— click here for Pro

The mammoth endeavor to strengthen the U.S. Treasury cash market1 has entered a new iteration. In the face of immense supply, ever-increasing measures to fortify the most systemically important debt market have now been paired with a new admin’s desire to greatly suppress yields on U.S. Treasuries (USTs). Monetary heads of state have hinted at enabling greater incentives2 for the largest market makers to absorb incoming issuance, potentially boosting the balance sheet capacity of dealers enough to initiate a “plumbing liberation”3. Officials are now in a semi-race against time to toughen the pipes of the UST plumbing before the next market episode arises.

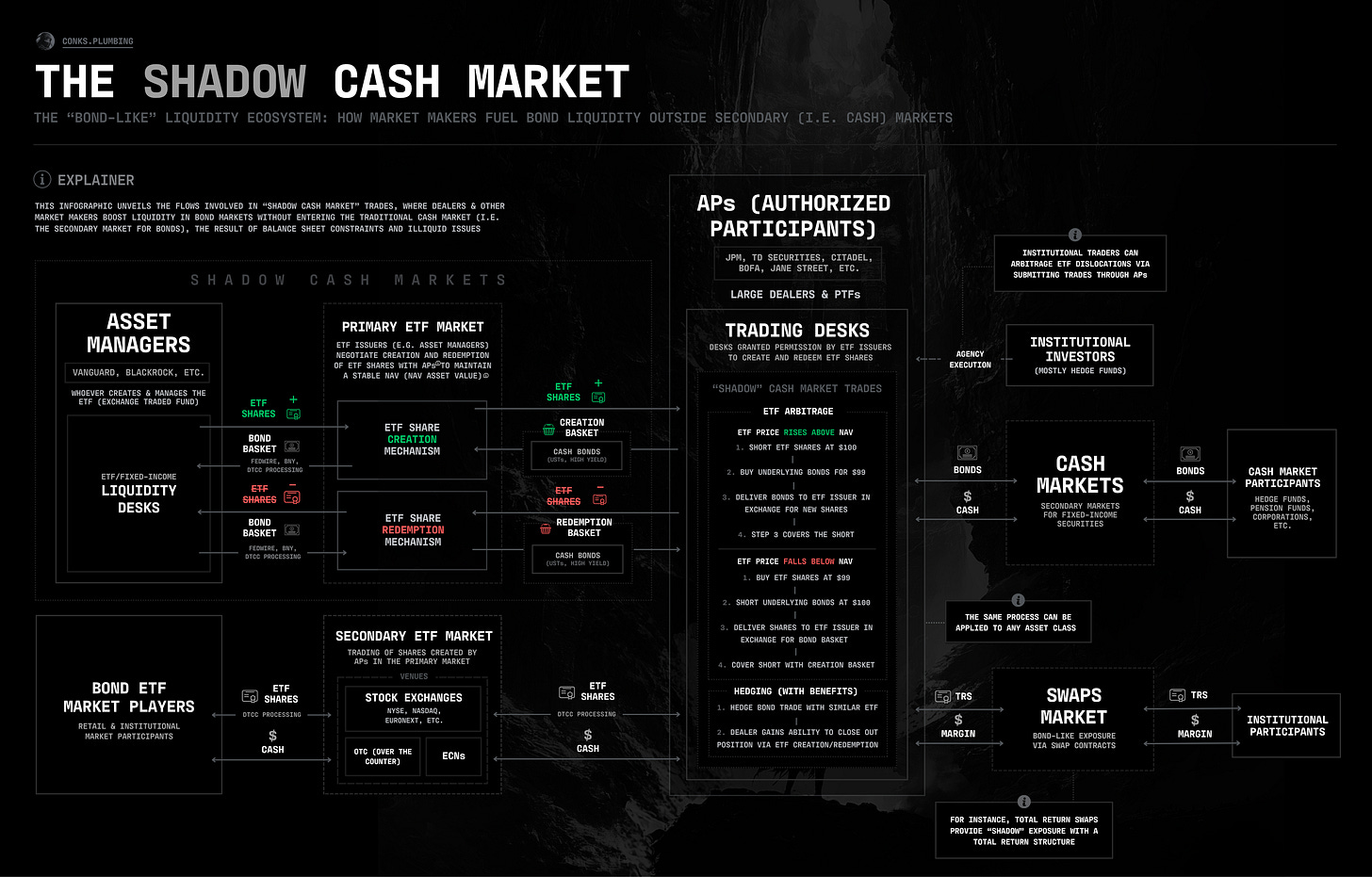

The fortification of the U.S. Treasury market is now fully underway. While Sec Bessent and POTUS execute policies (aiming) to dampen yields, thought leaders both inside and outside the Federal Reserve have expanded their efforts to instill confidence in America’s sovereign debt goliath. The release of regular, optimistic liquidity checkups, plus the removal of obstacles preventing hedge funds from arbitraging dislocations, are just a few examples. Elsewhere, under the all-seeing eye of the agencies4, the FICC (Fixed Income Clearing Corporation) — the sole central counterparty for USTs — has begun to liberalize access to its centrally cleared markets, an ecosystem believed to quash systemic risk. As leaders enforce relentless measures to bolster market stability, however, obscure regions of financial markets, unknown to most, continue to provide a substantial liquidity boost.

Over the past few decades, financial alchemy created by major liquidity providers, both traditional (i.e. banks with primary dealer arms) and contemporary (other non-bank market makers5), has been largely concealed from the mainstream while giving rise to fresh techniques that grease cash bond liquidity. Dealer banks and other “legacy” market players have somewhat retreated, leaving nascent market makers to fill in the liquidity gap6. The Shadow Cash Market, where “bond-like” exposures allow market makers to intermediate trillions of dollars in fixed-income securities, has thus arisen. Liquidity in the most systemic market is consequently being underestimated, but also a subsequent batch of constraints that could bite major players during the next UST market upheaval.