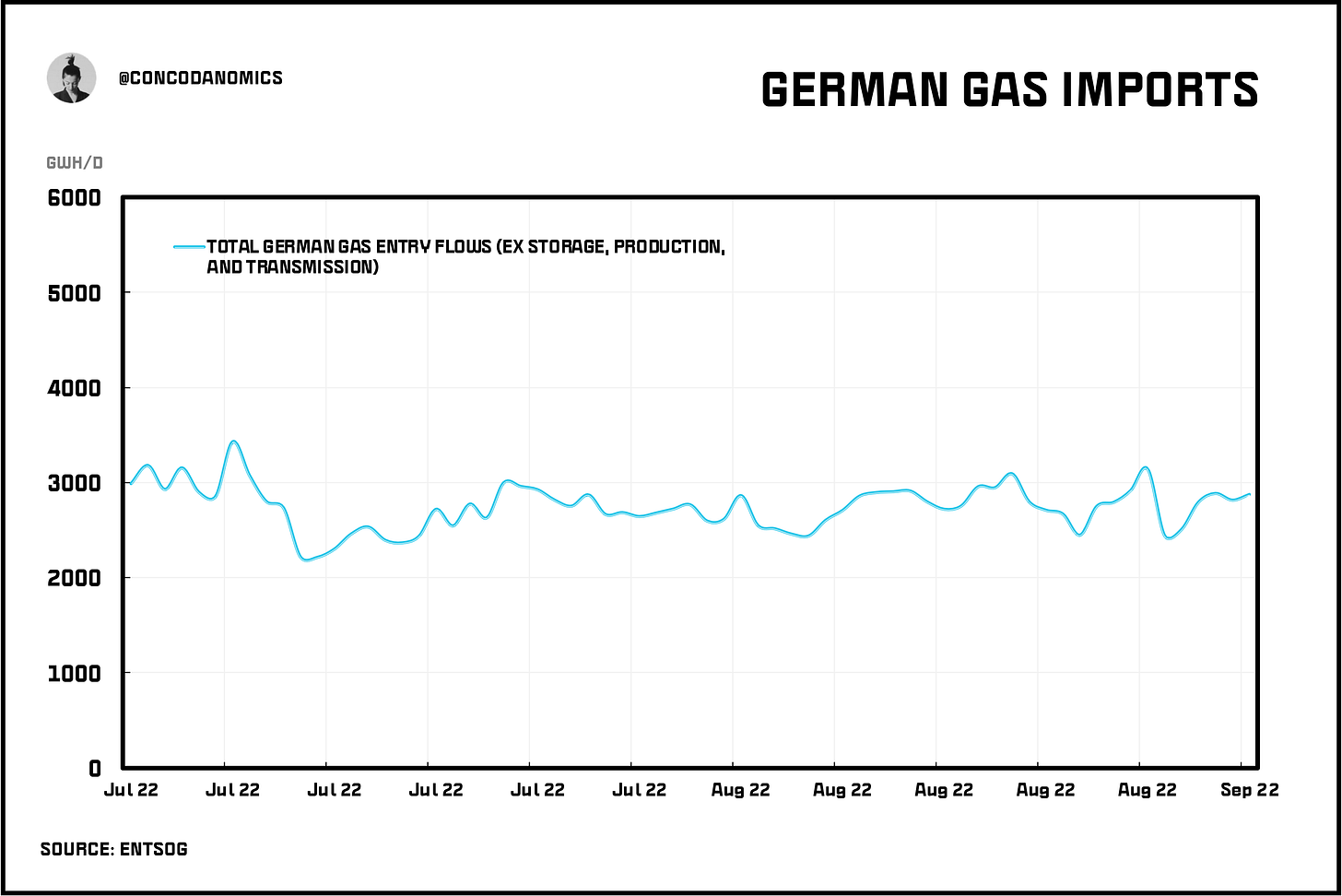

As a political bonus, Europe’s incumbent hyperpower has almost cut ties with its number one adversary. Germany managed to rapidly decrease its reliance on Russian energy, with Reuters reporting how the country’s natural gas imports fell from 55% last year, to 26% this June, to merely 9.5% this August. Even despite diminished gas outpours from the Nord Stream I pipeline, which drove most of the recent plunge in Russian dependency, Germany’s total gas imports have remained elevated. Taking Putin’s place: Norway and the Netherlands, making up around 60% of Germany’s natural gas inflows.

Storage may have been secured, but this does not guarantee a warm German winter on its own. The maximum quantity of gas able to be withdrawn from storage facilities could be insufficient to meet the needs of consumers in a severe winter. Without getting too deep into technicals, the more gas you inject into storage, the more cushion gas you must leave inside, which maintains adequate pressure needed to make future withdrawals.

Possessing no politically digestible backup plan for this possible shortfall, Germany (and other import-heavy European economies) must now scramble to obtain additional gas flows, a formidable struggle in a tight global energy market. Before a well-stocked and diversified France can send extra liquified natural gas (LNG) to Germany in 2024, half of the floating LNG terminals that the German government has leased will come online near the end of this year. Only then will we witness the effectiveness of German leaders’ Natural Gas World Tour™, where Habeck and others traveled the globe, from Algeria to Azerbaijan to Qatar, in search of Putin’s long-term replacement.

As for other energy sources, renewables will try to take a further chunk out of Germany’s lignite (soft coal) consumption, while extreme negative sentiment around nuclear may start to reverse if an extreme cold snap emerges. Unlikely, though, since even during an ongoing energy crisis, German leaders have doubled down on their strategy to assign remaining plants for decommissioning.

But whatever the final resolution, Germany will experience higher energy and electricity prices. Citizens now face the brunt of record outlays, which have soared more than four times since last year. The fact that the Dutch TTF contract for natural gas peaked last week was a consolation prize.

Now, with many Germans incapable of affording such exorbitant expenses, large-scale state intervention is inevitable, and plans to execute are already ongoing. The G7’s latest announcement of a price cap on Russian Oil and Germany imposing windfall taxes on energy companies have kicked off proceedings.

This is a significant moment in European politics. Whether or not everyone agrees with these policies, it is noteworthy that Von der Leyen said Brussels was working on “emergency intervention” as well as structural reforms to the power market, which she says will lead to cheaper renewable energy to help set electricity prices. Friend of Conks, Le Shrub (@agnostoxx on Twitter), offered a similar take (just ignore the language):

The old consensus of letting the market do its thing is over, as the energy crisis continues to swing Europe further away from populism. When you witness even Austrian politicians who’d otherwise defend fiscally conservative ideas cave in to pressure, all policies that could keep the peace are now on the table. Leaders will throw as much money and enact as many policies as needed to try to maintain stability. The Great European Intervention, as this era will likely be monikered, is about to begin.

If you enjoyed this, feel free to smash that like button or quote tweet a link via social media. We appreciate your support!