The Coming Volatility Suppression

the Fed's primary bailout mechanism is growing more systemic

The most noteworthy transformation of the global monetary system is almost complete. By shifting from an unsecured to a secured standard, monetary leaders have attempted to eliminate systemic risk. But risk has only been transferred, not eliminated. The Federal Reserve’s Volatility Suppressor™ is about to be unleashed.

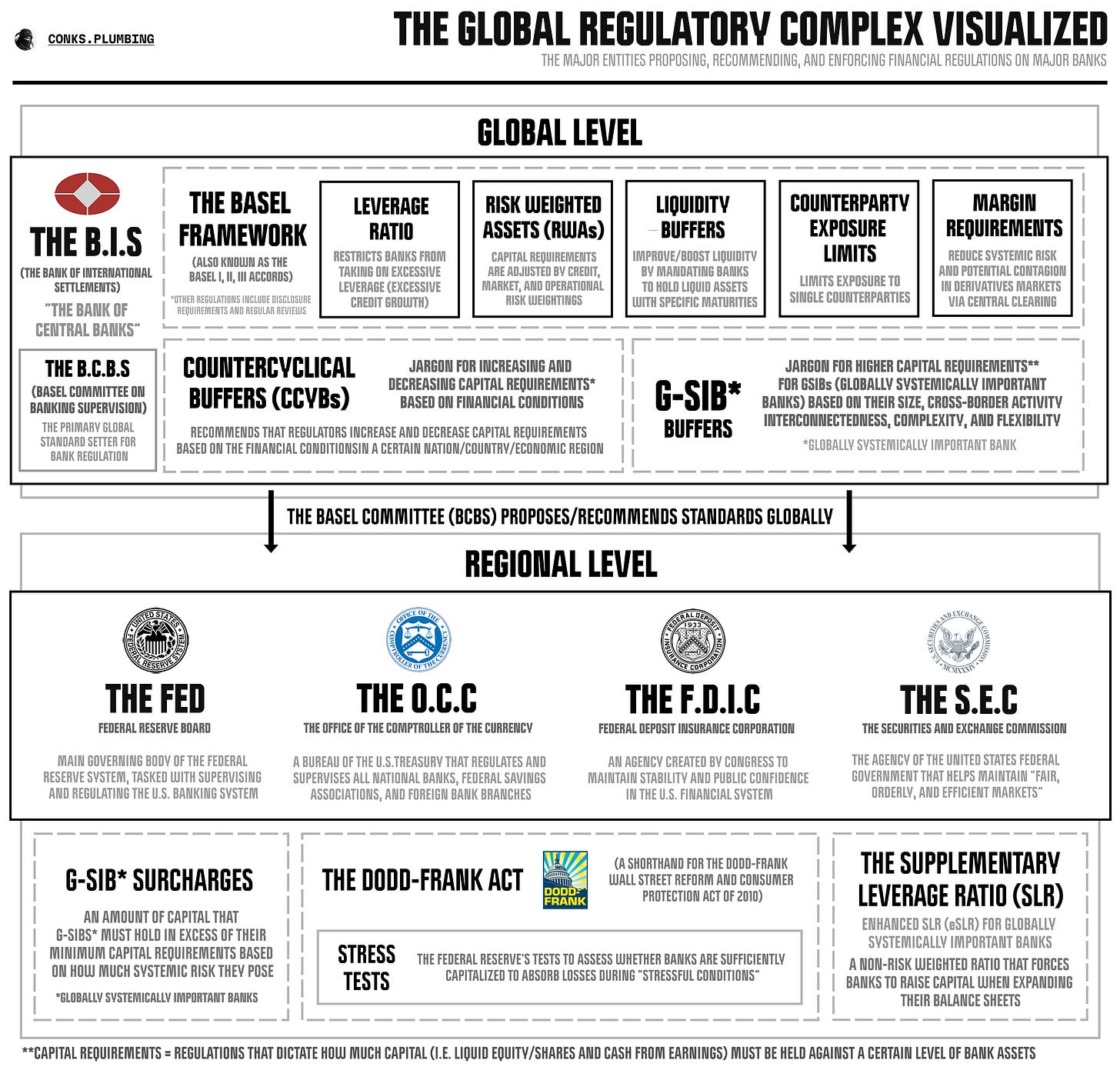

After the bursting of the subprime bubble in 2008, a paradigm shift in banking unfolded. While banks suddenly no longer wanted to lend to each other or bear excessive risk, the global regulatory complex set out to prevent a repeat of the crisis. The demise of the “unsecured standard” had commenced. Central bankers flooded the system with enough reserves to kill the Fed Funds market, the market for unsecured interbank loans. Meanwhile, the regulatory establishment had begun to devise an exhaustive array of measures to discourage unsecured lending. Dubbed the Basel III Accords by its architects at the BIS (Bank of International Settlements), a new global banking standard had been born.

Known collectively as “the agencies,” the Federal Reserve Board, FDIC (Federal Deposit Insurance Corporation), and OCC (The Office of the Comptroller of the Currency) not only adopted the BIS’s (Bank of International Settlements) new banking standard, however, but went a step further. By April 2014, each agency had fully enforced an additional set of constraints, obliterating the concept of banks taking on excessive risk forever. From then on, the Wall Street behemoths had to raise enormous amounts of capital to execute — what used to be — even the simplest of trades. Any dealing deemed mildly speculative by monetary officials had been outlawed from the banking system.

By doing so, America’s monetary leaders had not only forced banks out of risky trades but also forced the largest market makers to pull back from providing liquidity in key areas of the financial system. With the “shadow banks”, non-bank financial institutions not subject to the same stringent regulations, successfully filling in the gaps, the regulatory war against banks’ risk-taking abilities reached escape velocity. The Global Regulatory Complex™ achieved its most sought-after objective.

Slowly but surely, over the past decade, the banking arm of every global financial goliath has been transformed into nothing more than a boring utility, alleviating itself of its most speculative risk-taking capabilities. Even so, following the Silicon Valley Bank collapse and subsequent regional banking panic, regulators have once again decided to reignite their tenacity. In the face of a shocked and puzzled finance industry, authorities are about to force banks to implement even harsher capital requirements — raising the amount of liquid capital that must be held against their assets. Some estimates suggest the largest Wall Street banks will have to raise their capital “buffers” by a whopping 24%.

Swiftly, it’s become clear that the regulatory war on bank risk-taking is far from over. Yet what’s also evident is the effects this ongoing battle will have on global finance. No matter how extreme, the upcoming constraints will push even more activity away from banks and toward the shadow banking layer. A subsequent increase in the opaqueness of the financial system will ensue, prompting an even greater reliance on the Fed’s volatility suppressor to come to the rescue when choppy waters emerge. How will the U.S. central bank’s primary bailout mechanism save the day? It’s more than just a confidence booster. Let’s dive in.