Plumbing Notes: The Repo Fortification

the Fed's attempt to strengthen its fragile "upper jaw"

The Fed’s upper jaw, the upper boundary of its target range, remains defective. The climax of the excess cash era1 has shifted the floor in o/n (overnight) rates above the Fed’s minimum bid (SRFR) at its standing repo facility (SRF), prompting hundreds of billions in repo trades to print outside the U.S. central bank’s target range. An o/n repo facility should enable leaders to enforce a ceiling by broadcasting the cheapest rate at which primary dealers and banks can increase their cash balances. On the surface, it appears a “risk-free” arbitrage exists, where money dealers can borrow at a much cheaper Fed rate (at times, around 20bps below their usual private counterparties) to bridge market imbalances. Beneath, however, numerous covert forces are preventing dealers from tapping Fed liquidity, producing an active yet impaired upper jaw. With repo rates threatening to again breach the Fed’s perimeters and drive spillovers into other markets during the next Covid-style event, a Repo Fortification is looming.

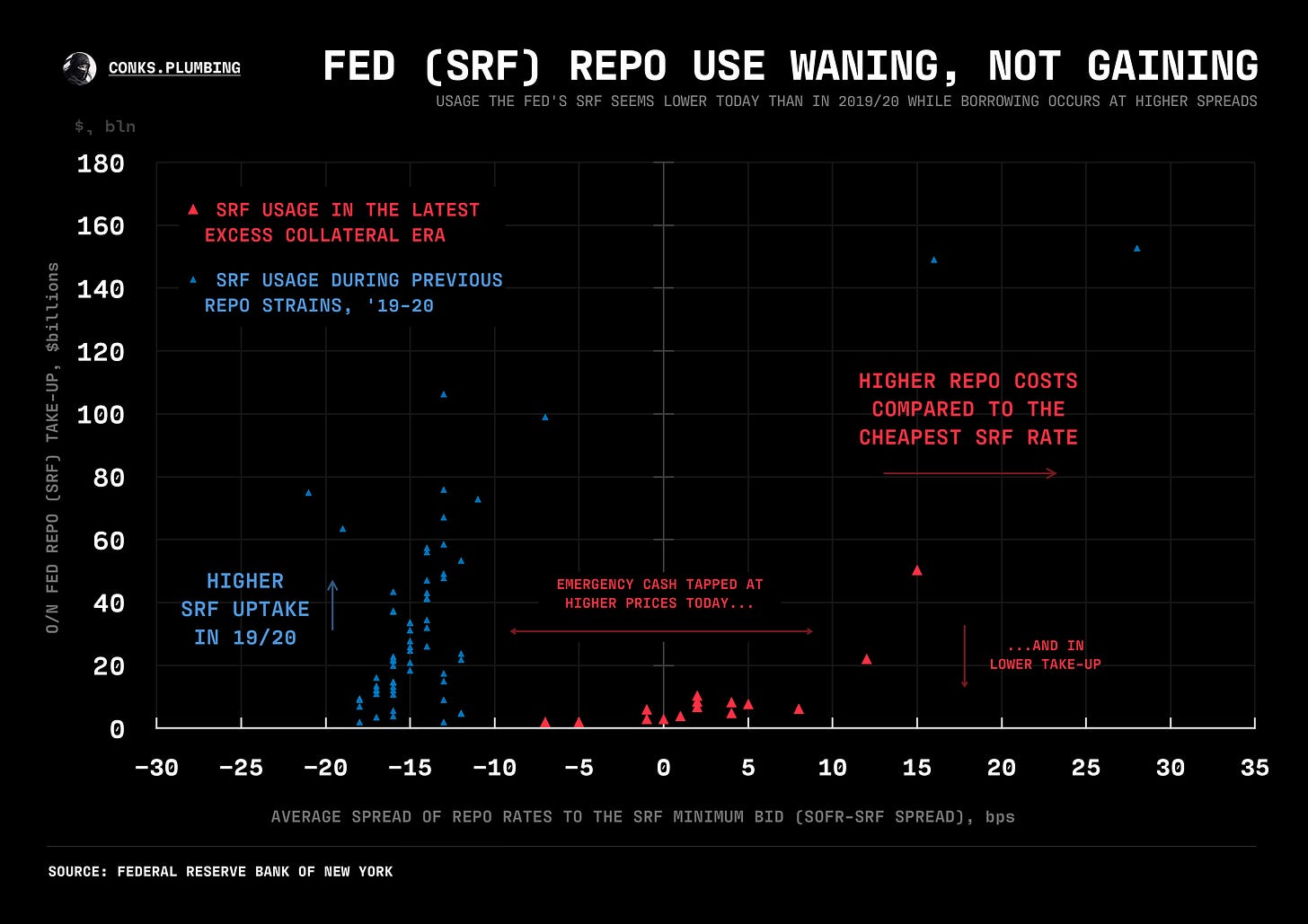

During mid-November, New York Fed President Williams convened with the heads of primary dealers2 at the annual U.S. Treasury Market Conference. The meeting took place not to resolve — presently nonexistent3 — liquidity issues but to remind key dealer banks they could tap cash via the SRF freely without stigma: the fear that other banks may conclude you’re in trouble upon borrowing Fed liquidity. SRF take-up (i.e. usage) appears to be worse than it was half a decade ago, even before the facility became official4. Much like the Fed’s leaky lower boundary (the bottom of its target range), the SRF has failed to contain money market rates, which officials now consider to be routine on month-ends. Rather than forming an immaculate ceiling, the Fed has come to admit that its repo counterparties won’t tap the facility en masse, despite vastly cheaper rates. Lackluster usage, even with persistent nudges from officials, reveals stigma has not only endured but proliferated.

Officials are already losing the battle to convince prominent market makers to use the SRF in size. But officials must also repair other defects with the current repo backstop. Stigma is only one of numerous obstacles preventing truly seamless access to central bank cash.