The Silent Monetary Revolution

a lengthy transition onto a "secured lending" standard has gifted the Fed more power than ever before, and as of recent events, there's no turning back

The most significant shift in global finance has been playing out behind the scenes: The power to price trillions of dollars in financial assets, once held by bankers, is almost in the hands of the Federal Reserve. Now, its powers are set to increase.

A lengthy attempt to eradicate risk from the global financial system, by both monetary authorities and major financial actors, is approaching its climax. What began as a panic reaction to the 2008 subprime crisis has transformed the way financial entities do business. The GFC (Great Financial Crisis) was a crucial turning point in how banks perceived risk. After decades of working on the flawed assumption that an ecosystem built on stark complexity had grown indestructible, they changed their perspective.

No longer believing in the fiction that lending between banks had become riskless, they saw a system fraught with peril. The major flaw of finance, where protection turns into the very thing that prompts a meltdown, had even threatened the most systemically important benchmark. In August 2007, as the subprime crisis began to unfold, the most critical interest rate globally had detached from its counterparts, the same number used to price well over $300 trillion in financial products: the London Interbank Offered Rate, known as LIBOR.

The rate that the world relied on to price everything, from business loans and securitizations to adjustable-rate mortgages and private student loans, had gone haywire. But this shouldn’t have come as a surprise. It’s just that everyone had dismissed LIBOR’s dubious origins.

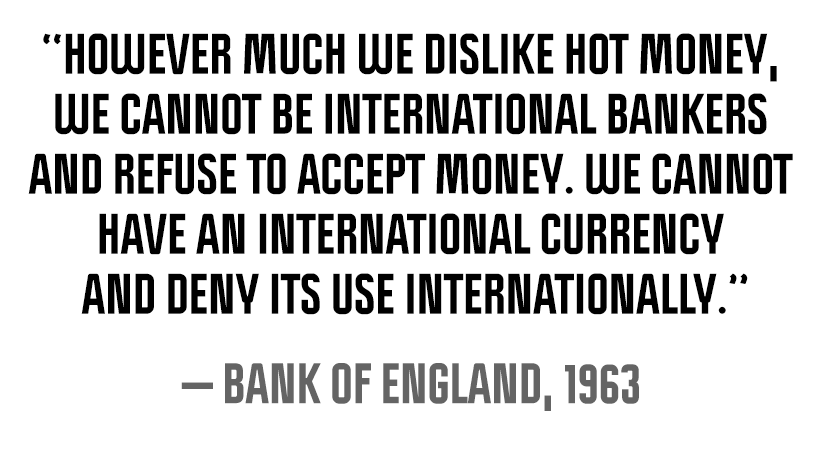

It all began after the U.S. promoted globalization, post-WWII. In the 1950s, London grew into a global financial hub, since U.K. banks had the most freedom to finance prohibited dollar transactions. The Bank of England found out, but penalizing the bankers for mischief meant curbing global commerce.

Under the security pact America signed with almost every other nation, the financial behemoths quickly took advantage. The U.S. banks set up branches not just in the U.K. but worldwide, while non-U.S. banks set up branches in America. Hot money flowed into U.K. banks from other major powers. Among them were America’s main rivals (Russia, China, and many Arab states), who chose to keep their dollars outside America for political reasons, mostly out of fear that their funds could be frozen. As a result, financial alchemy flourished.