Every day in financial markets, over $11 trillion in dollar funding transactions take place, fueling the world’s ever-increasing demand for trade and commerce within America’s global security alliance. While internationally active banks and hedge funds tap trillions in funding from global money pools — cash balances of institutions and corporate giants — via repo and money market funds (MMFs), large corporations issue short-term debt in commercial paper markets to fund their operations. These transactions, of course, provide only a glimpse into the exotic dealings that occur in the dollar system daily. But what every trade has in common is the reliance on a particular entity: dealers A.K.A the monetary plumbers. Without them, the U.S. empire’s liquidity machine would break down.

Ever since America disarmed financial tensions in the post-war period, virtually all prominent financial institutions from every major nation launched thriving dealer businesses. Not only that, but they assembled trading desks to make markets in just about every dollar funding instrument, from FX swaps to certificates of deposit (CDs) to repo agreements. Megabanks like JPMorgan even ran trading desks for lending and borrowing bank reserves, with brokers of Federal Funds (the official name for reserves traded in the Federal Reserve System) stationed in New York helping them source interbank loans and Eurodollars.

But with regulators, in response to the GFC (Great Financial Crisis) of 2008, implementing Conks’ Big Three™ — The Dodd-Frank Act (hindering banks’ risk-taking abilities), The Basel Framework (discouraging systemic risk and excessive leverage), and the SEC’s money market reform (substituting riskier dollar funding sources with safer alternatives), the “secured standard” has arisen.

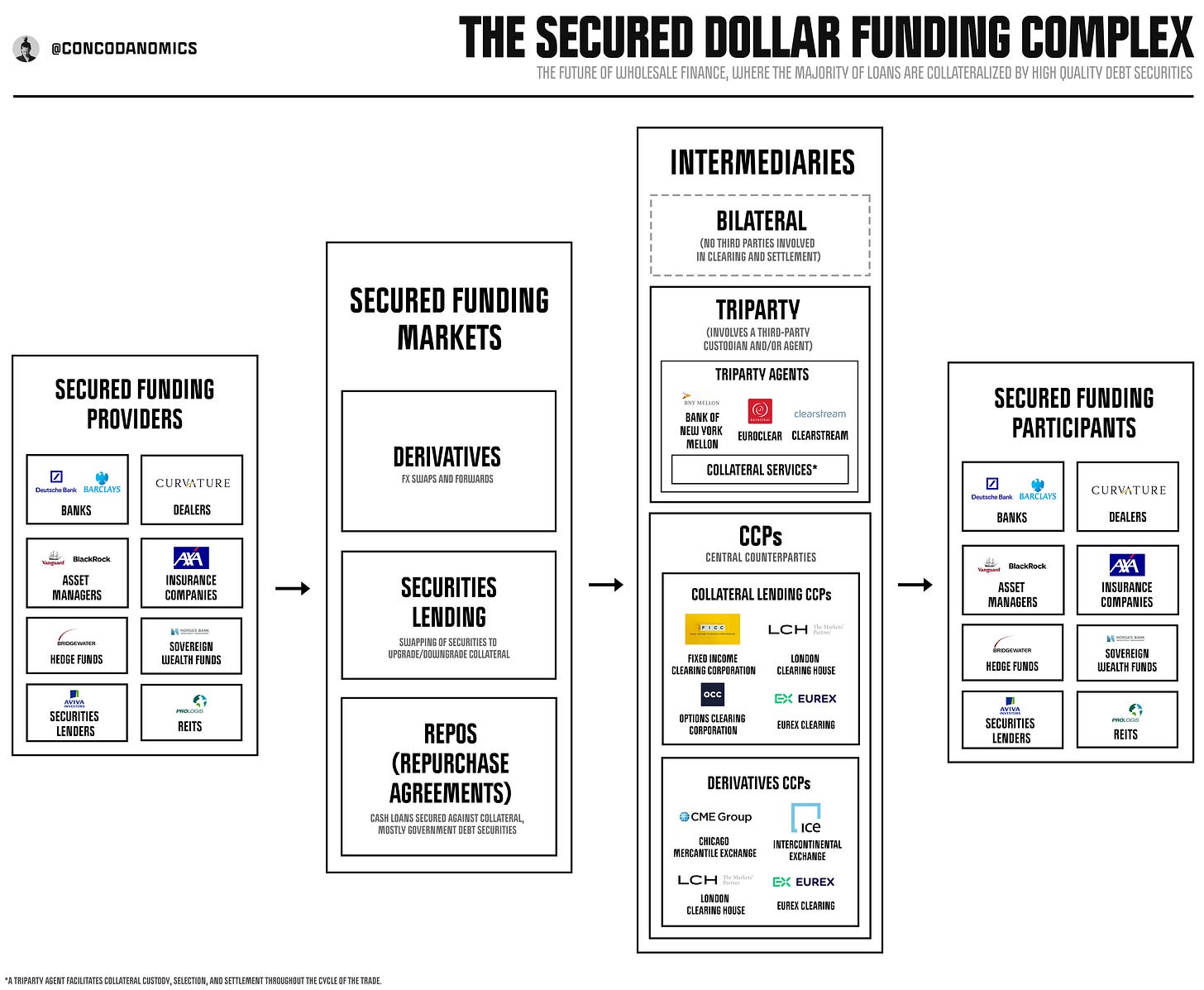

Subsequently, most unsecured dollar markets have begun to decline into irrelevancy, along with the dealers and trading desks that fueled their ascent. As the secured standard has evolved and expanded over the past decade, most activity from its dying counterpart has been transferred over to repo (secured cash loans) and securities lending, which combine to form the Secured Dollar Funding Complex (SDFC). To understand the financial plumbing of the future, demystifying the dealers that supply liquidity to the SDFC is vital. Securities dealers, however, are quite intricate. It’s time to dive into the world of the monetary plumbers.