Plumbing Notes: QT For (a Little) Longer

mid-month pressures have arisen but will soon clear. nevertheless, higher money market rates will prevail, increasing odds of central bank action. this could come as late as Q1 next year, however

Welcome to another Conks Money Market Update. In case you missed it, our latest piece, The Fed’s Reckoning: Part I, went live recently. In other news, Conks will be on business in London, UK, from October 10th to 14th. If you’d like to meet, let us know.

Up next: Part II of The Fed’s Reckoning (or possibly beforehand, a more pertinent piece)…

But first, another ever-expanding money market update…

Summary & Brief Commentary

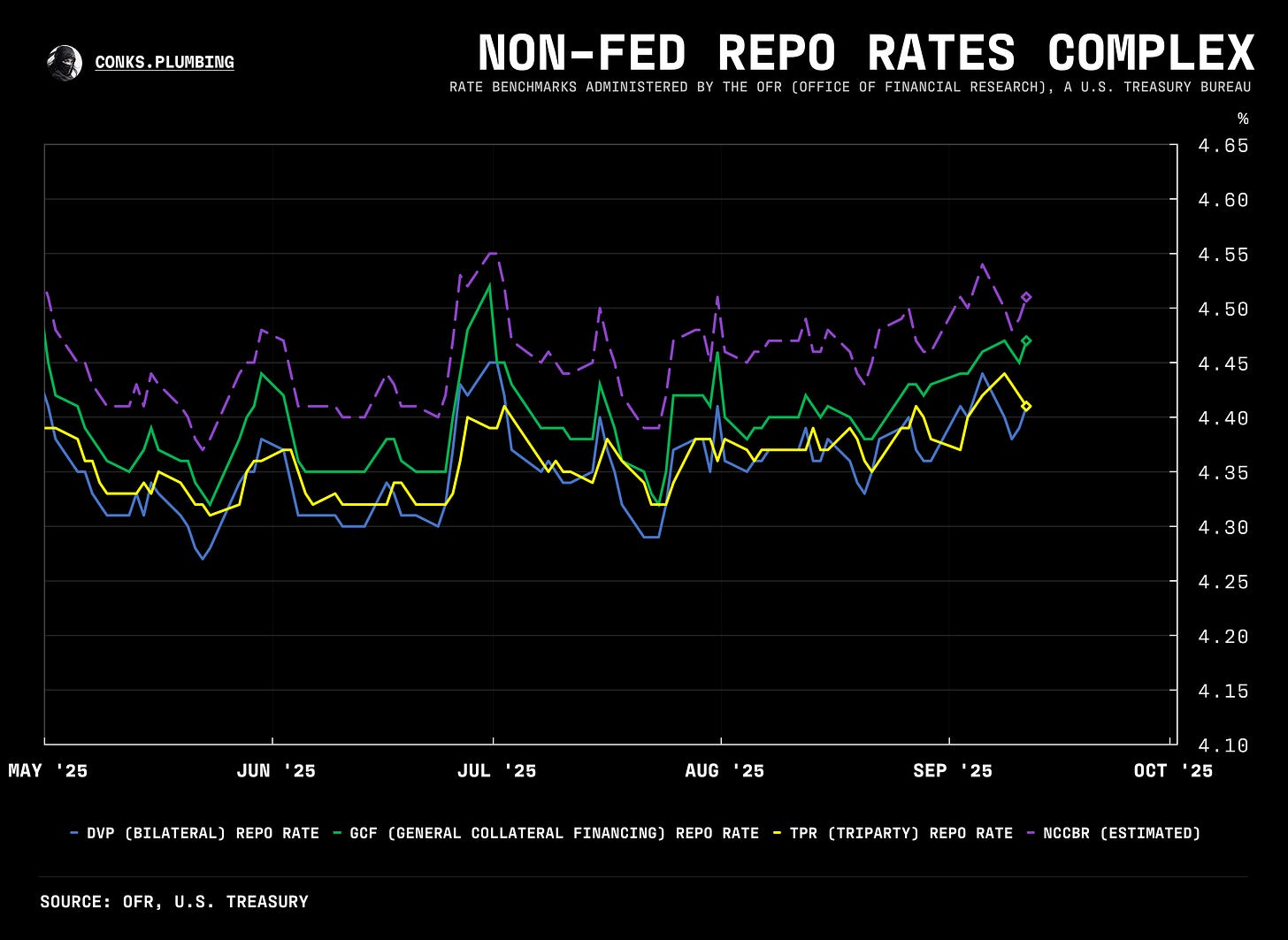

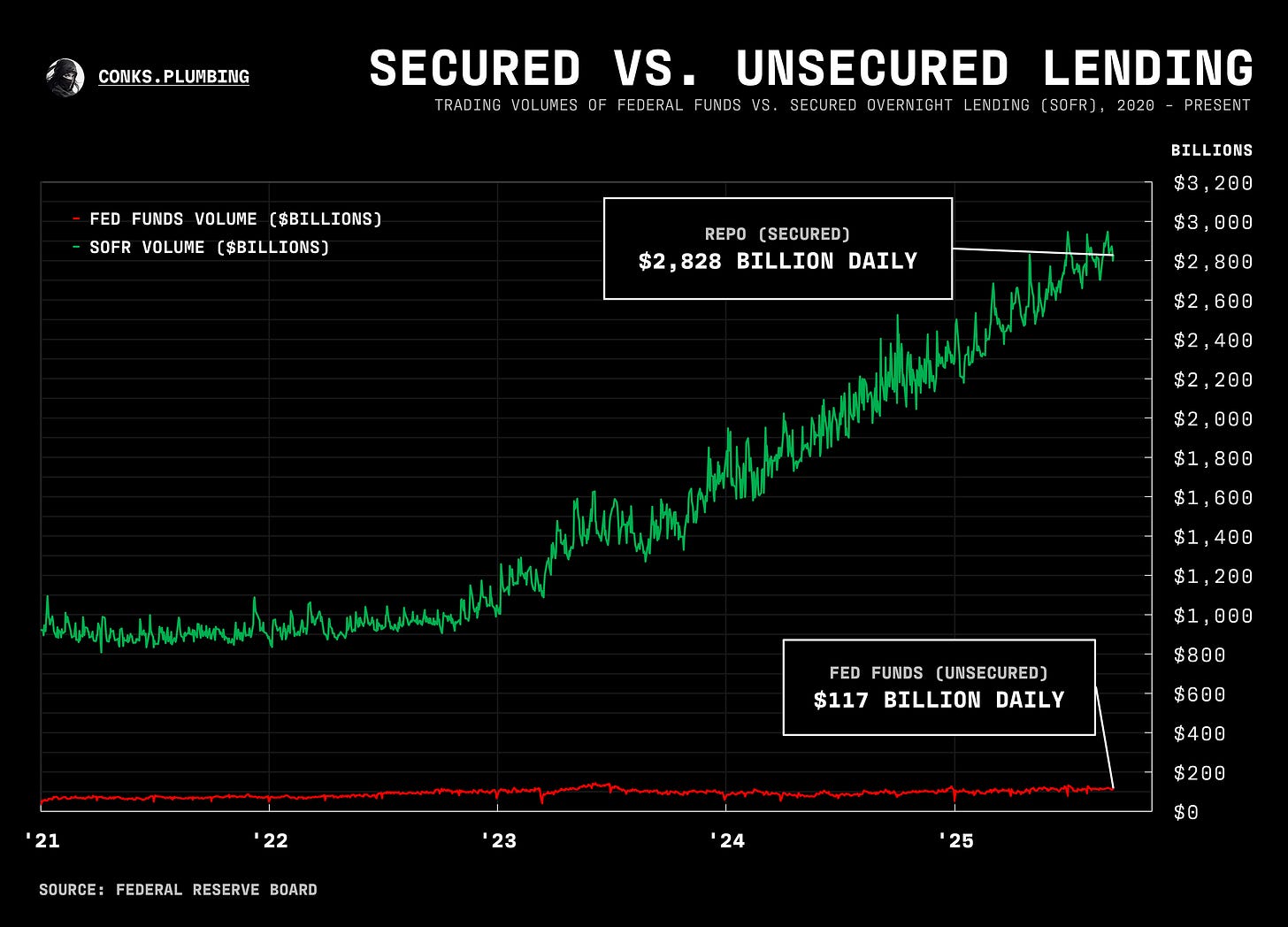

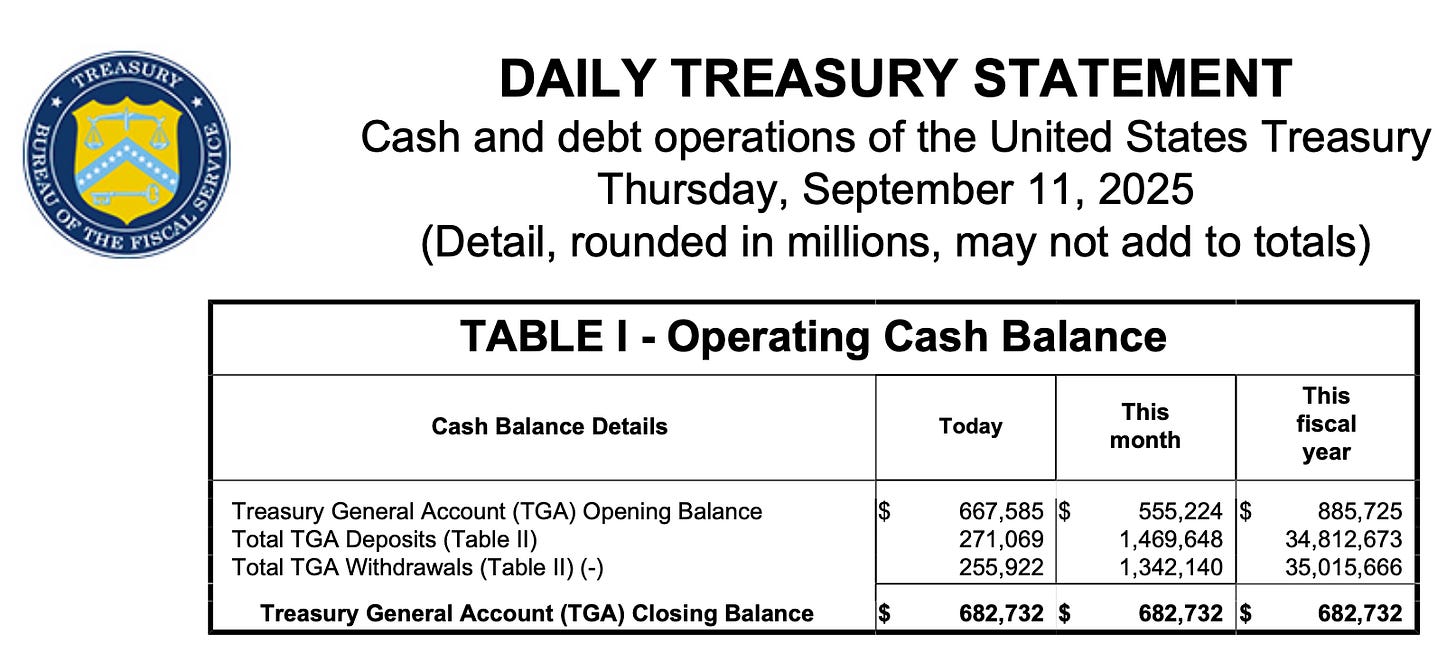

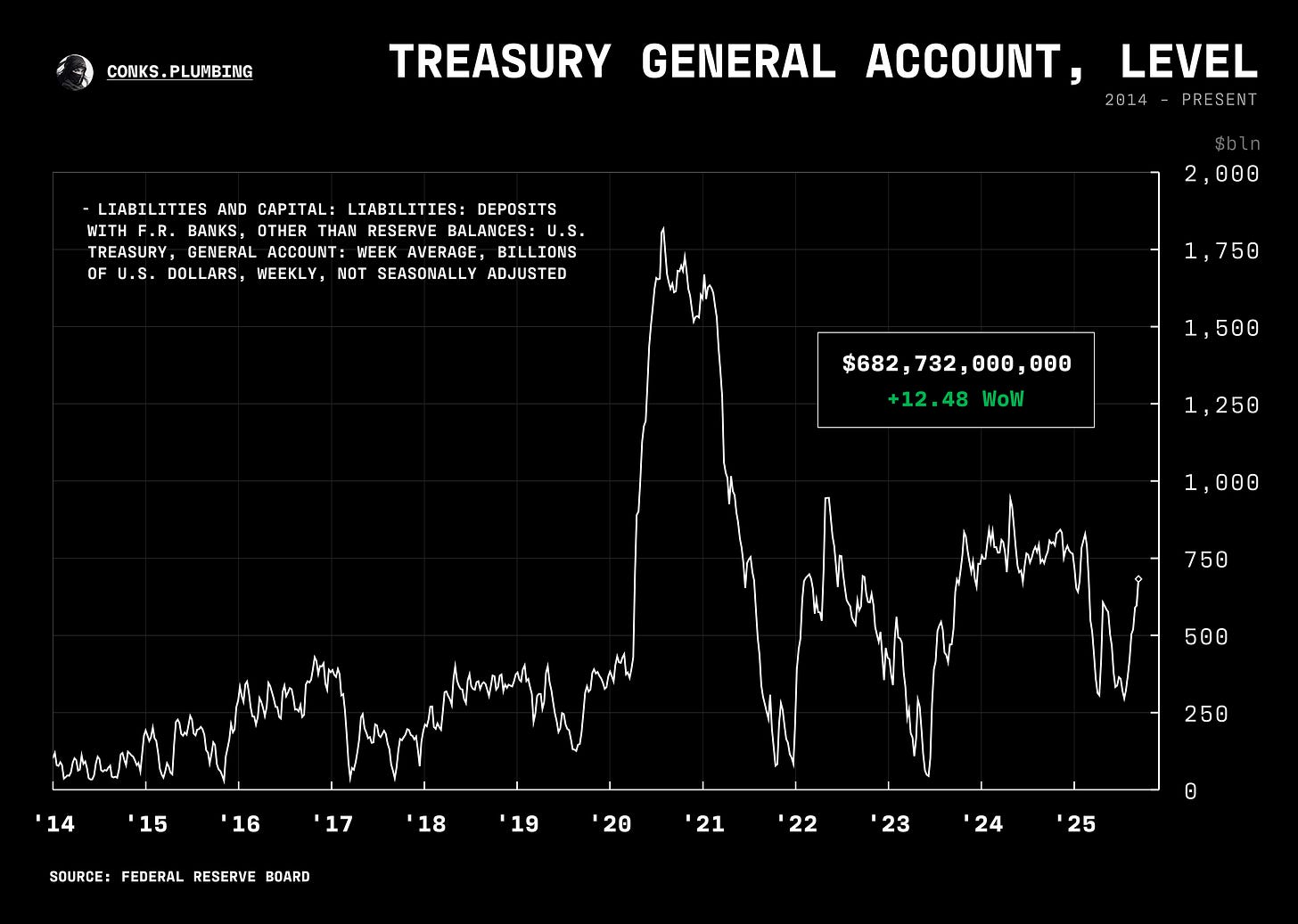

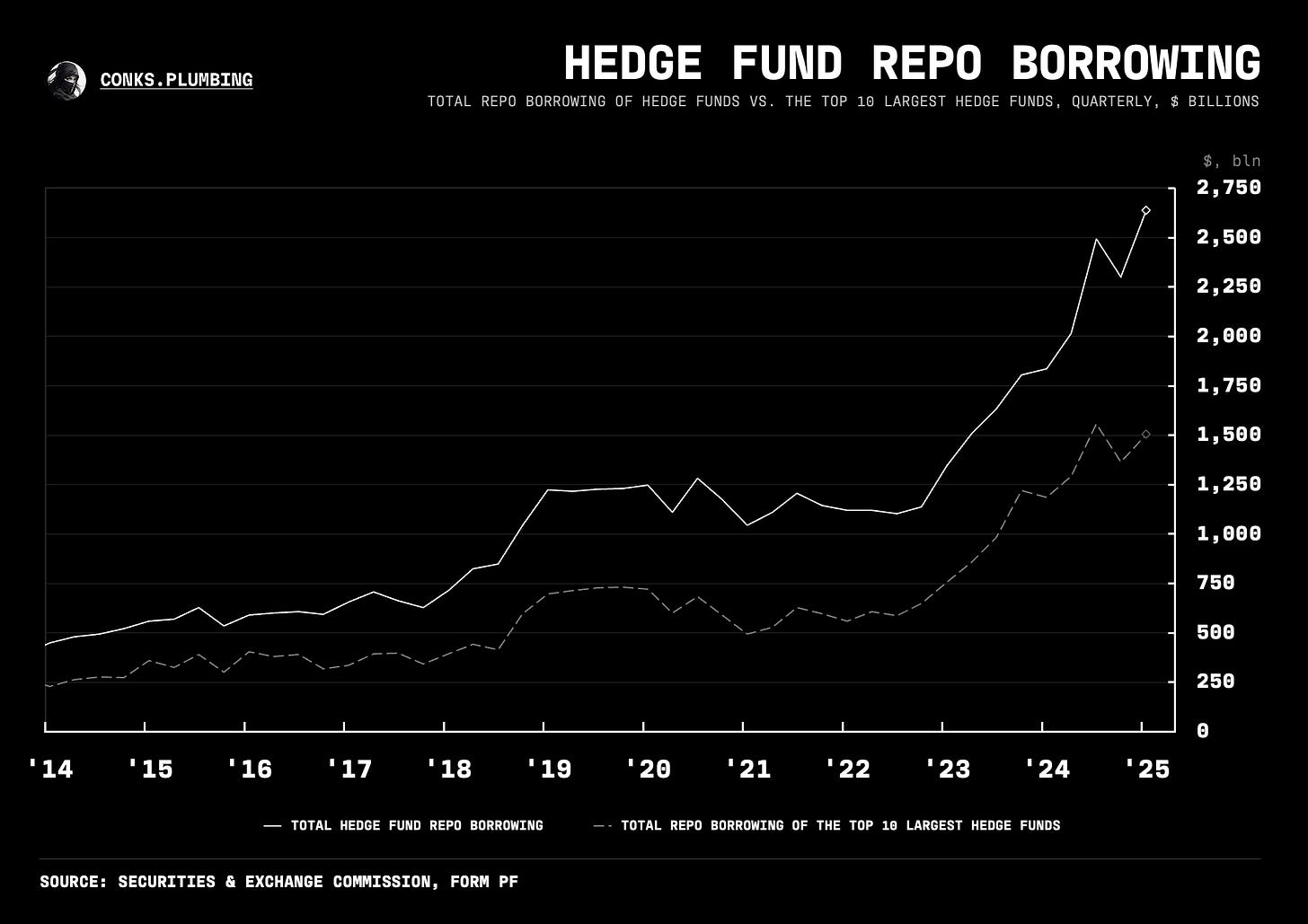

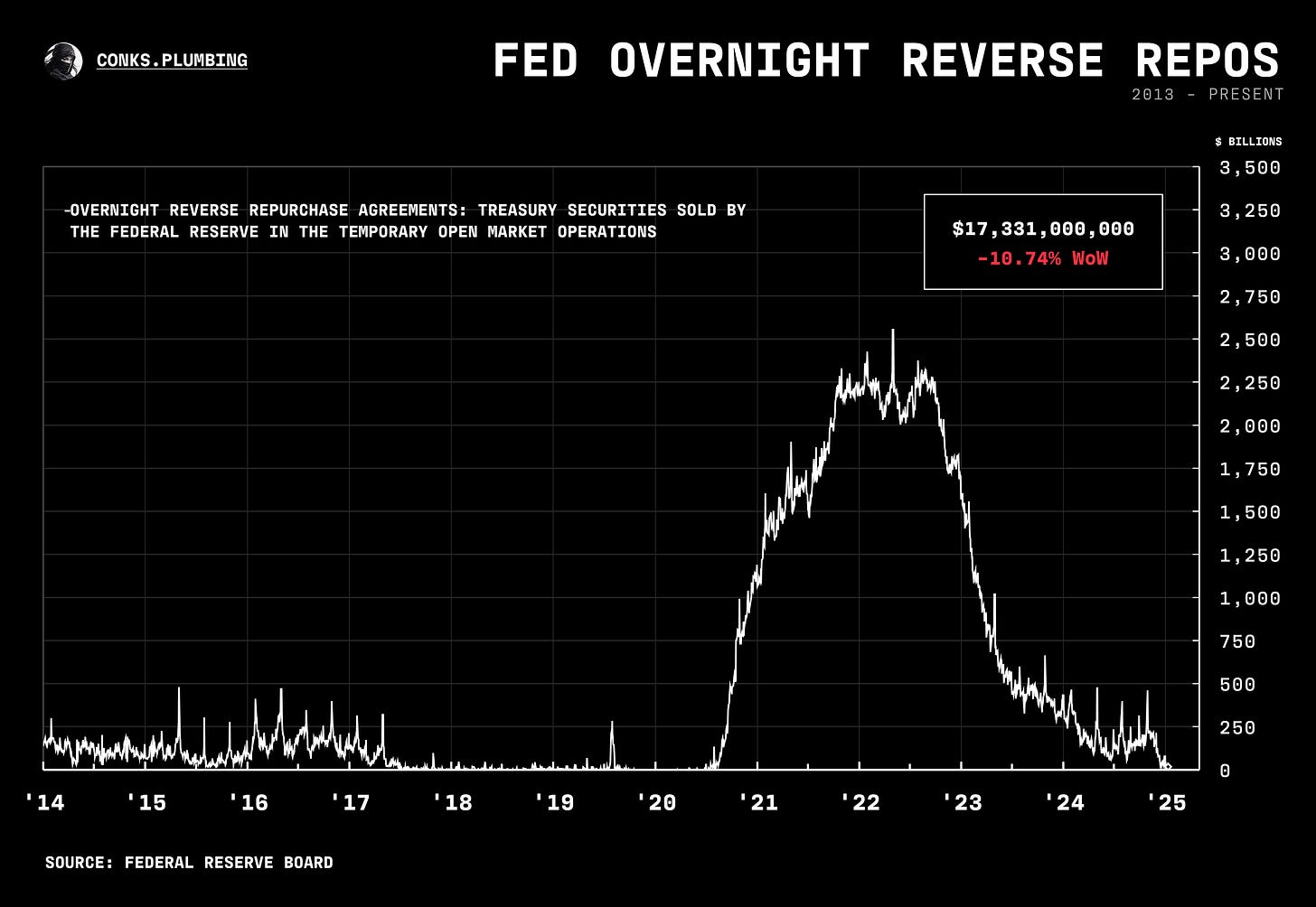

As mentioned in The Fed’s Reckoning: Part I, rates have spiked as we’ve entered a mid-month, not a month-end, mini-funding squeeze. Large U.S. Treasury settlements due on the September corporate tax date (today) have prompted repo rates to climb above the rate paid on bank reserves (IORB). Dealer rates have been trading above the standing repo facility’s (SRF’s) cheapest borrowing rate. Thus, banks have had a greater incentive to use reserves to clear market imbalances and pull liquidity from the interbank system.

Even so, nobody has tapped the SRF in size. Consensus is that reserve scarcity won’t become an issue for the Fed until early next year, when we’ll witness, for the first time in years, the Fed Funds rate (also called o/n FF, EFFR, and the interbank rate) no longer printing in a straight line. But for now, most of our scarcity indicators (see below) show that recent funding pressures will subside. Any upward pressure on EFFR will signal the Fed to act — and (wise) speculators to frontrun intervention (ending/reducing QT creates a more psychological bid than a technical one).

In the previous cash-starved repo era, the Fed was okay with not only repo rates but also EFFR oscillating within its target range. This time, compared to before the 2019 repocalypse, “emergency” Fed repos are now available via the SRF in the evening and in the morning. SOFR can thus trade much higher and more comfortably near the Fed’s upper boundary before central bank intervention.

As for the market reaction, we’ve seen an anticipated widening in the SOFR-FF basis (i.e. the difference between SOFR and EFFR, a.k.a. repo vs. interbank rates) beyond Conks’ target of 6bps for October. We believe recent pressure, however, has peaked and is priced in for the month.

Meanwhile, in more mainstream markets, STIR traders now expect three rate cuts by year-end. We’re sticking with our “one (25bps cut) and done” and think fading three cuts is the play.

Elsewhere, gold has reached all-time highs. There was subsequent hype around waning $ reserve currency status, but those paying attention to FX reserve managers’ viewpoints on gold knew that they were already thinking of larger allocations, and that would increase further if geopolitical tensions and macro uncertainty arose. UST custody holdings have also been declining rapidly. However, this does not mean that FX reserve managers’ net positioning of U.S. dollar assets has subsided, given the obscure nature of offshore Chinese custodial holdings (in Belgium and other locations). If they are selling USTs, they are likely buying gold, but more in riskier dollar assets like U.S. agency bonds — in our view.

Lastly, (swap) spreads, Conks’ best measure of plumbing frictions, are now fighting against deficits and threats to Fed independence. Recent drama around Fed autonomy and record-high deficits has counteracted an easing in plumbing conditions via a potential liberation of dealer constraints and a reversal of the proposed “Basel III Endgame”. Despite an SLR rework, spreads could tighten further (i.e. grow more negative) as deficits keep ballooning and POTUS starts to gain more indirect influence over both monetary and regulatory functions of the Fed. An even bigger Relief Valve is needed!

WIP: consolidating charts into monitors for easier access, plus a STIR monitor/Treasury monitor to accompany these updates.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.