Plumbing Notes: A Global Compression

Fed ops have prompted a global dampening in $ funding markets

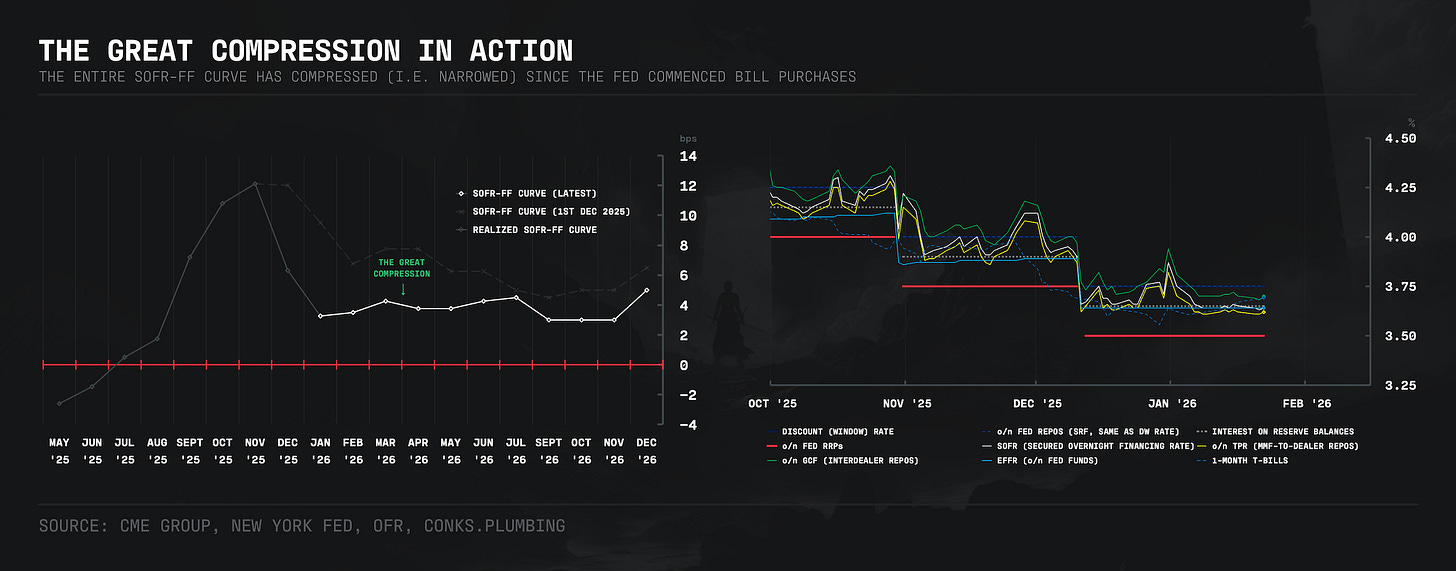

The U.S. central bank’s liquidity injections are working too well. After a month or so of Fed bill buying, the entire SOFR-FF basis curve has been crushed, with SOFR, the U.S. central bank’s primary repo benchmark, already hovering around its o/n (overnight) “sweet spot” — a few bps below IORB (interest on reserve balances).

The Fed will hope SOFR stays in its sweet spot, as the major $ clearers remain less willing to step in. The “Big Six” banks, led by JPMorgan, have ostensibly front-run cuts by swapping out more of their reserves for USTs (U.S. Treasuries)1, while those bearing unrealized losses in their investment portfolios hoard an extra reserve2 cushion to stem uneasy outflows. Further rate cuts by the Fed will only decrease large banks’ “excess” reserves further but increase their willingness to step in with their remaining balances at lower spreads3, containing o/n rates. Cuts are also an antidote to the weakening macro outlook, a win-win for monetary leaders.