Money Market Update

calm returns to the ultra short-end as a cash deluge emerges. meanwhile, money architects begin to solidify plans to fortify Treasury and money markets

Welcome to another Conks money market update. In case you missed it or just joined us, the conclusive part of the Fed’s Relief Valve went live recently.

Up next, it’s business as usual. We’ll demystify the obscure but increasingly systemic parts of the Treasury market, publishing infographics and other media as we go. As a reminder, the first-year taster rate for Pro expires on May 20th.

Now onto a (gradually improving) money market update…

Summary & Brief Commentary

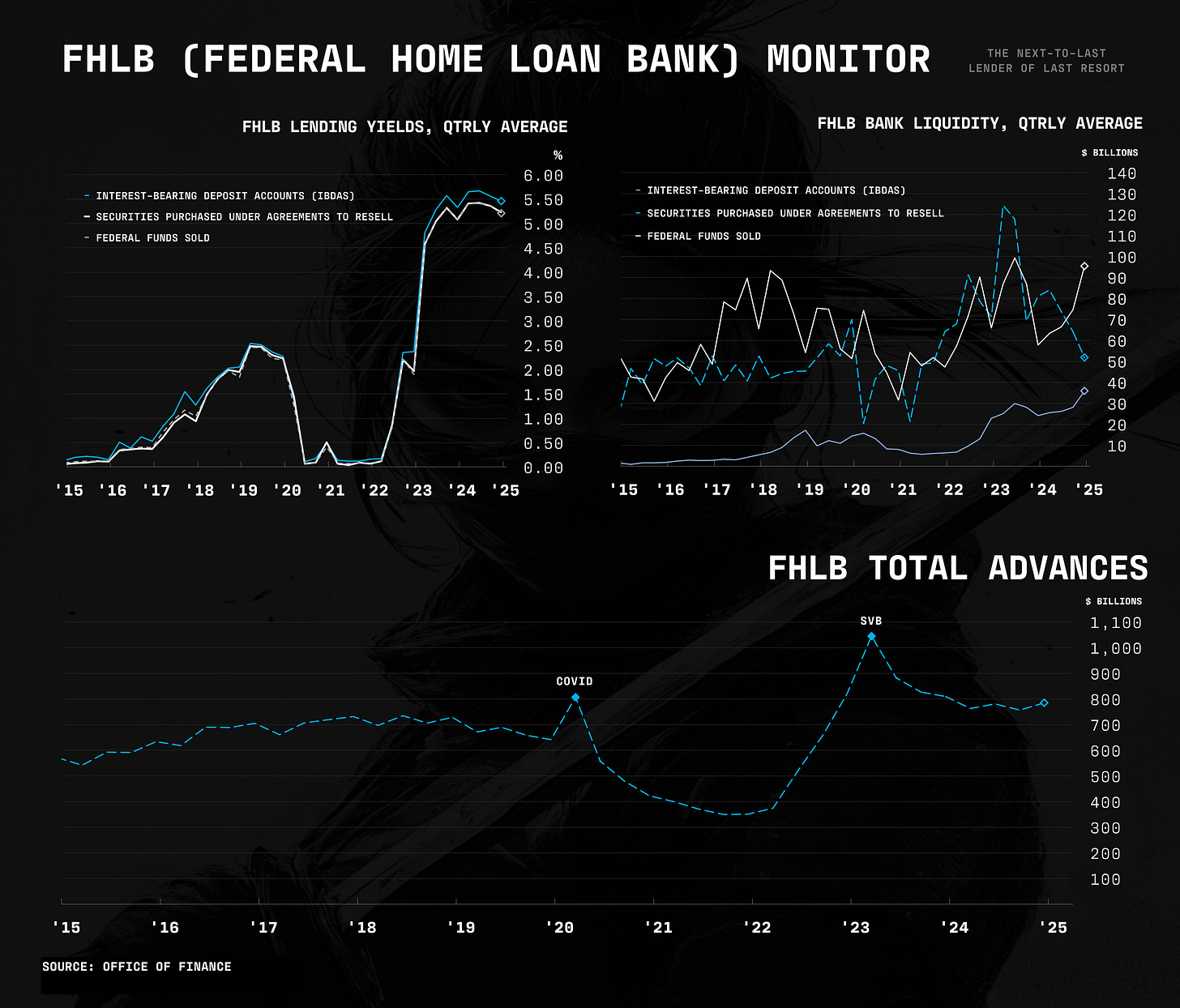

Today, Dallas Fed President Logan hosted a panel on market structure comprising every major plumbing “fortification” we’ve covered extensively, from the Repo Defensive to the Treasury Market Evolution. While all modifications showed promise, the stigma of using the Fed to obtain liquidity remains the elephant in the room.

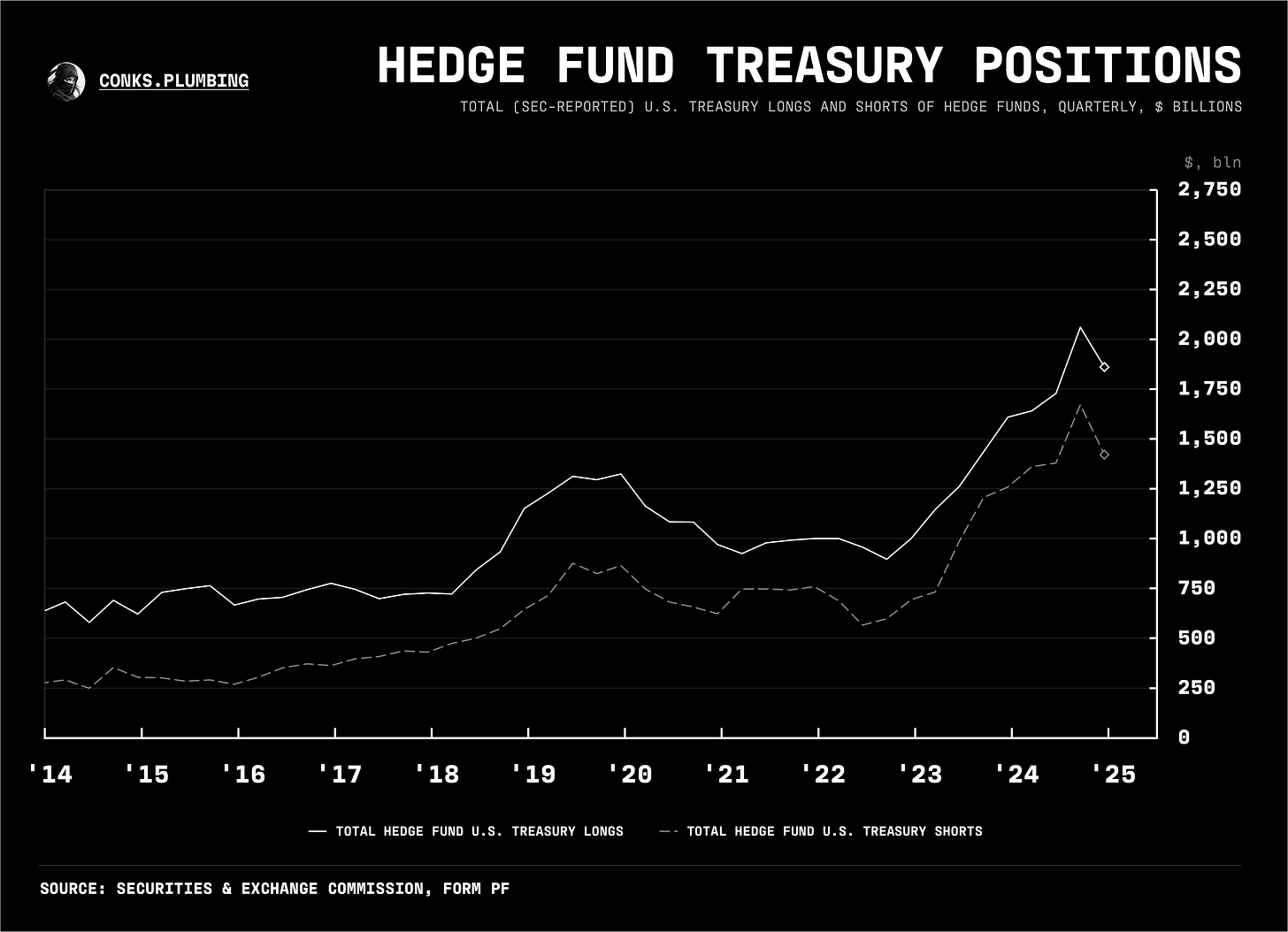

According to market heavyweights on the panel, most turmoil during the Trump “tariff cascade” was caused by equities and rates selling off simultaneously. Panelists also confirmed that the tariff cascade impacted swap spreads trades more than cash-futures basis trades, the latter getting most media attention. Our latest piece dives deep into swap spread mechanics, for those interested.

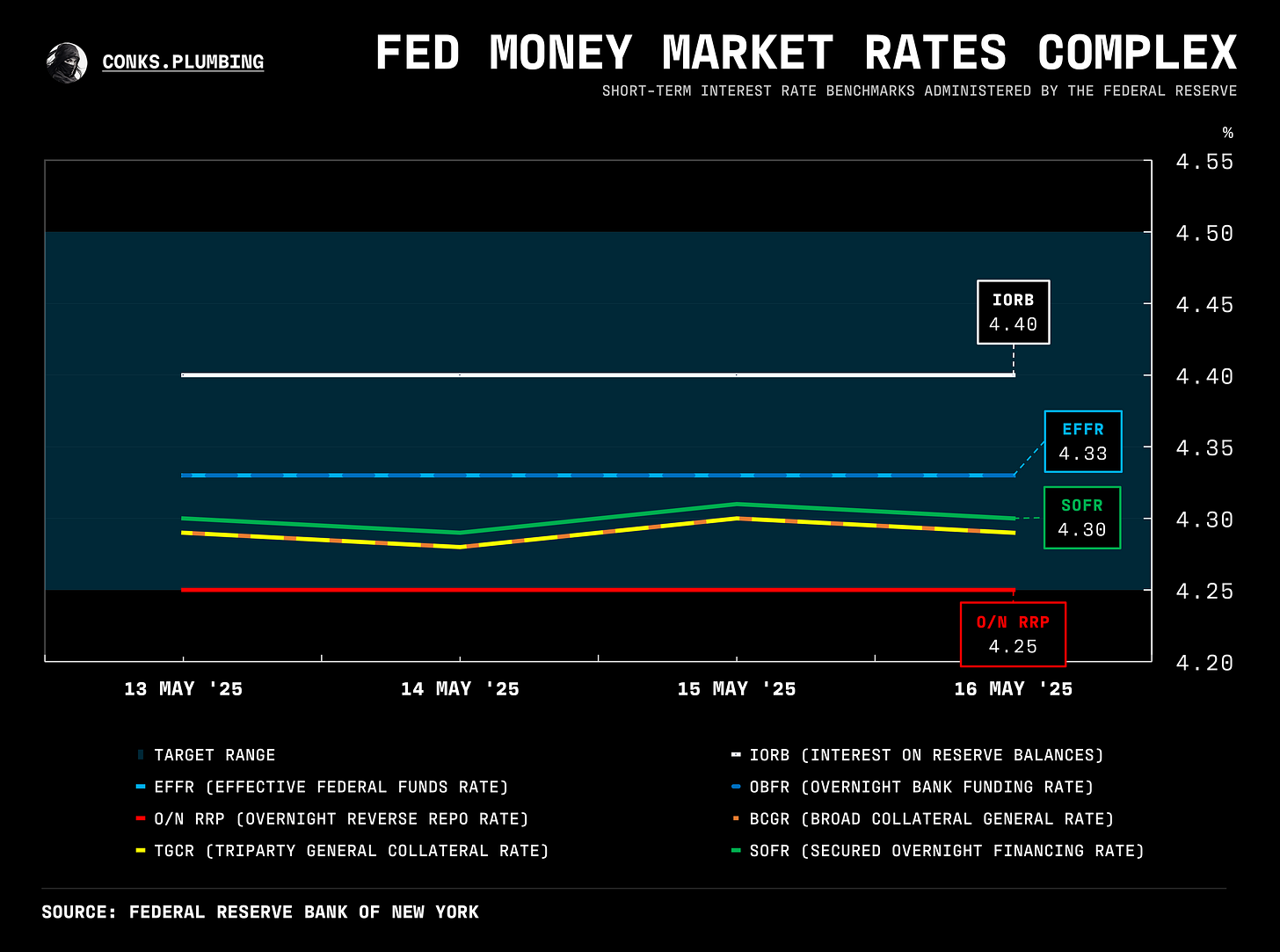

Meanwhile, cash remains plentiful in repo markets after a collateral squeeze, with lighter volumes persisting and SOFR now back below o/n FF.

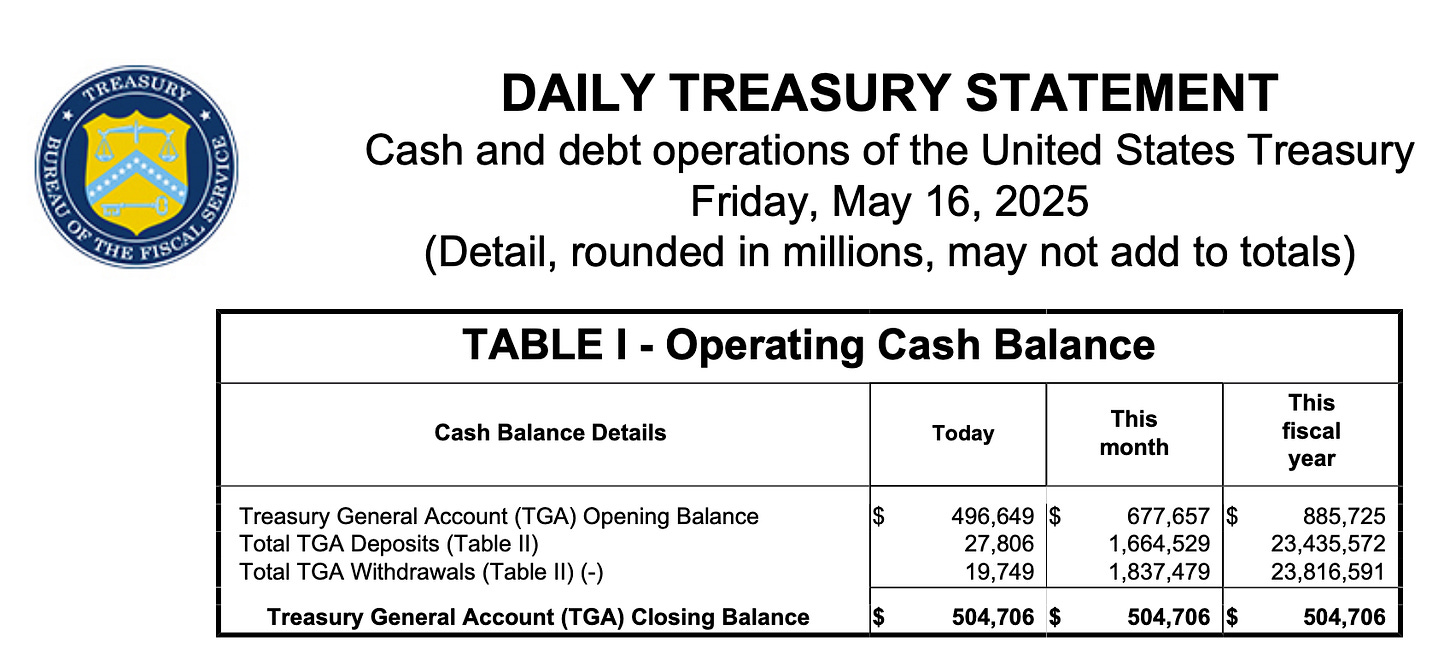

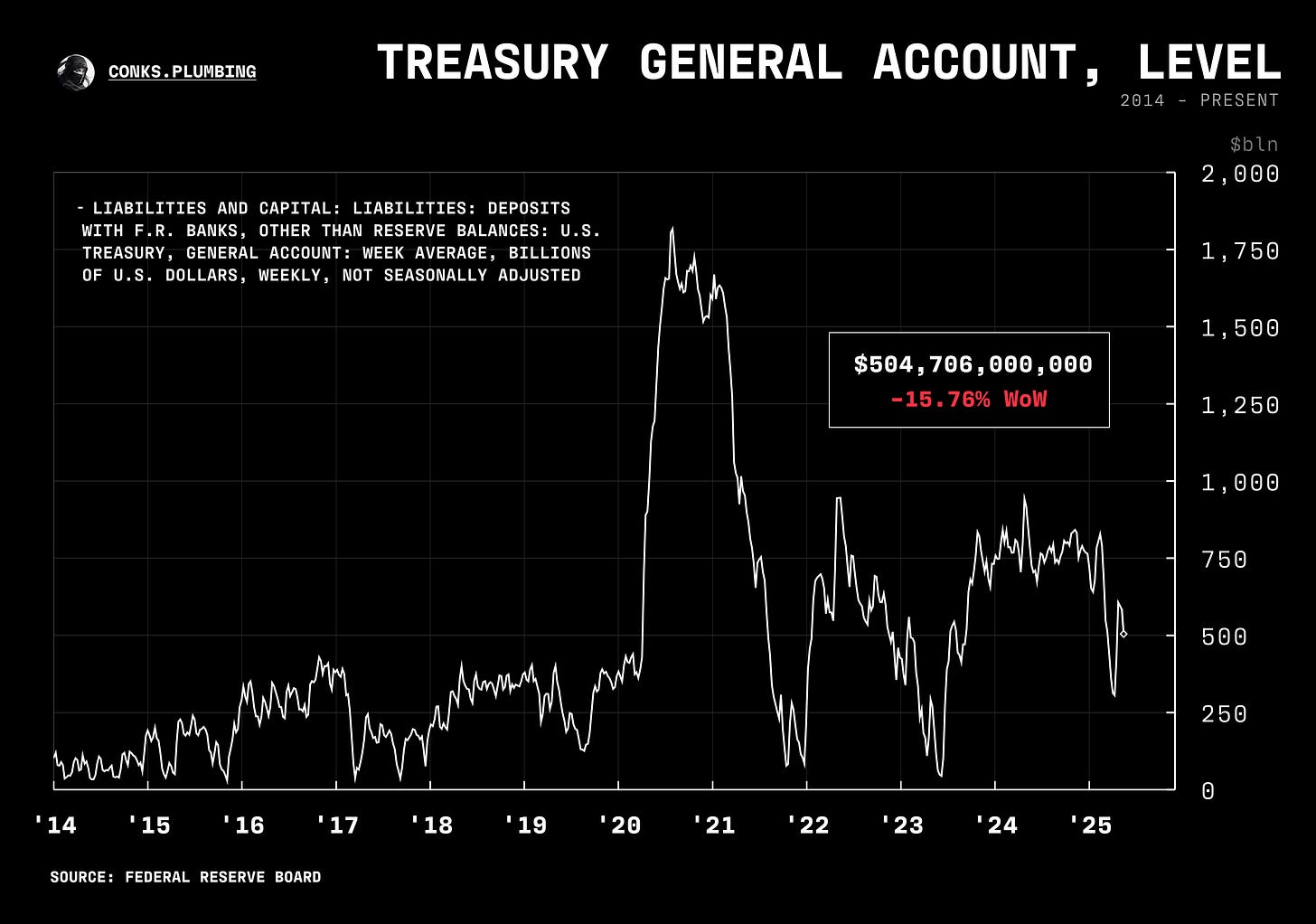

As the debt ceiling binds, money funds will likely start moving cash out of the RRP facility and into non-Fed repos, while a lower chance of rate cuts may prompt more bill purchases further out on the curve. The X-date (the day the Treasury “runs out” of money) looks to be around mid-August.

As for the Moody’s downgrade, it is a nothingburger, in our view. This isn’t August 2011 or August 2023. The quick reversal by mid-Monday should not have been surprising. In fact, we were more astonished that only a few officials, such as the SNB President, stated that no alternative to USTs existed. Maybe that’s a sign to go long U.S. Treasuries after a pause in U.S. exceptionalism.

Lastly, we’ve prioritized adding a “STIR monitor” to the next money market update, as it’s more relevant than other monitors we’re working on, including a Treasury and bank monitor. Stay tuned…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.