Plumbing Notes: No Limits

as the latest debt limit "guessing game" concludes abruptly, funding pressure at the ultra-short-end of the curve is set to emerge. a nugget-filled FOMC minutes reveals a sliver of what's to come

Welcome to another Conks money market update. A sneak peek (and relevant chart) from the upcoming, infographic-heavy Shadow Cash Market: Part II…

But first, another ever-expanding money market update…

Summary & Brief Commentary

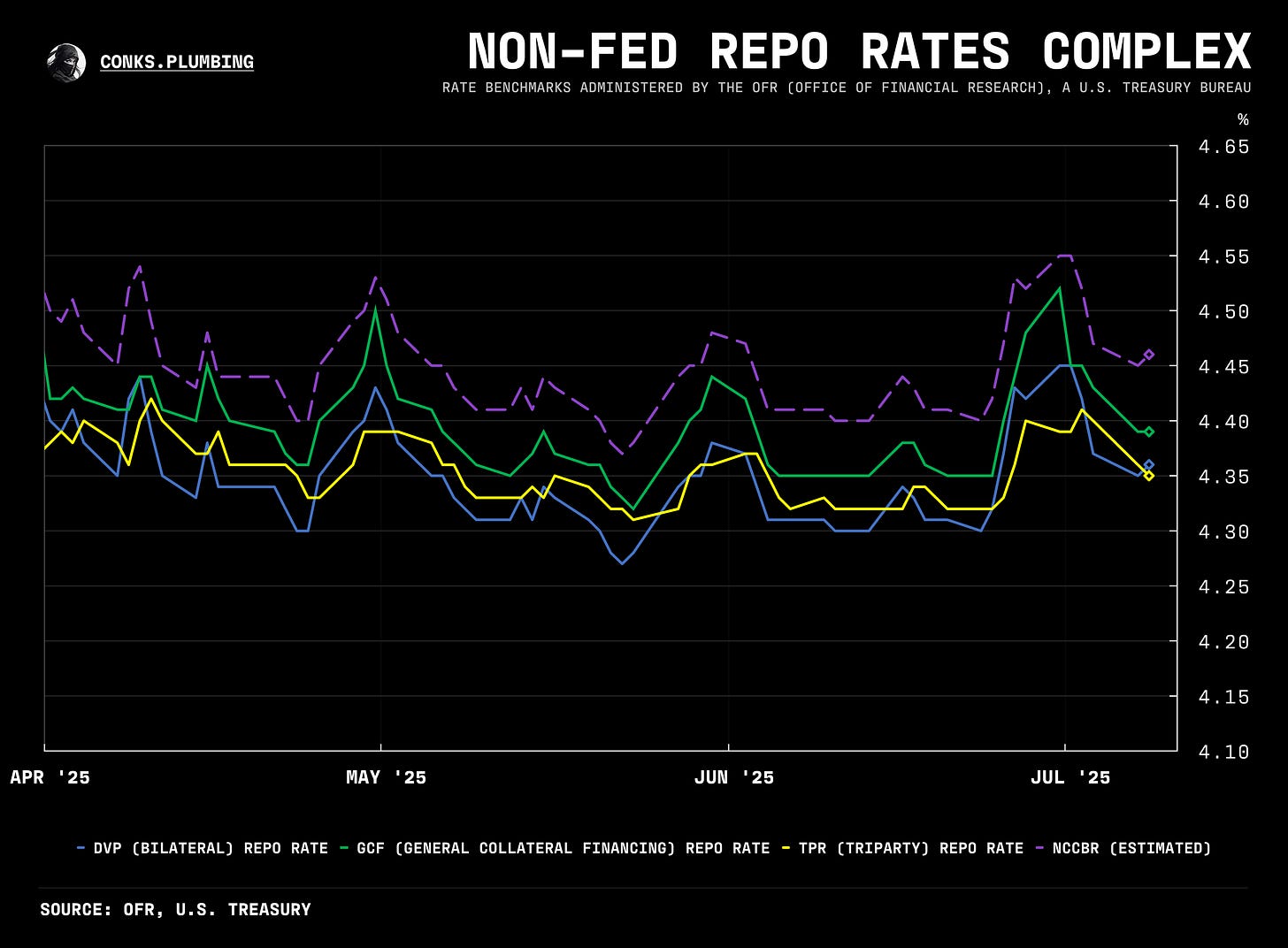

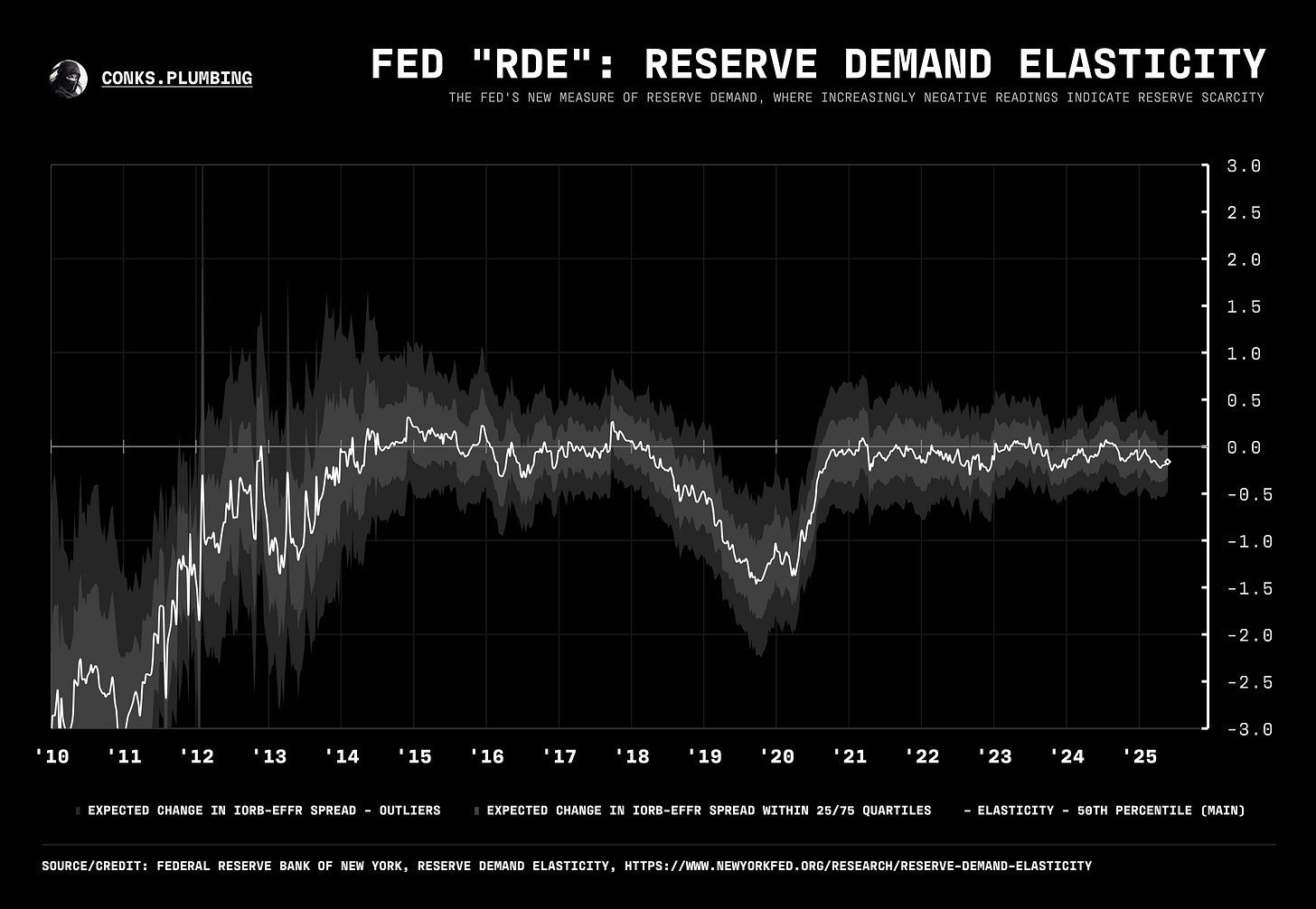

The debt limit “guessing game” (of predicting the bill’s passage date) has concluded, with funding pressures in money markets set to intensify. Bill “paydowns” (i.e. a net reduction in bill issuance) during another debt ceiling debacle helped suppress short-term rates and boost repo demand and thus usage of overnight repos (o/n RRPs) at the Fed. Now, however, these flows will unwind, while irregular funding pressures build, eventually forcing the U.S. central bank’s hand. The Fed’s RDE, which measures reserve scarcity (see the near-bottom of the chartbook), will finally start to decline, signaling an increased battle among banks for interbank liquidity and placing upward pressure on o/n FF (overnight Fed Funds).

Not helping the situation, the latest FOMC minutes revealed that The Desk and market participants expected a swift TGA rebuild, a negative (positive) for the SERFF (SOFR-FF basis) curve, as it removed any hope of relief from a proposed slower rebuild, which would have somewhat eased money market pressures.

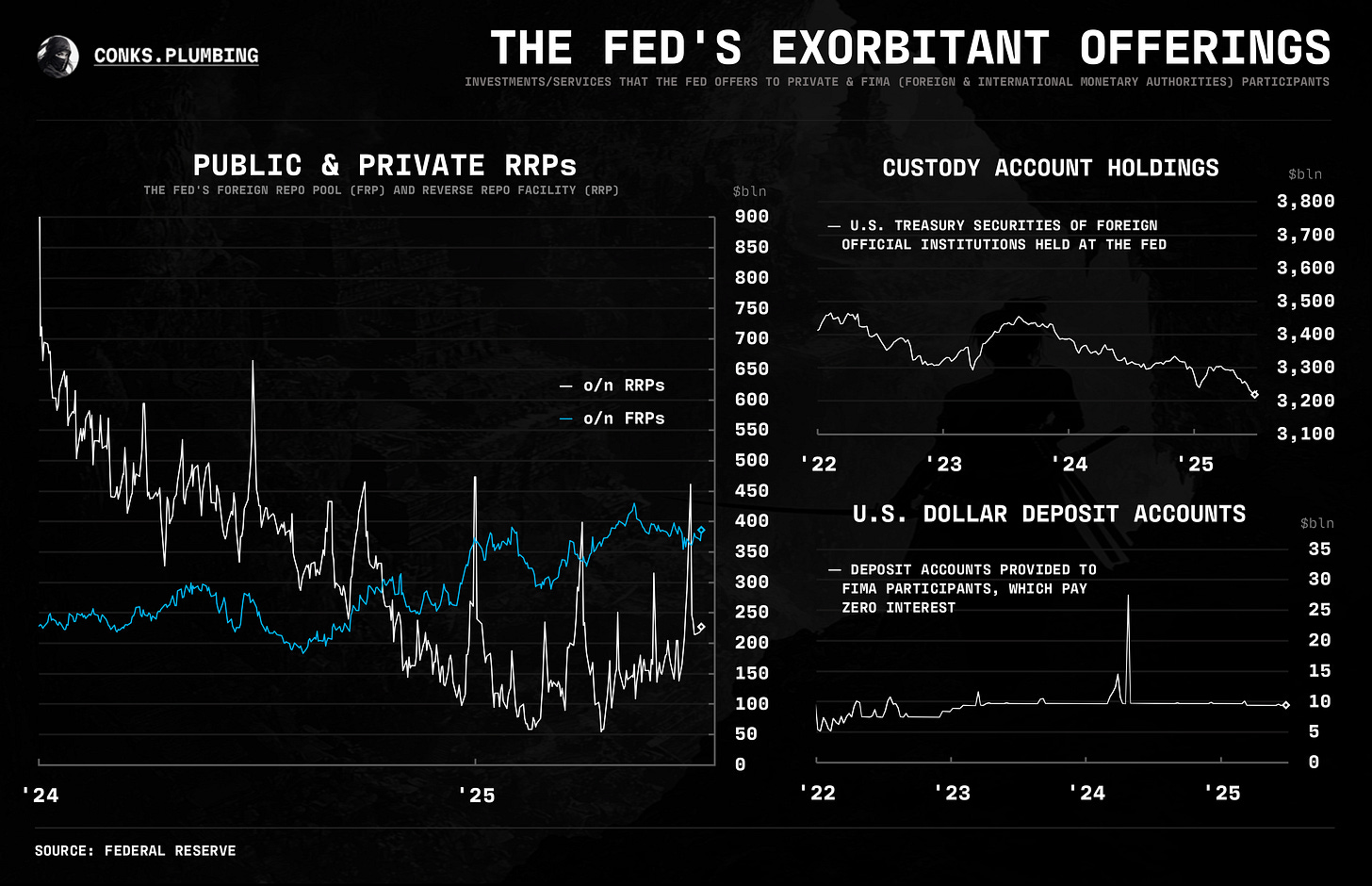

Any “fireworks” will have to wait, however, until the shredding of around $500 billion in reserve balances stored in banks’ Fed master accounts or “neutralized” in the Fed’s RRP facility — since an increase in central bank RRPs (reverse repos) removes reserves temporarily. Without the RRP chockablock, market participants now expect reserves to fall to $2.9 trillion by early next year, below Conks’ lowest comfortable level of reserves (LcLOR). February next year has become the newly anticipated chokepoint for the U.S. central bank to once again fire up “the money printer” in order to preserve the ampleness of reserves — hopefully preemptively.

Reserve balances will also see more shrinkage from foreign central banks (FCBs) anticipating more policy uncertainty and piling into o/n FRPs (overnight repos at the Fed’s foreign repo pool). These trades with the Fed also neutralize reserve balances while offering an early cash return for FCBs, thus providing superior intraday dollar liquidity (for reserve management purposes) compared to other investments (i.e. bills).

Notes, bonds, and longer-term rates futures, meanwhile, have rallied post the release of the FOMC minutes, after no major surprise. A couple of Fed officials were open to rate cuts (those likely vying for the Fed chair role), while others wanted no further cuts for this year. Subsequent price action suggested that upside pain remains limited, unless fiscal concerns (which The Desk’s latest survey highlighted as a top consideration) re-enter the picture as soon as next week. The short-term selloff we anticipated (actual short-term spooky bonds!) is likely over. We expect yields to remain static over the next week.

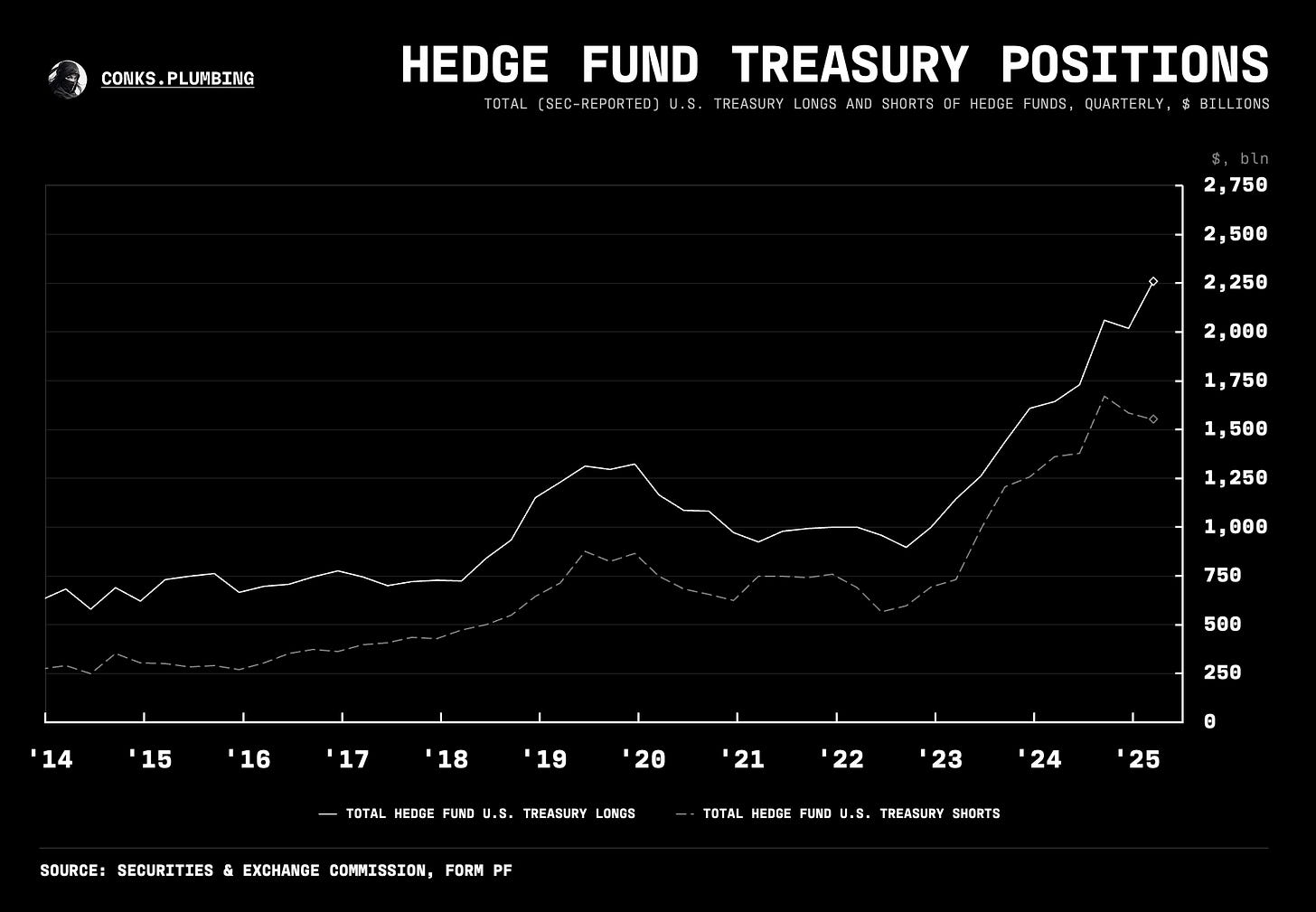

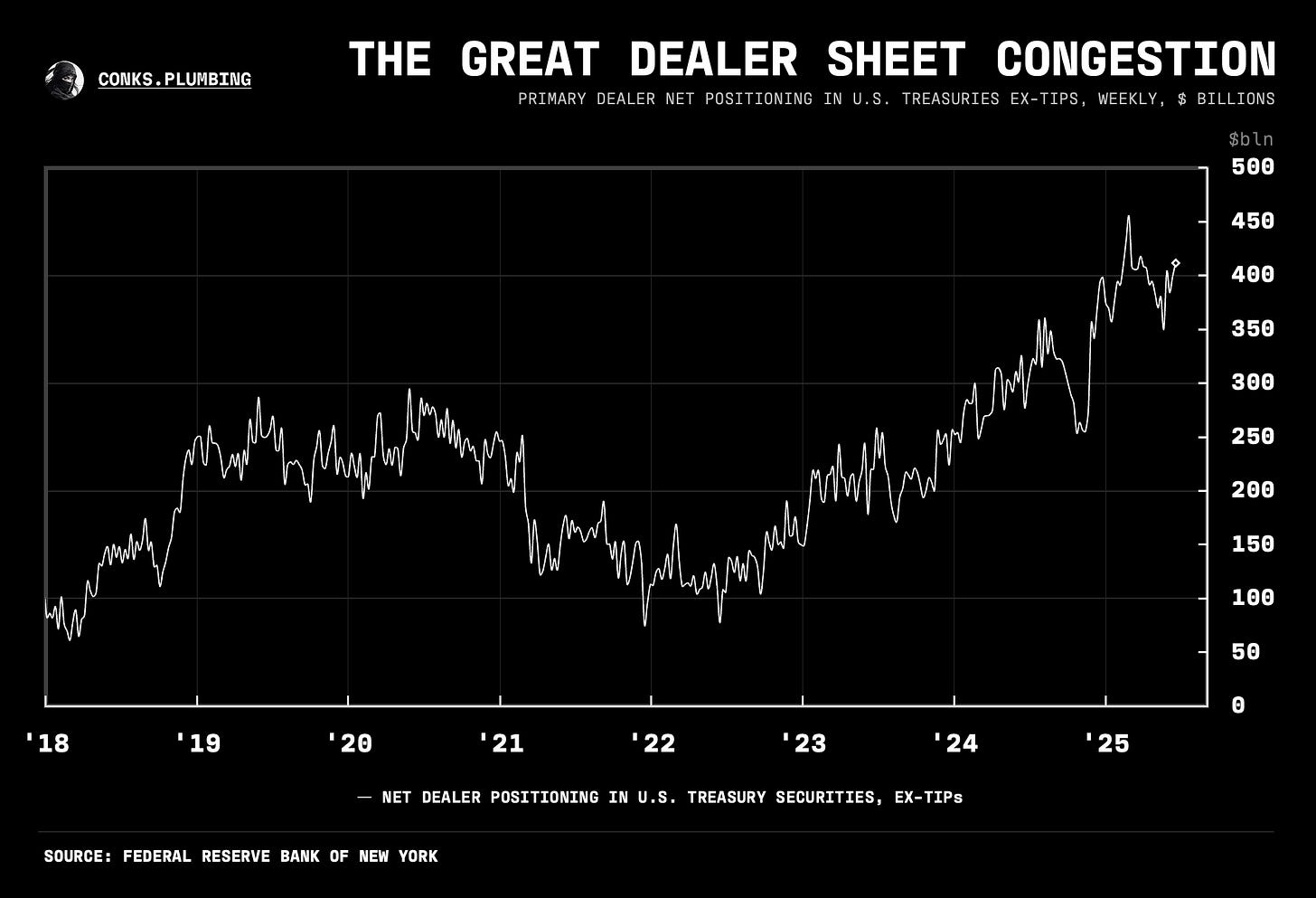

Likewise, the FOMC minutes further indicated a stable bid for U.S. bonds, with SOMA manager Perli noting that available data indicated stability in foreign holdings of U.S. assets. As for UST (U.S. Treasury) demand, investment funds, hedge funds, and other levered players continue to step in for banks, FOIs (foreign official institutions, i.e., foreign central banks and governments), and (indirectly) the Fed. Fiscal strains have instead manifested more in swap spreads — the premier gauge of plumbing frictions — as even the front-end of the spreads curve displayed negative plumbing sentiment via tightening i.e. declining price action. Cue the meme: we’re going to need a bigger relief valve!

WIP: a STIR monitor/Treasury monitor to accompany these updates.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Wait, so all the drama about shortening Treasury WAM was a lie?

I never checked it myself, because very respectable people had very smart discussions about that and nobody questioned the fact...

Is ATI about Fearmongering and removing people from the Earth?

No it isn't.

Climate Change Science is never settled

The wildfires are arson, not from climate change: https://cctruth.org/wildfire/

https://rcmp.ca/en/manitoba/news/2025/05/manitoba-rcmp-make-two-arson-arrests-following-wildfires

https://www.ecosia.org/search?method=newtab&addon=chrome&addonversion=7.1.0&q=Rowena+Fire+arson+arests

https://www.koin.com/news/wildfires/alder-springs-fire-in-central-oregon-was-human-caused-officials-say/

https://rosedogbookstore.com/climate-crisis-changed-the-intergovernmental-panel-on-climate-change-ipcc-reports-are-deliberate-science-fiction-ebook-text/

Because the high schools teach the fear mongering of the media and UN. Nothing they have said will happen has ever happened.

Trees release terpenes which induce rain.

The high school teach our published high-school textbook and the arson fires will stop.

Climate Change is about Fear mongering and removing people from the earth.