The Money Market Blindspot: Part I

a liquidity mirage is about to surface

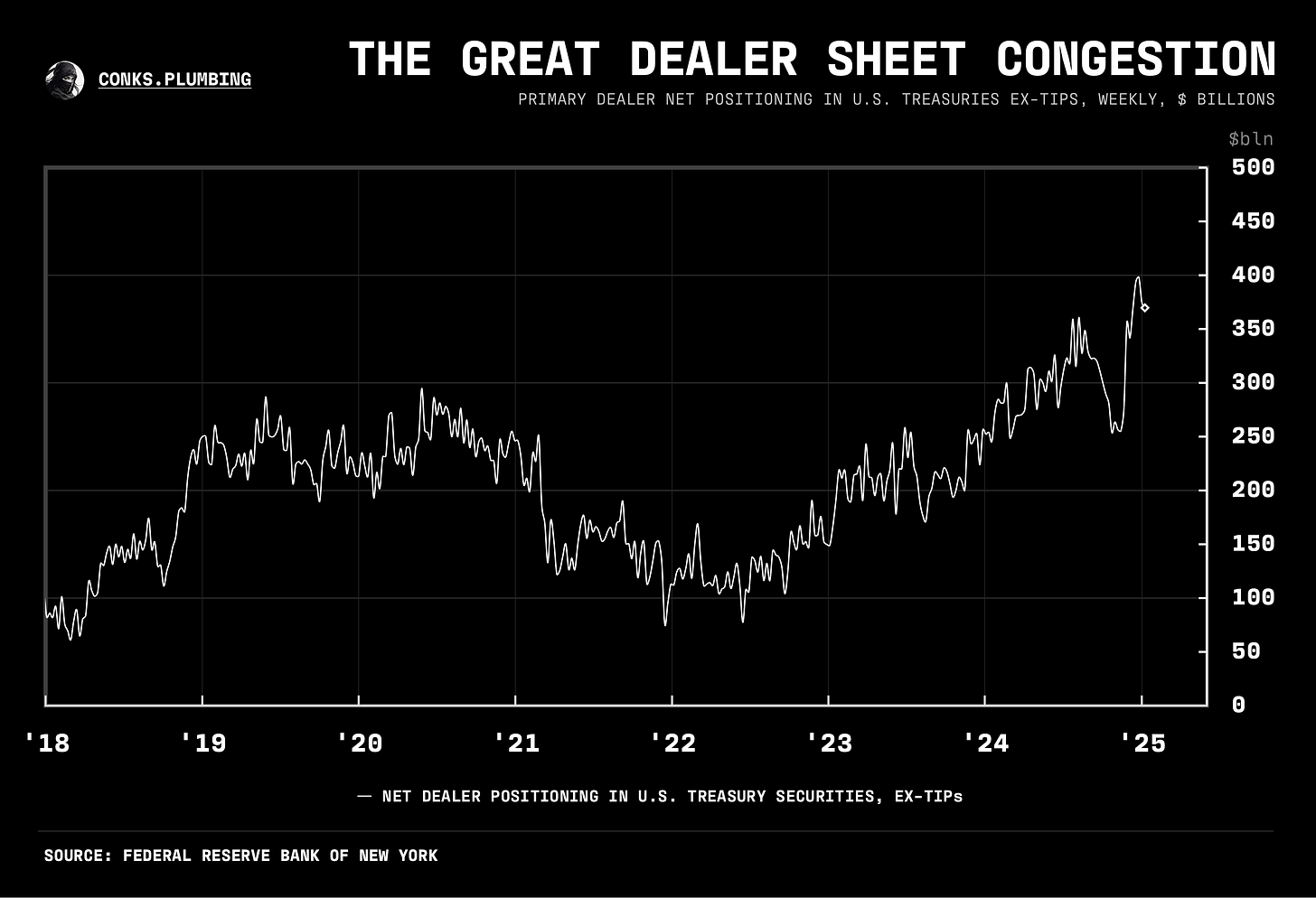

A funding squeeze is slowly becoming a liquidity deluge. Following a muted year-end, in which the Fed announced increased repo operations, once-elevated funding rates have subsided while constraints on market makers have evaporated. Dealer balance sheets are now set to “decongest” as the Trump Trade Steepening™ attracts demand previously sidelined by a curve inversion1. Nevertheless, just as conditions begin to ease, another debt ceiling2 battle is about to reignite volatility in money markets. With no truce in sight, political frictions have forced Treasury leaders to initiate another drawdown of the TGA3, the U.S. government’s bank account, prompting a cash surge in the banking system4. Upon a debt limit resolution, this flood may cause monetary flows to have overstated liquidity, a mirage that Fed officials (unwilling to terminate QT5) continue to dismiss. A money market blindspot is looming.

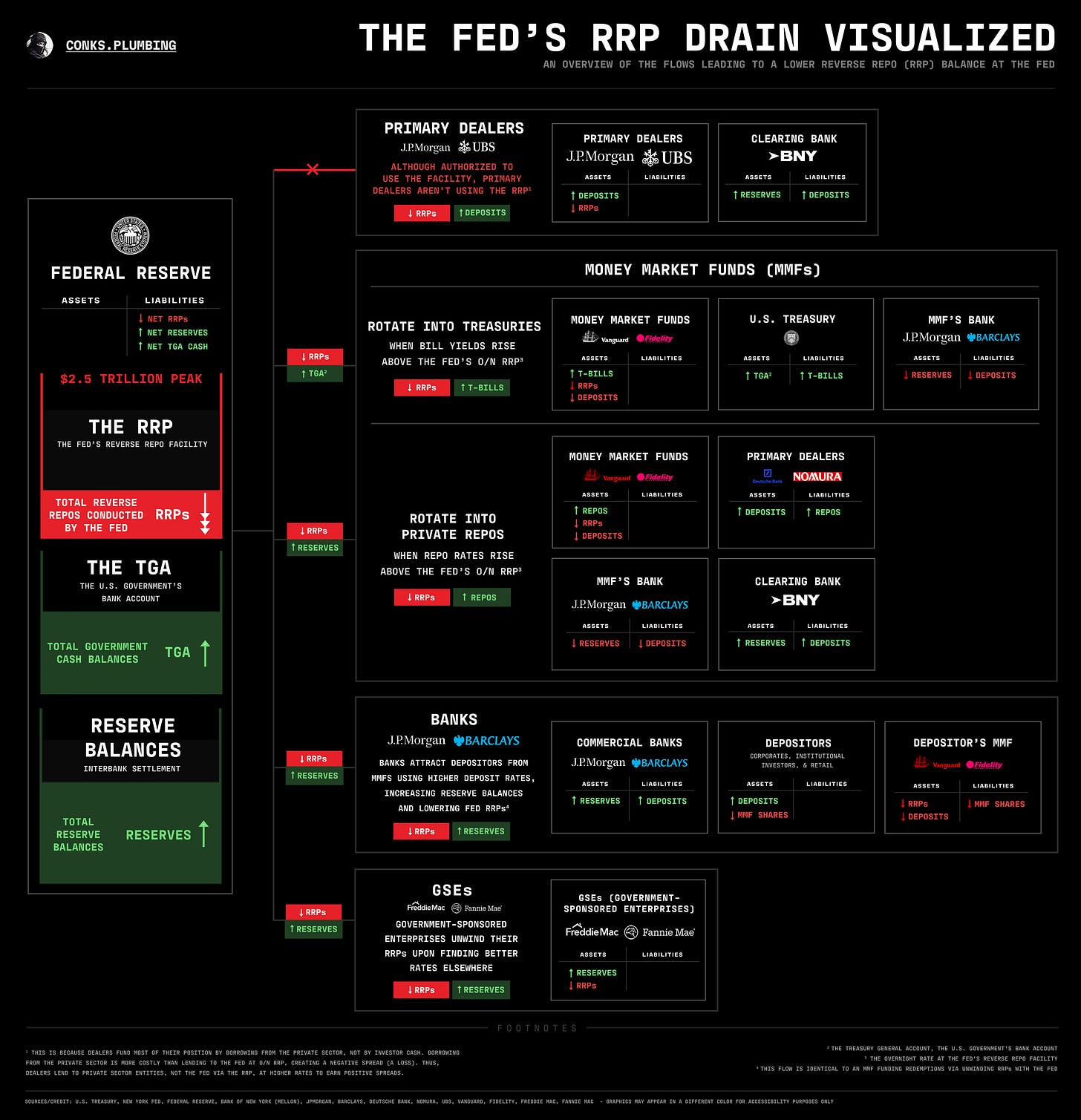

Following the peak of the COVID-19 liquidity injections, the financial system has shed trillions of dollars in excess cash. The Fed’s RRP, its liquidity “shock absorber”, has been depleted by money funds6 shifting into higher-yielding t-bills and private repos, all while funding an increasingly mammoth TGA housed at the Fed7. This cash surge, the so-called “RRP drain”, has prevented any severe funding stress from emerging in money markets. Reserve balances that the U.S. central bank once “neutralized”8 have been set free, providing a continuous feast for the Fed’s “QT shredder”.

Now, as money markets again try to enter an “excess collateral” era, another cash flood will saturate the U.S. banking system. For at least another quarter, the barrier protecting dollar funding markets from chronic volatility will be preserved. Another debt limit suspension has expired, prompting the Treasury to reduce its nearly $1 trillion cushion from insolvency, a mix of remaining (and incoming) cash in the TGA plus extraordinary measures9. The “debt limit bypass” has now been initiated. Its eventual unwind, however, could spark fireworks.