Money Market Update

the cash deluge is set to become a cash snooze, but as a pending debt limit truce looms large, this will soon upgrade to tighter dollar funding conditions

Welcome to another Conks edition. In case you missed it or just joined us, the latest infographic went live recently.

Our next piece, featuring additional graphics, will be available soon.

But first, a (gradually improving) money market update…

Summary & Brief Commentary

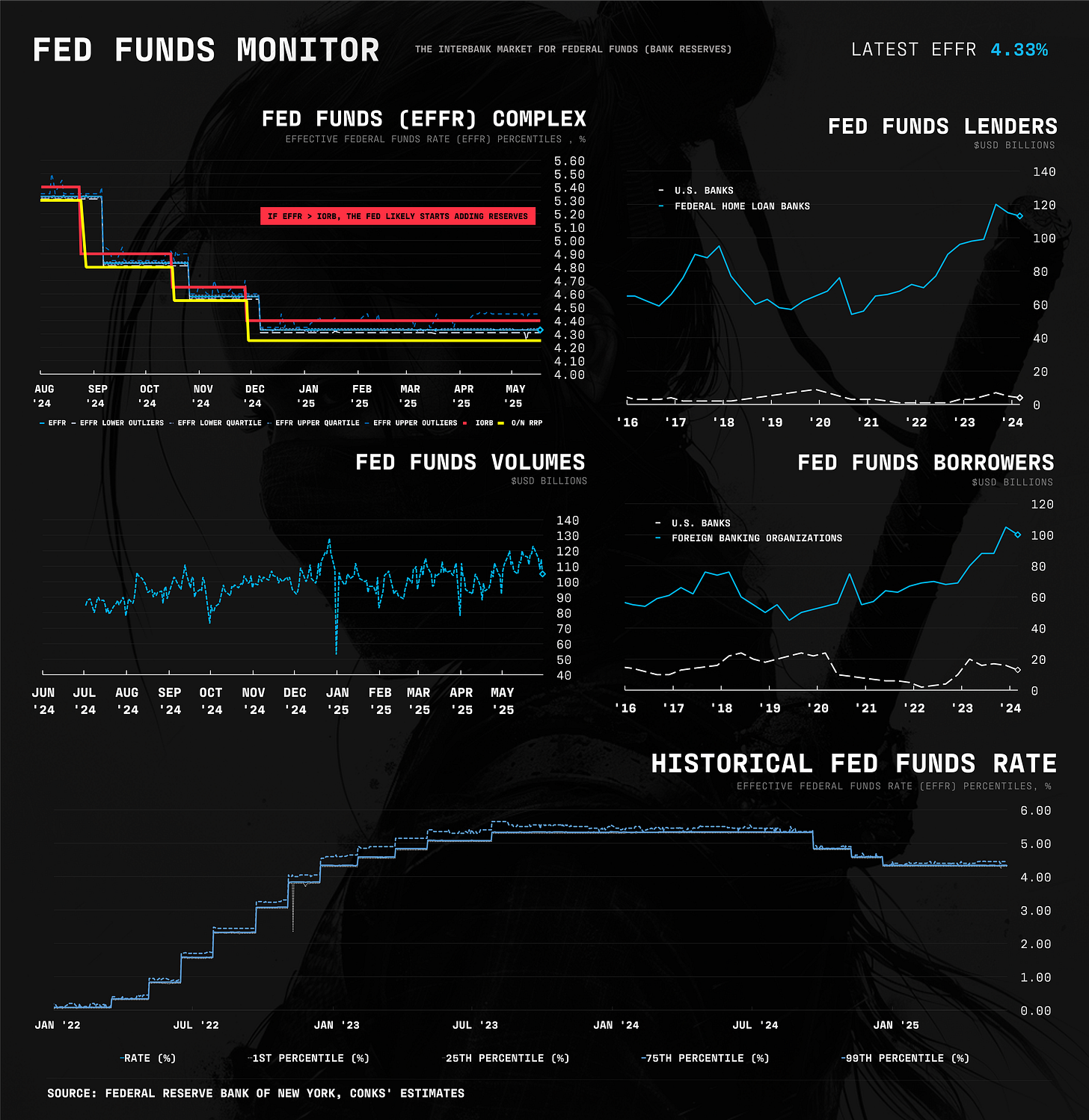

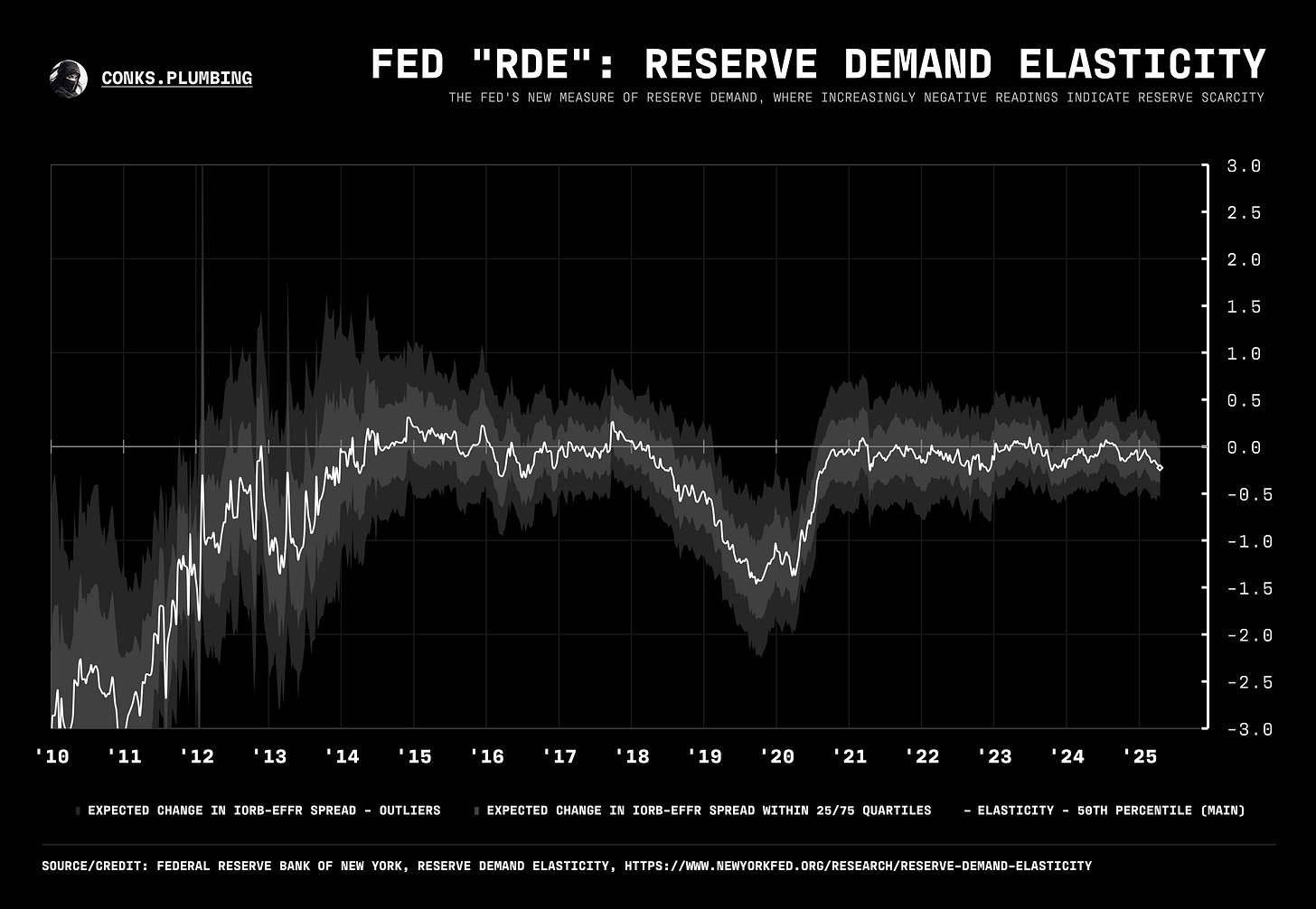

The cash flood of May ‘25 is likely behind us, set to be replaced with mild funding conditions, as tax receipts and additional extraordinary measures will soon be available to the Treasury. Bank reserves remain in the Fed's abundant zone, while the U.S. central bank’s RDE (chart below), its measure of reserve scarcity, indicates that a small change in reserve balances will have a negligible effect on the SOFR-IORB spread. From a global perspective, the EUR cross-currency (XCCY) basis has been widening, albeit with a gradual decline. Subsequently, we still expect the Fed to hold onto its remaining QT (balance sheet reduction), likely for as long as possible, at least till September.

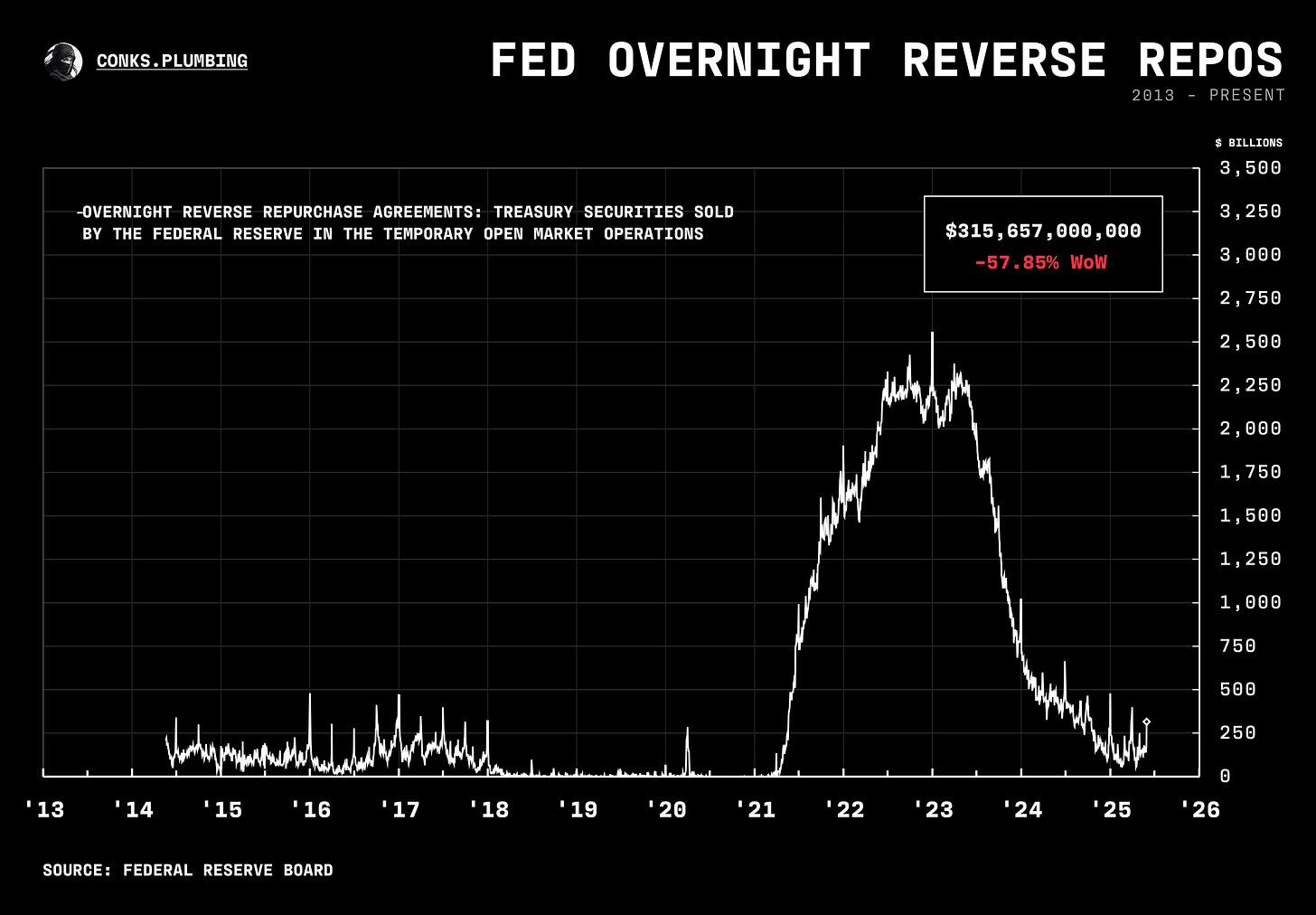

These mild conditions will expire once a debt limit resolution is reached, with up to a trillion dollars in bill issuance set to hit the ultra-short end of the market. Since the Treasury warned that it would exhaust all its cash, plus extraordinary (now ordinary) measures, by August, we expect a bill flood — and a subsequent draining of reserves and RRP balances — to commence around that time. The August SOFR-FF basis expiry (SERFF:BBG or SR1-ZQ:CME) has priced out most of the move from Trump’s tariff cascade, making a long basis trade (thus a short SOFR/FF futures basis trade) attractive.

Further out on the curve, supply is not expected to play a significant role in ongoing UST fears, with coupon issuance expected to remain fairly steady, even until the end of 2026 in some scenarios. Likewise, the belly (>1y and <10y) of the curve will only see moderate increases in issuance. Foreign demand for USTs, however, will still be weakened by local currency bonds (such as Gilts and Bunds) offering superior returns over FX-hedged USTs, with JGBs offering Japanese investors a ~180bps relative pickup. The great dealer sheet congestion remains ongoing.

Meanwhile, in the macro space, we’re saying goodbye to the deferred rate cuts theme and saying hello to “good news” rate cuts (channeling Fed Waller) via a Z5Z6 steepener (long Dec ‘25, short Dec ‘26 in 3-month SOFR futures).

In the (swap) spreads market, practically the entire street is expecting short-end spreads to rally while long-end spreads to turn more negative. Spread tighteners, though, remain under threat from a surprise SLR announcement or “worse” — a relaxation of risk-based capital (such as risk-weighted assets). See our Relief Valve pieces for the mechanics involved.

Coming soon (WIP): a STIR monitor to accompany these updates.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Agree z5/6