The Fed's Reckoning: Part I

a plumbing "soft (or hard) landing" awaits monetary leaders

— click here for Pro

After a series of pauses and near misses, the “excess cash” era is finally coming to an end. The Fed’s arsenal to defer the next money market rates upheaval, in order to reduce its balance sheet as much as possible, has been depleted. Upon an expected violent end to funding markets the previous year, the Fed has already lowered its o/n RRP (overnight reverse repo)1 rate (by 5bps) to the bottom of its target range, boosting reserve balances and suppressing broader money market volatility. The U.S. central bank then solidified its “upper jaw”, the SRF (standing repo facility), offering morning and afternoon auctions2, thereby placing a stronger cap on money market rates3. The window before banks try to venture into markets that monetary leaders do not want them to tread4 has thus been extended.

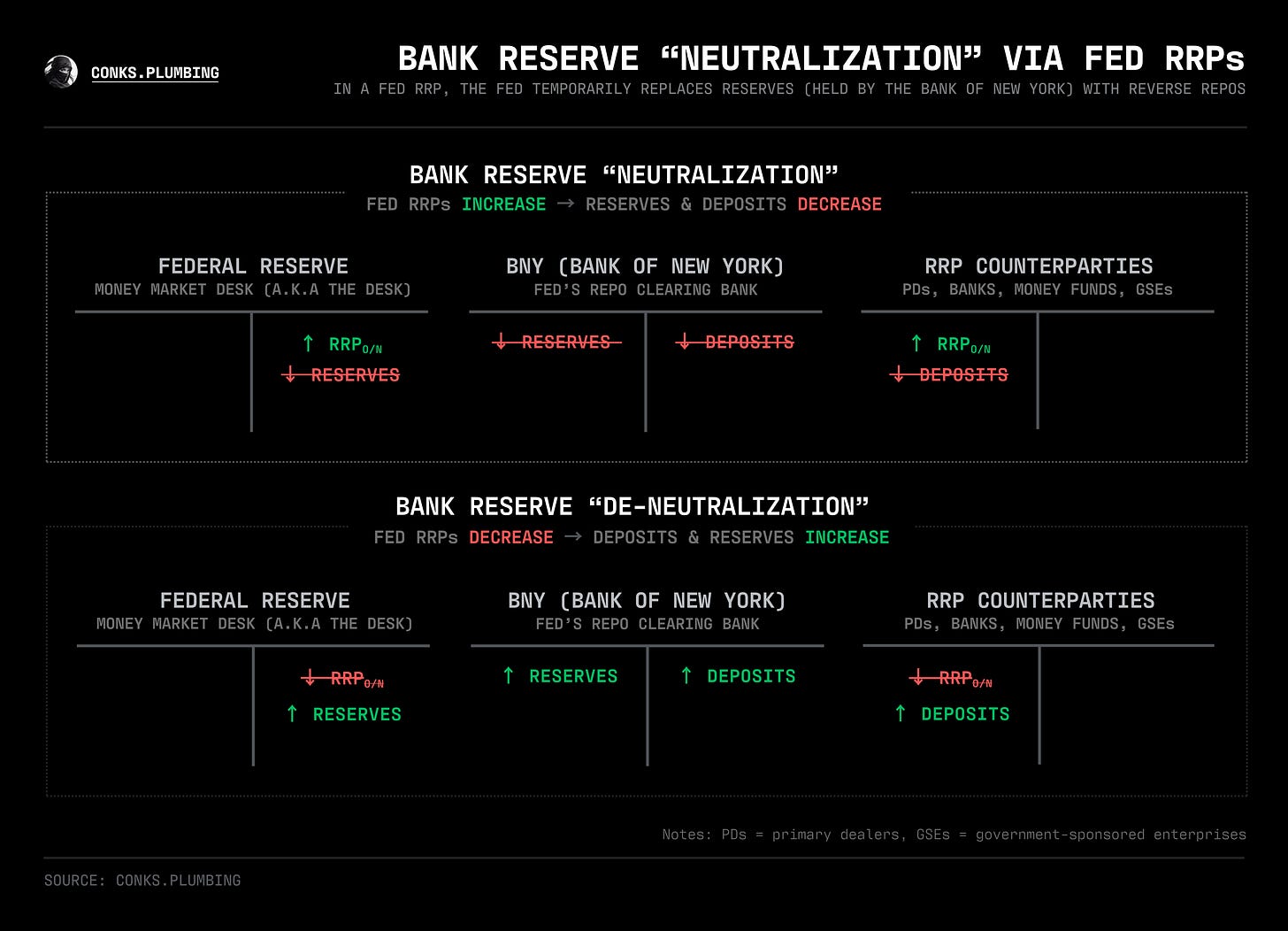

This gap has widened even further after the Fed, reacting to potential blind spots arising from increasingly volatile money market flows5, has partially unwound QT, downgrading the “threat level” of balance sheet runoff (i.e. the effects of reducing its balance sheet on asset prices) to neutral. Even so, with the Fed now shredding “pure” reserves — those straight out of banks’ reserve accounts, not “neutralized” in the Fed’s RRP6 (see above), officials must eventually initiate their next plumbing bazooka and restart liquidity injections. The challenge, however, is in the timing. The Fed’s Reckoning is approaching.