Money Market Update

as the Fed Funds market remains "undead", large demand for repos pushes SOFR higher. meanwhile, the cutting cycle begins, with "too many" cuts priced in. we think two more by 2025

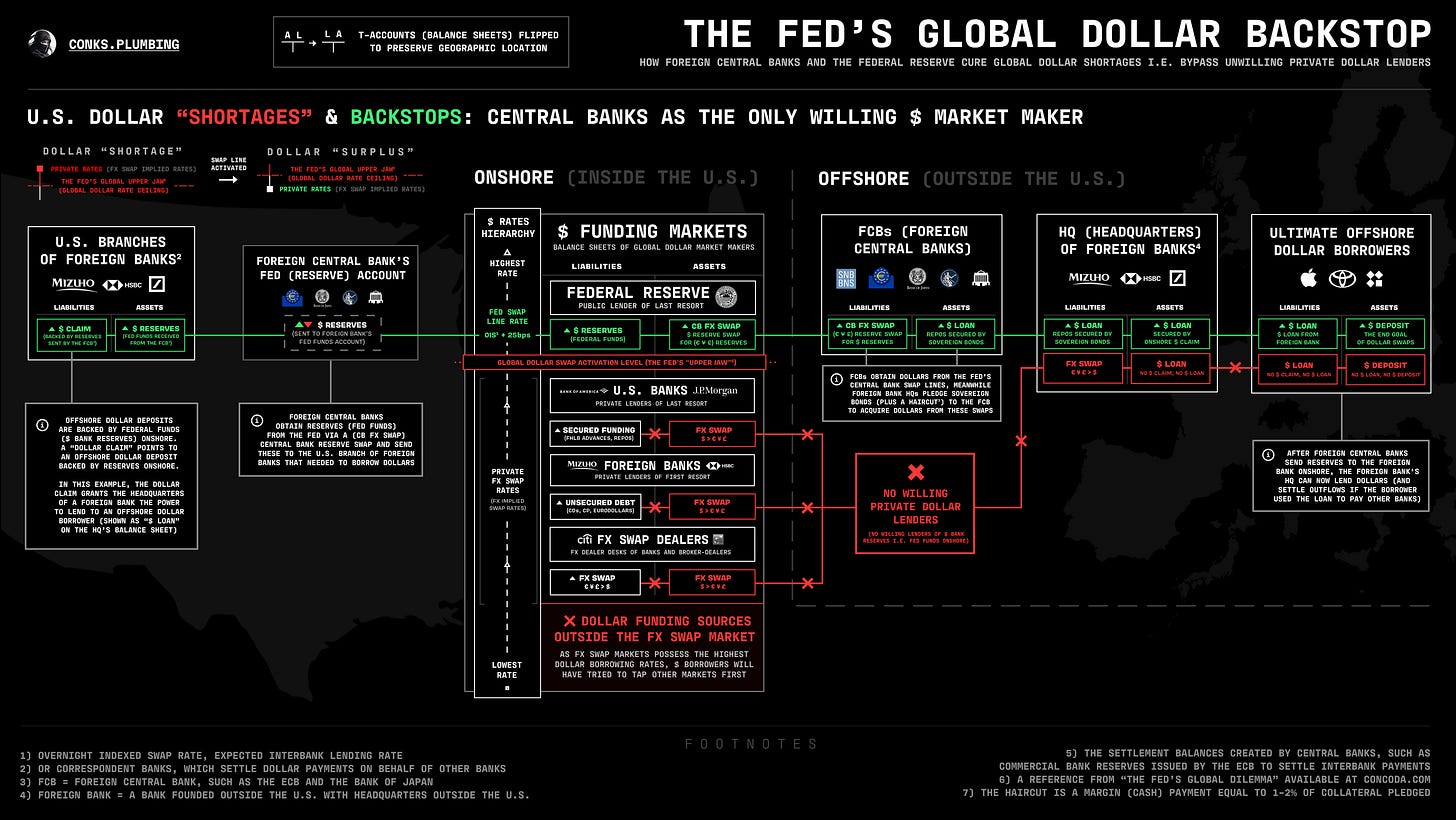

In case you missed it — or you’ve just joined us — our latest piece, The Fed’s Global Put: Part I, went live recently.

Part II is on the way (plus a primer on the mysterious cross-currency (XCCY) swaps market). Stay tuned.

But first, a (gradually improving) money market update...

Summary & Brief Commentary

You may have heard that Fed Chair Powell cut 50bps. Powell also mentioned that reserves remain ample. We agree, for now. Per The Fed’s Global Put (and for reasons noted in the upcoming Part II), we think they will cease QT in early 2025.

Contrary to popular belief, money market funds don’t usually see outflows because of rate cuts immediately, not even 50bps. Historically, rates need to fall below 2% for any significant outflows — and thus buying pressure elsewhere.

As we move into Q4, another “debt limit” or “TGA drawdown” debacle will likely become a topic of discussion. Conks projects the Treasury has enough cash + extraordinary measures to last until Q3 2025 before the X-date is nigh.

“Who will buy all that debt?” Foreign investors mostly, as it turns out, according to the Fed’s latest flow of funds data. Meanwhile, the Fed remains a net seller.

Are more Wall Street repos imminent? SOFR has begun to move higher toward interest on reserve balances (IORB). Meanwhile, as has been the case the entire year, Fed Funds (EFFR) trades flat as a pancake. In the Basel III era, secured rates trading above unsecured rates is now a feature, not a bug.

The previous money market update marked the short-term bottom for the SOFR spreads we cited, which have now entered consolidation and will continue lower, in our view. Market participants will have been thinking about what lies ahead. After the first cut, you create momentum. There’s a fear you might get left behind. Following a slight unwind in positioning, we think this dynamic takes hold.

Finally, with great sadness, we say goodbye to the not-QE corridor — the unconventional monetary policy infographic. Conventional rate cuts are back.

Now, for the chartbook (more monitors coming soon)…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Was there a spike in sofr in repo market recently? What is driving this sofr-ff gap?

Repocalypse Redux incoming...?