Money Market Update

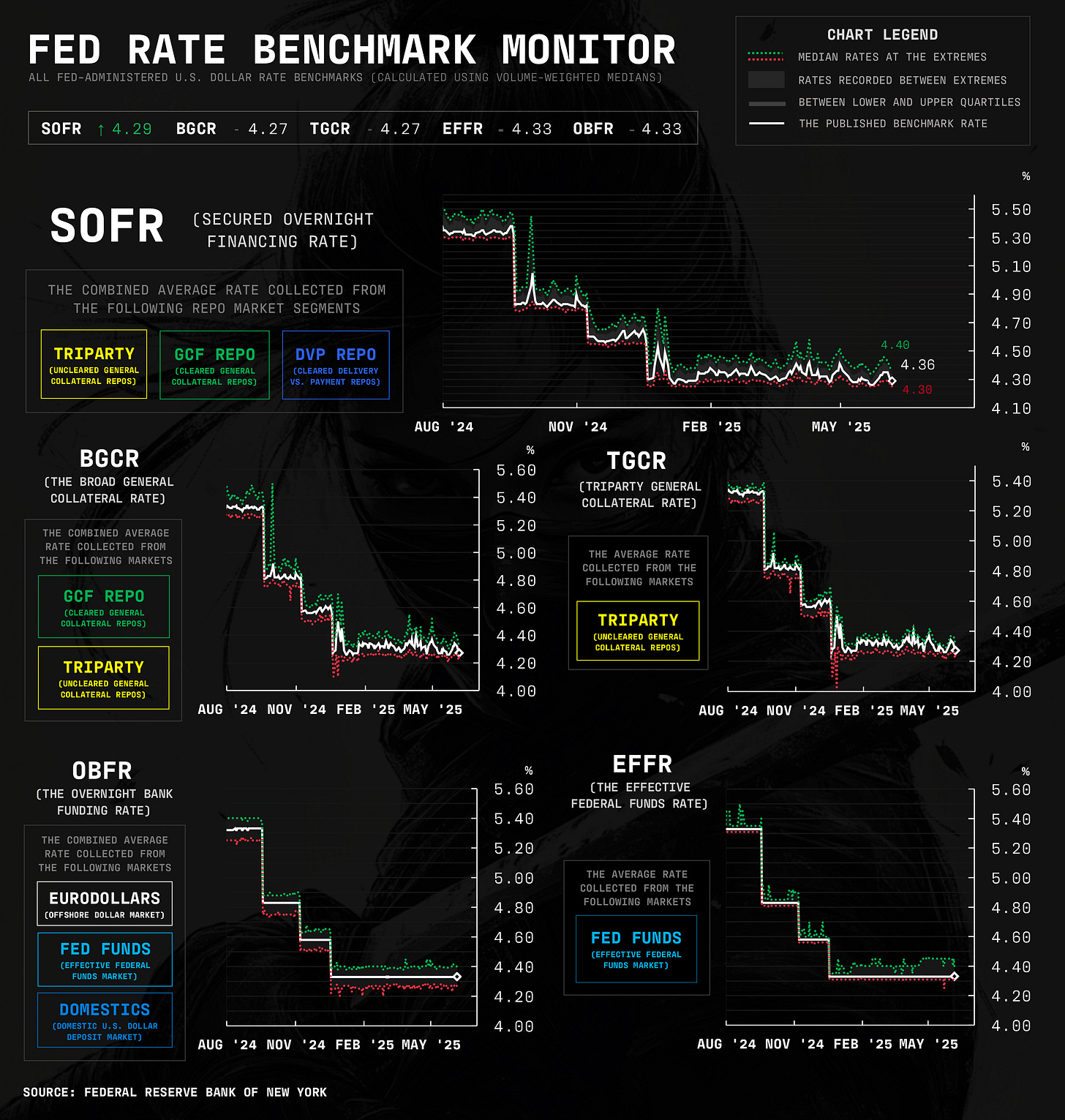

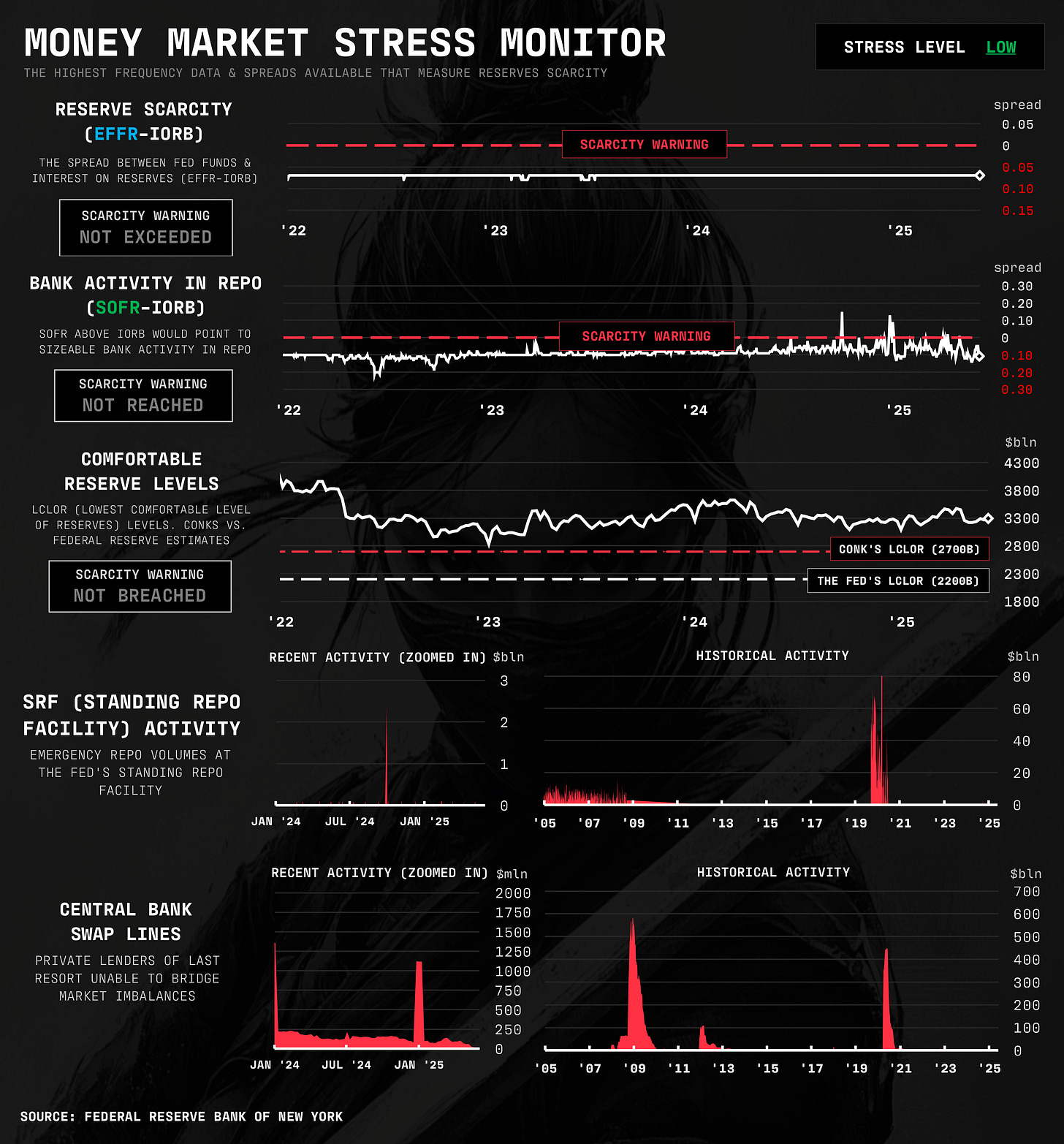

the money market snooze persists, as dealer balance sheets continue to absorb more USTs. meanwhile, talk of an enhanced Fed "relief valve" have caused markets to price in looser plumbing conditions

Welcome to another Conks update. Going forward, we’re looking to publish one every week. In other news, the first Pro Notes covered the effects of stablecoins on the ultra-short end and why the Fed's removal of IORB (as potentially proposed in the Big Beautiful Bill) is, well, misguided. Next up, our next long-form piece: The Shadow Cash Market…

But before that, one last money market update…

Summary & Brief Commentary

Last week, most grew fearful of “spooky bonds” (Conks’ name for the long end of the curve) in response to numerous dire predictions and higher expected long-end UST yields. So naturally, the curve flattened instead.

Auction graders (including yours truly) will now be out in full force this week with a Wednesday 10-year and Thursday 30-year auction. While yields hover around 5% (and Fintwit worries about fiscal dominance when we are very much still in a monetary dominance era), demand from price-sensitive foreign investors is expected to pick up again. We don’t expect too much of a buyer’s strike.

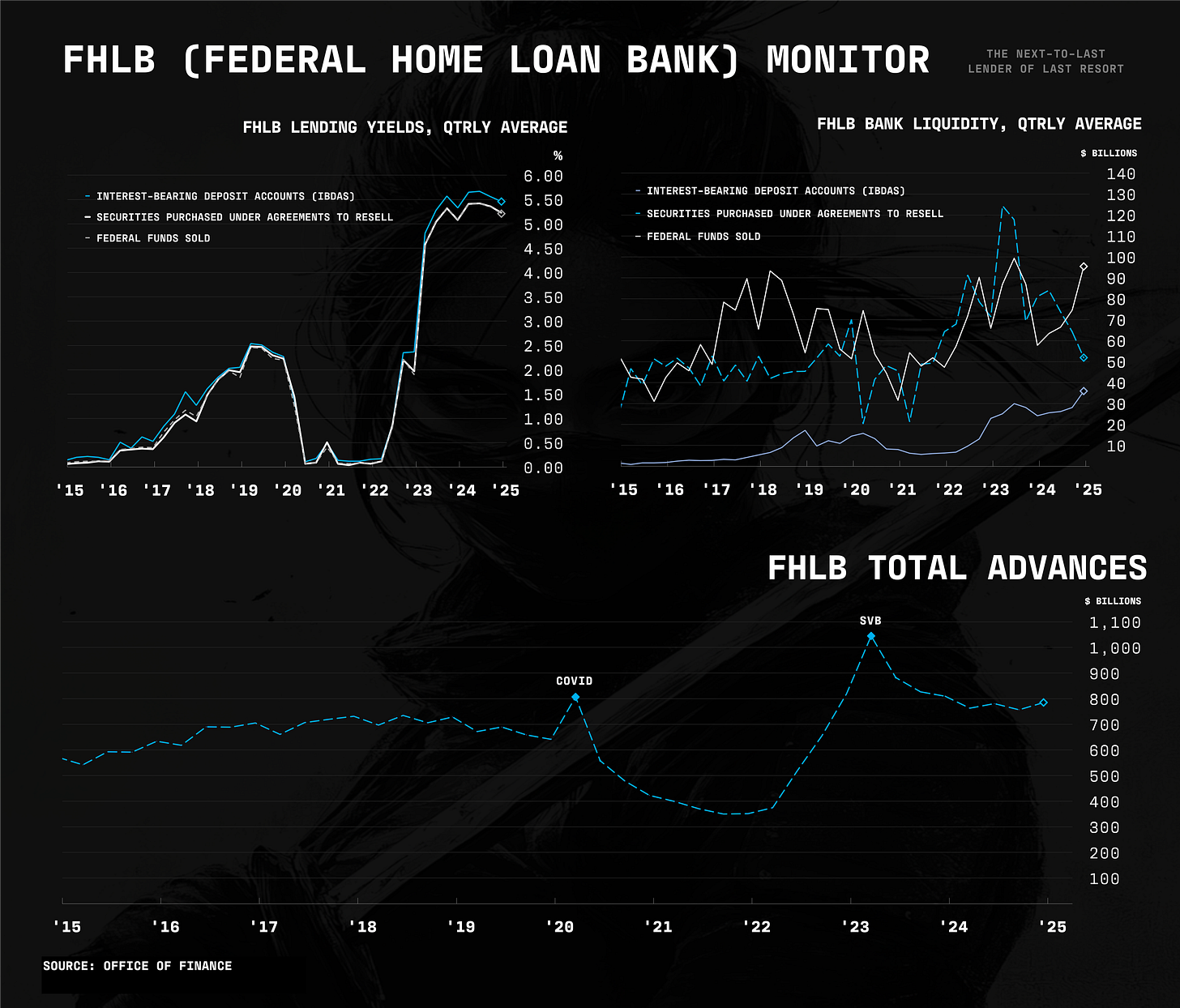

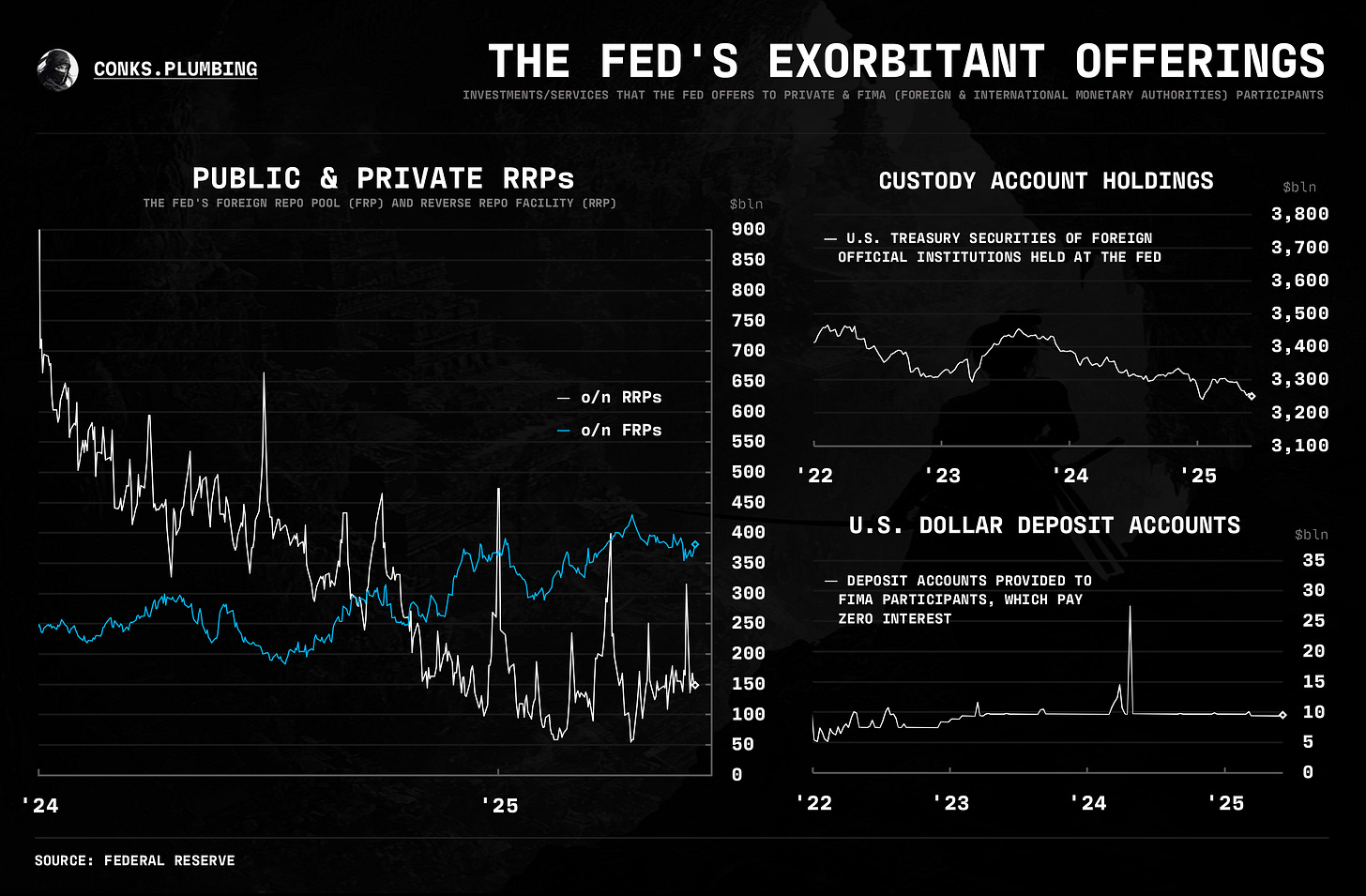

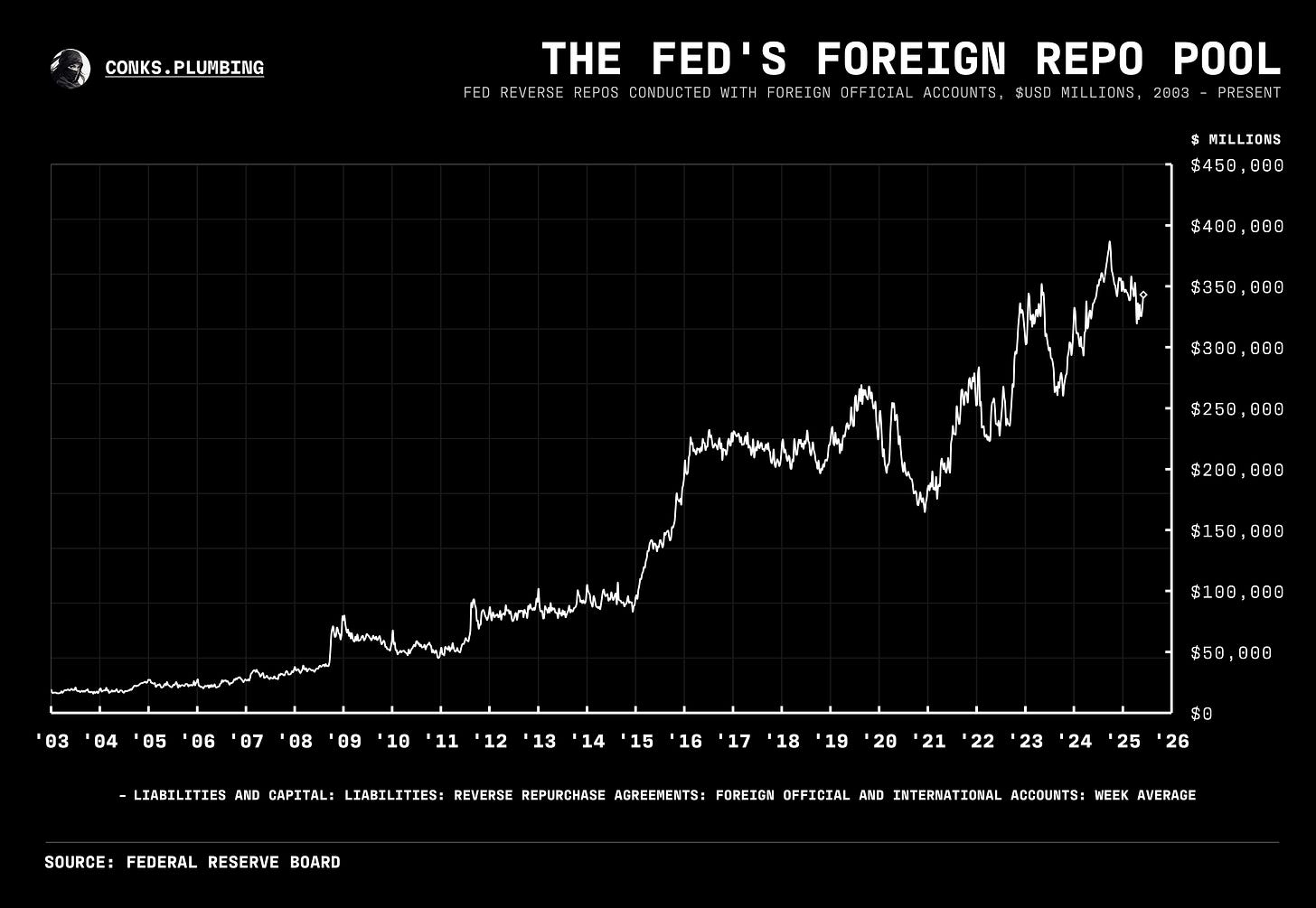

Still, one metric to consider is dealer balance sheets and the ongoing congestion, with primary dealers continuing to accumulate a larger net long position (chart below) in U.S. Treasuries (ex-TIPS). The Fed, meanwhile, absorbed more dollars (held by foreign official institutions) in its foreign repo pool (FRP) for the first time in weeks (chart below).

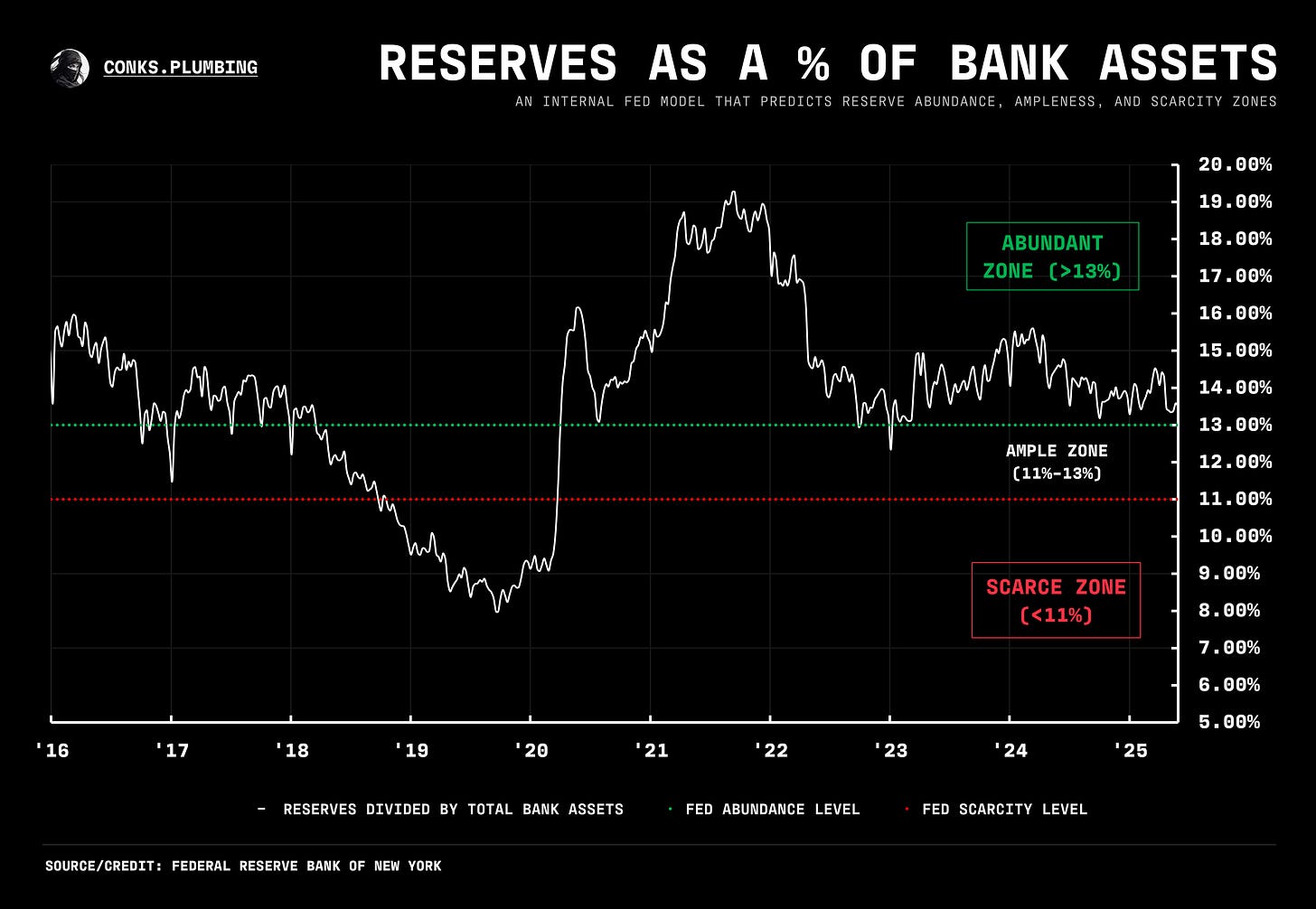

As for spreads, the Wells Fargo asset “uncapping” and Fed Bowman’s latest speech suggest more balance sheet relief is coming than merely an SLR downgrade (and in classic Conks fashion, just after releasing an article calling for a deregulatory capitulation). This will likely curb short-term downside in swap spreads and serve as a bullish catalyst for duration, regardless of whether adequate plumbing relief is ultimately delivered.

In STIRs, our call for a reversal in cuts priced in for next year, as indicated by the Z5Z6 SOFR futures spread, appears to have played out. We’d expect this to continue. Our call for the SOFR-FF basis to tighten at the August expiry has yet to materialize, however.

Lastly, at the ultra short end (t-bills), unlike the 2023 debt ceiling drama, we’re not seeing much pricing in of trouble ahead. In our exchanges with participants, some desks have started to grow cautious, but not to the same extent as during the last debt ceiling theater.

Coming soon (WIP): a STIR monitor to accompany these updates.

Now onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.