The Repo Market Blindspot

Monetary leaders are trying to uncover the secrets of the most mysterious market

Monetary leaders are about to uncover the inner workings of an obscure $2 trillion market, the most opaque ecosystem within the U.S. dollar funding complex. This, however, is not the much-hyped Eurodollar system. Instead, the Repo Market Blindspot™ is about to be unveiled.

In the midst of the 2008 crisis, the Fed and the U.S. Treasury received an abrupt wake-up call. The failure of Lehman Brothers started a run in every major market for dollars, from FX swaps to money market funds to commercial paper, not only onshore but globally. The illusion that onshore dollars and offshore dollars were identical had been obliterated. The rate to borrow (real) interbank dollars, Federal Funds, disconnected from LIBOR, the — now defunct — rate to borrow unsecured dollars offshore. “Eurodollars” were in scarce supply.

Faced with unrivaled monetary complexity, leaders had little choice but to not only inject billions into — what had become — global Wall Street banks but quell a global dollar shortage by firing up its swap lines. By supplying as many dollars as needed via its funding facilities, the Fed preserved the stability of the global dollar paradigm. The major financial players and wider market participants then deemed this as an unofficial pledge from authorities to provide enough liquidity to stem any future shortage. A permanent bridge between onshore and offshore dollars had been constructed.

Ever since the GFC (global financial crisis), the implicit promise from authorities to make onshore and offshore dollars fungible persisted, no matter the cost. By delivering endless dollar liquidity through FX swap lines and a cluster of other programs, the Fed solidified its “global jaws” — minus a few defects. But even this became a sideshow. In the decade following the subprime tumult, the global regulatory establishment set out to transform the monetary system entirely.

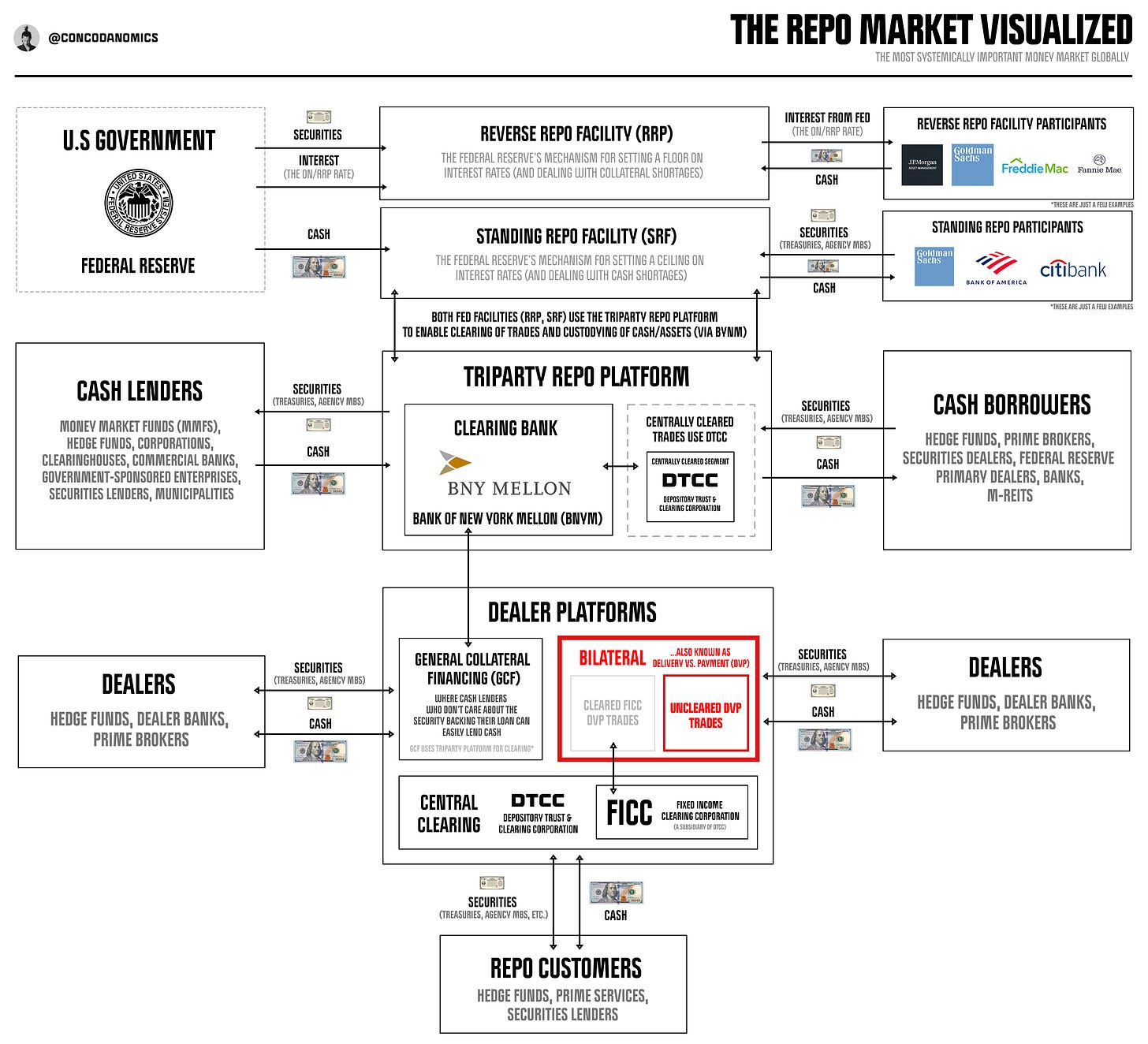

Slowly but surely, leaders chose to drive systemic risk away from banks and park it elsewhere. Through a series of ever more stringent regulatory actions, banks were prohibited from taking on too much risk and leverage, and the shadow banks assumed the banks’ riskier duties. Using U.S. Treasuries and agency MBS (mortgage-backed securities) to secure most of their trades via repo, money market funds and dealers — the new major plumbers of the monetary system — happily absorbed new hazards, assuming they were now backed by U.S. authorities’ willingness to intervene.

Fast forward to today, as shown by the COVID market meltdown, every subsequent dollar emergency has failed to push the system beyond its boundaries. With unlimited liquidity support from monetary leaders, the shadow banking layer has remained resilient. Sensing victory, however, authorities have made it their number-one mission to stamp out all remaining chokepoints in the system.

One particularly obscure market has been highlighted as a potential blindspot: “non-centrally cleared bilateral repo”, the uncleared market for secured cash loans. Known unofficially as NCCBR, uncleared bilateral repo is a market primarily for hedge funds to obtain enormous amounts of leverage at very low costs.

Even so, it has not only grown into the most obscure part of the repo market. It has become the largest, sporting an estimated $2 trillion in outstanding agreements. Authorities are now moving in to subdue the rising risk of instability in this obscure ecosystem. But as we’ll soon discover, it’s not that straightforward.