Plumbing Notes: Takeoff Begins

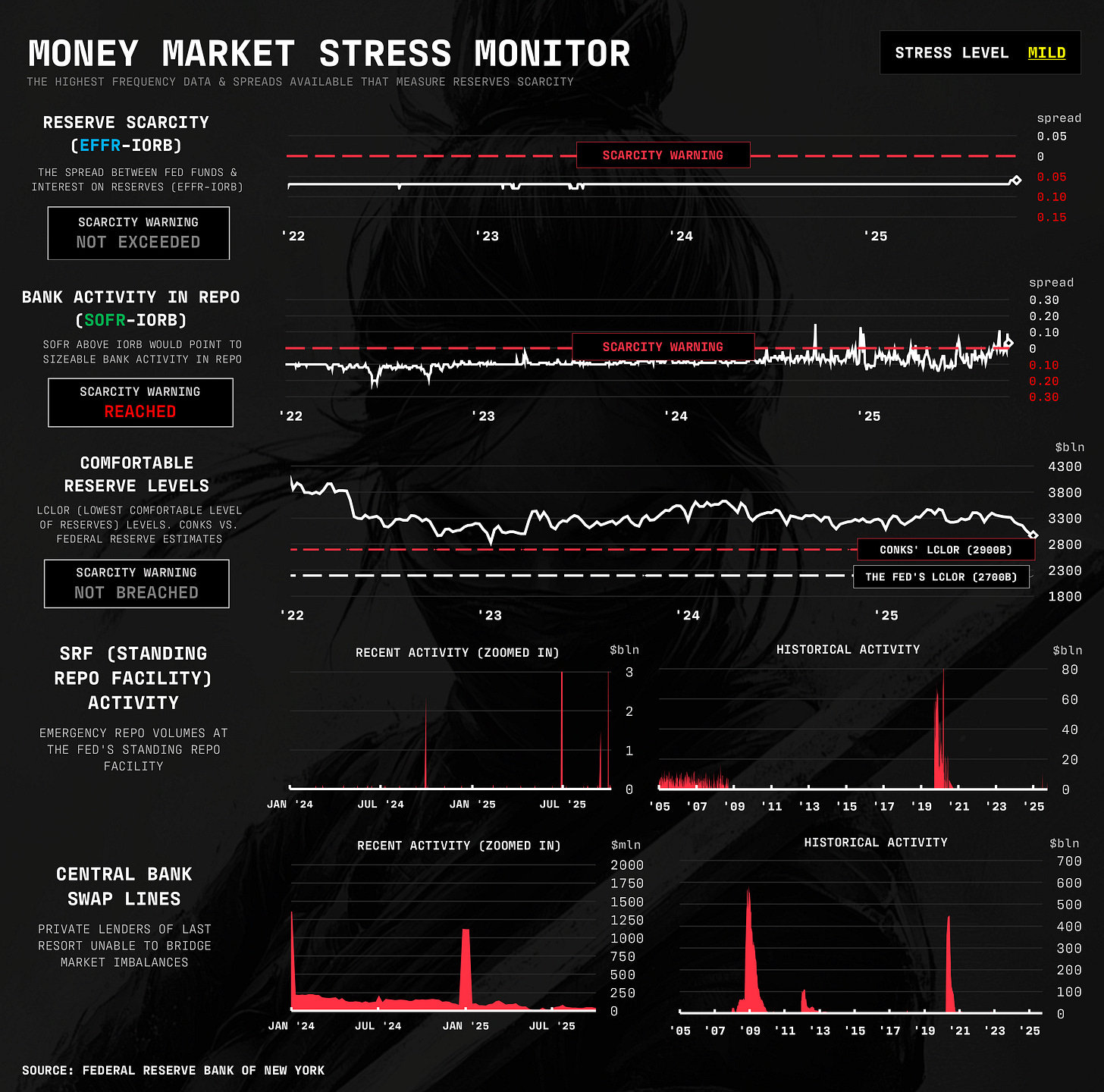

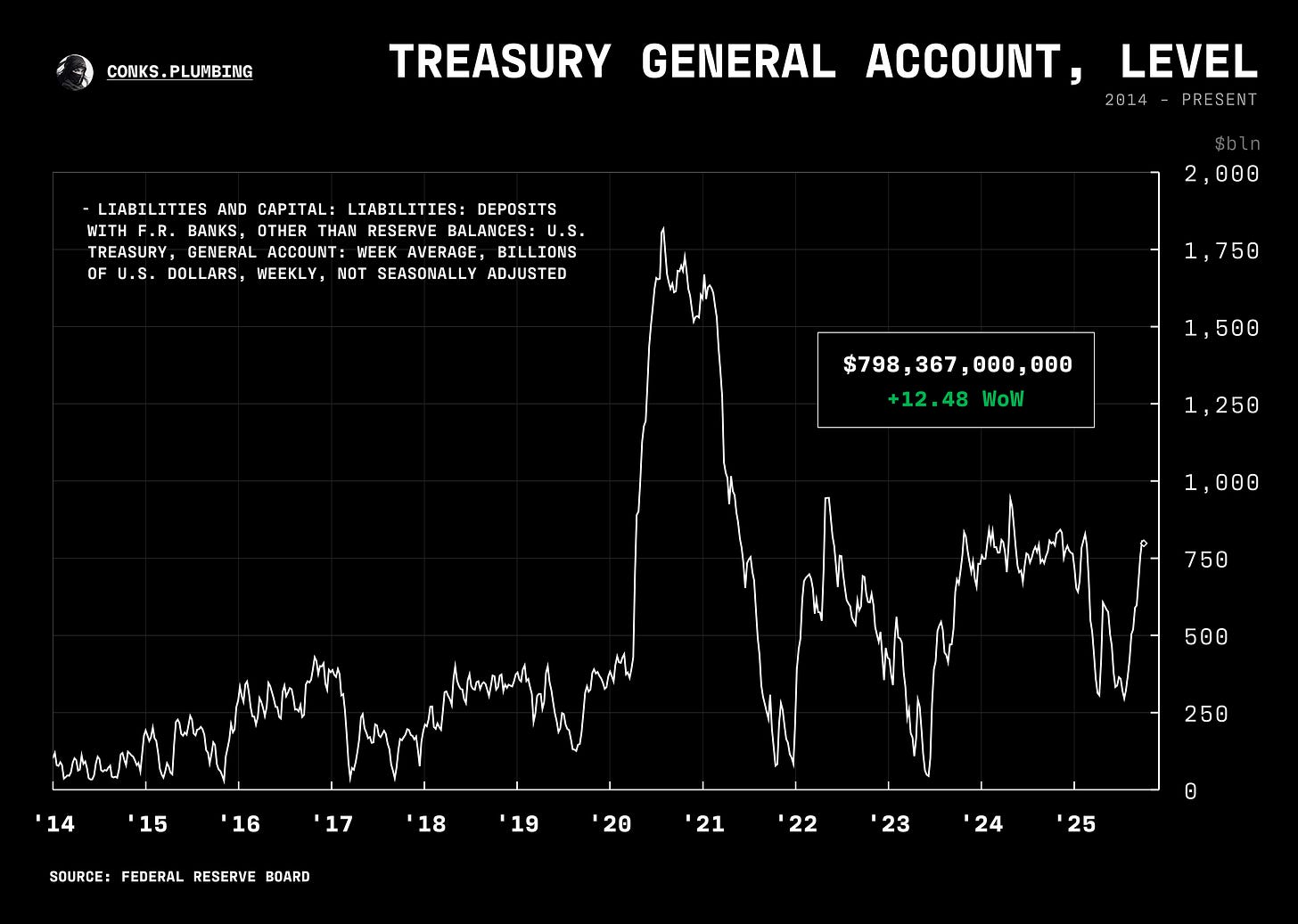

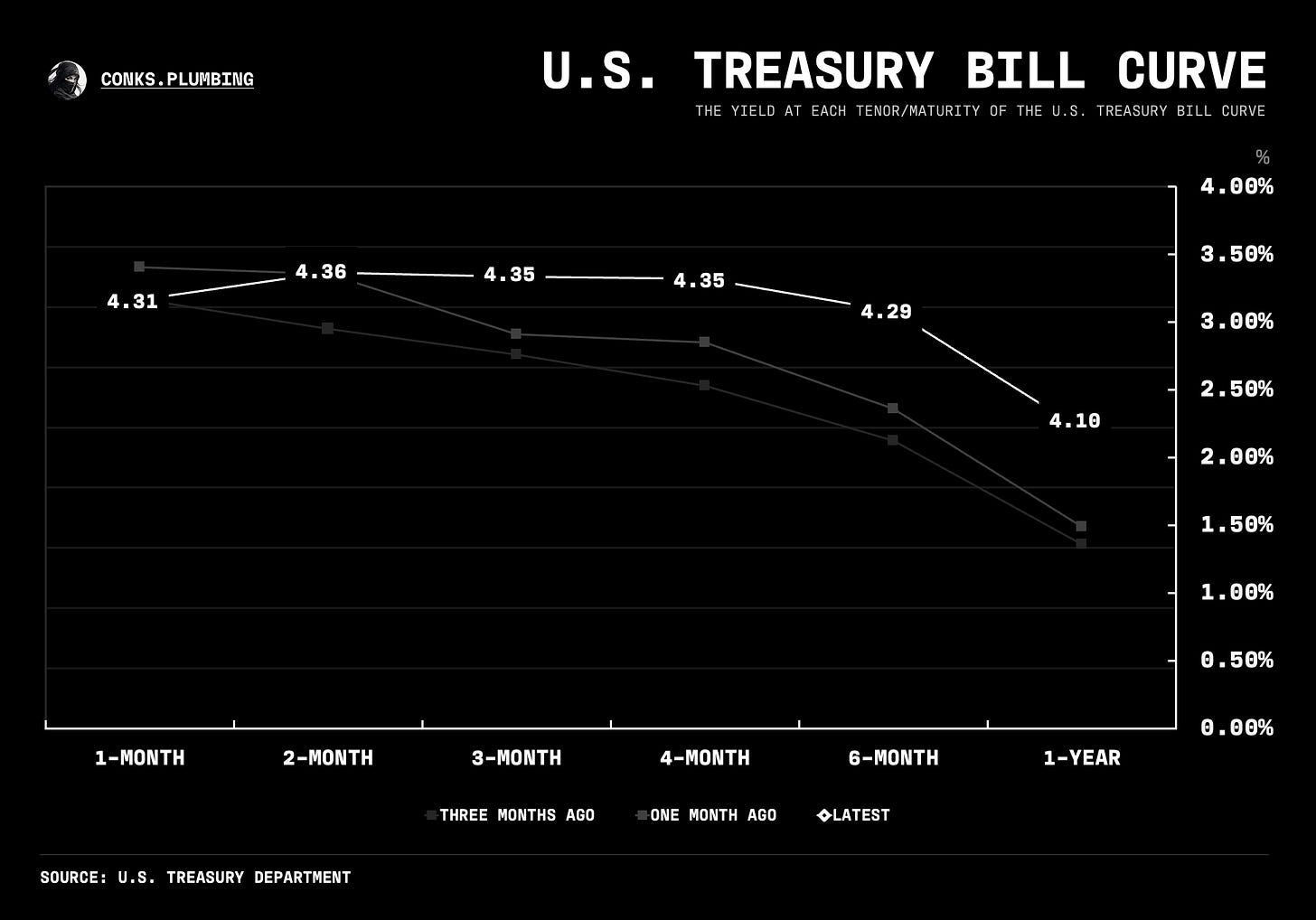

as the "takeoff" of ultra-short-end rates begins, a "landing" likely in the form of QT ending will follow, just as the Fed unofficially sets in motion the shift to its new (secured) target rate

Money Market Commentary

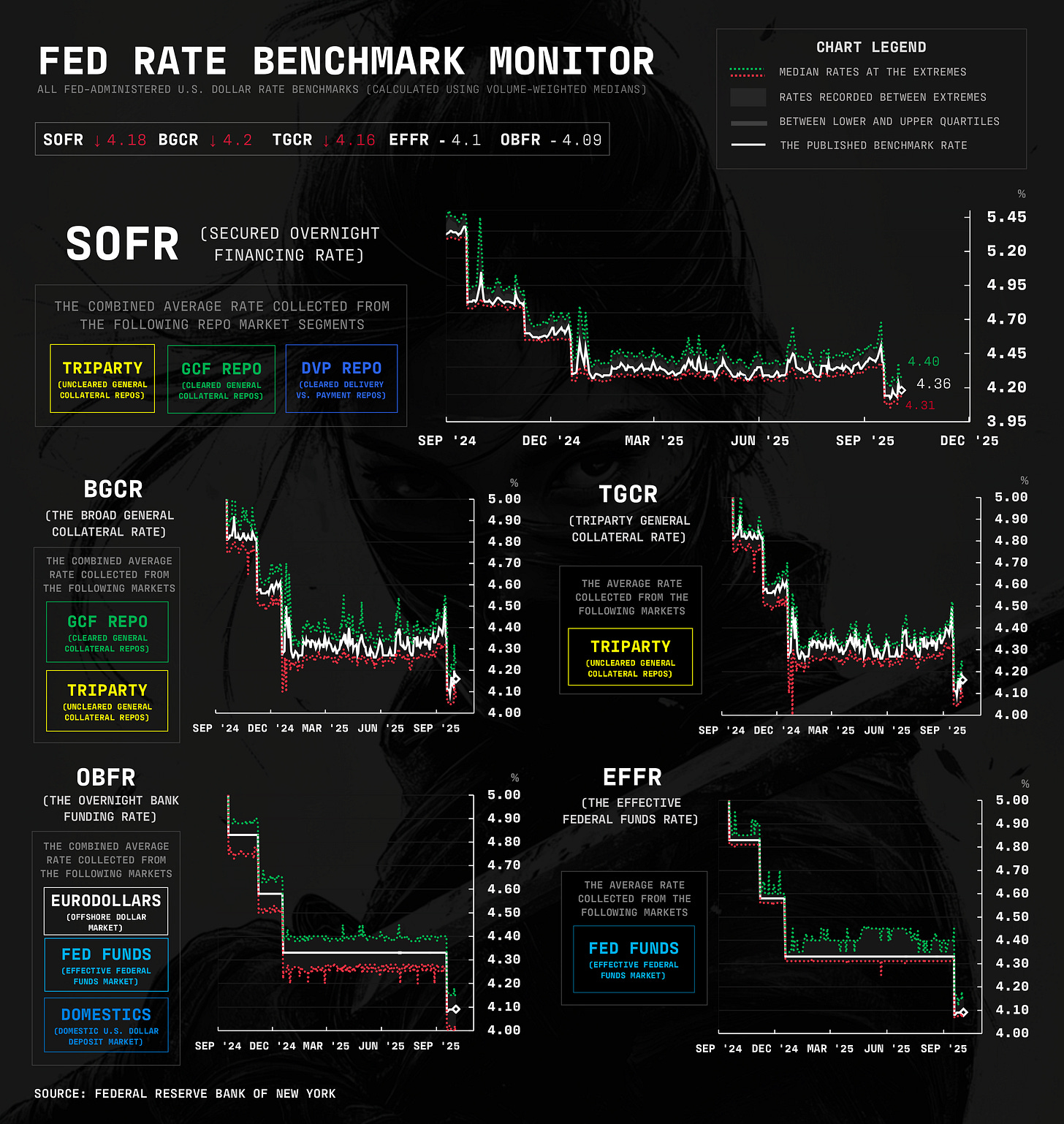

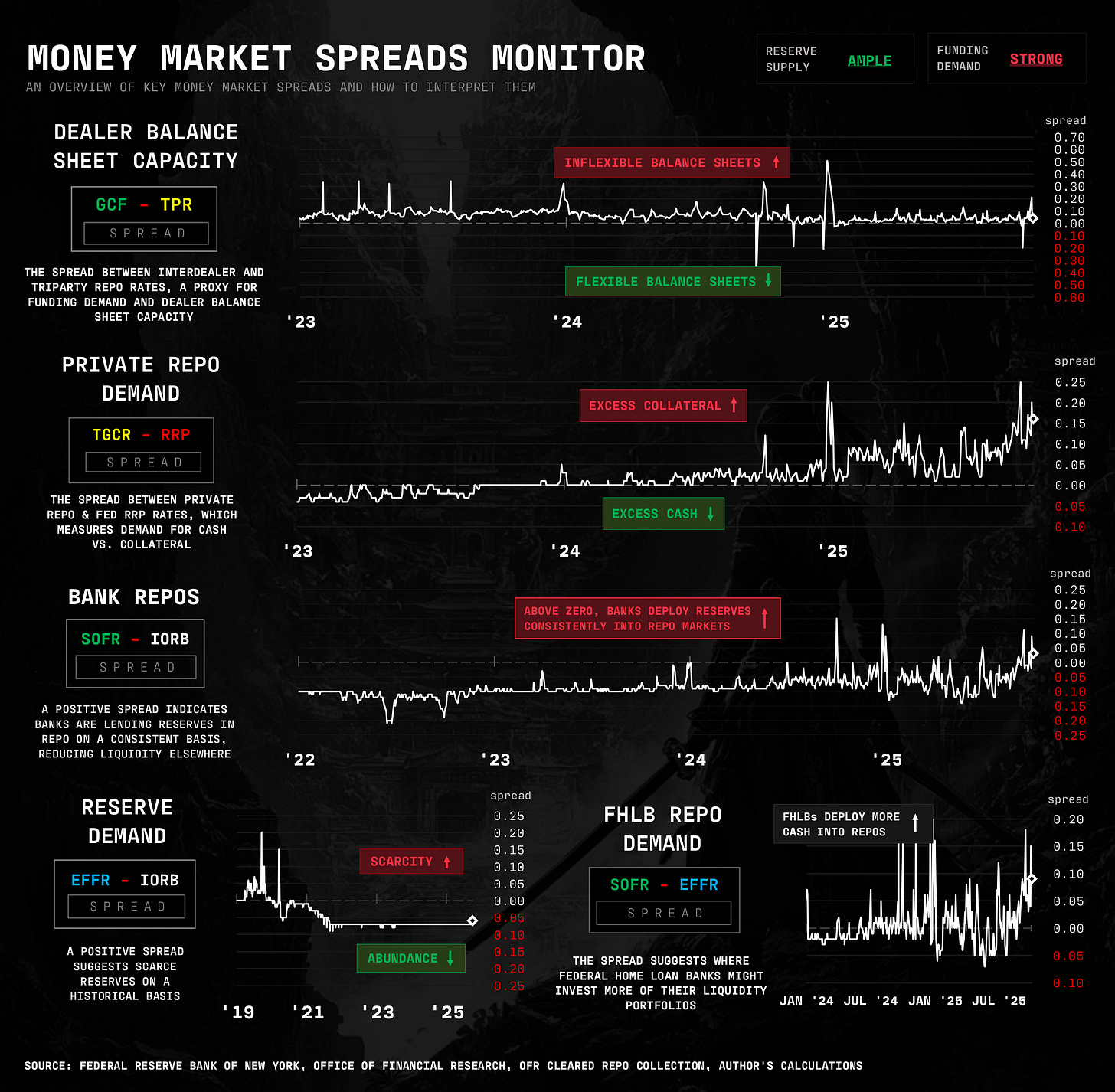

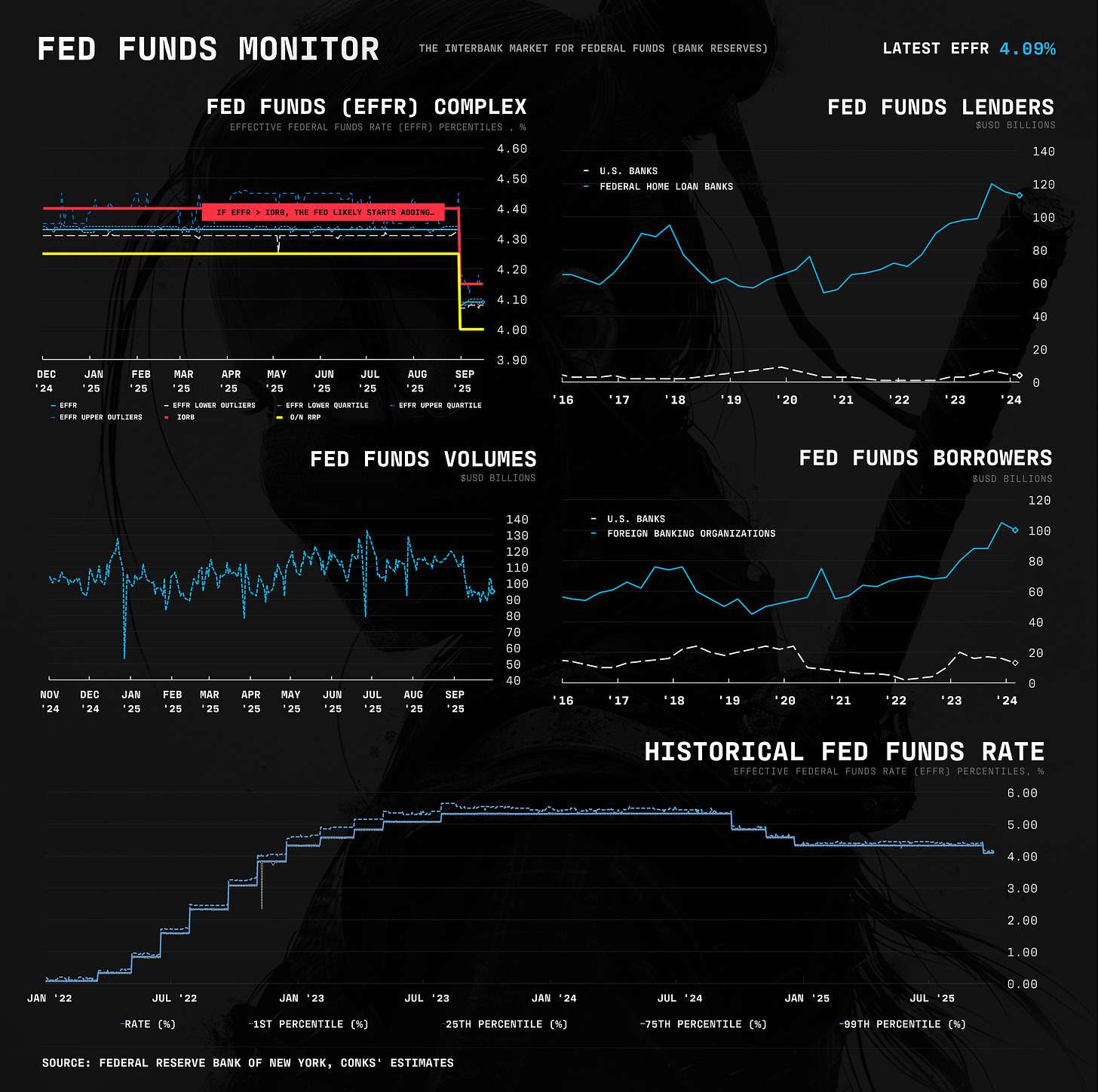

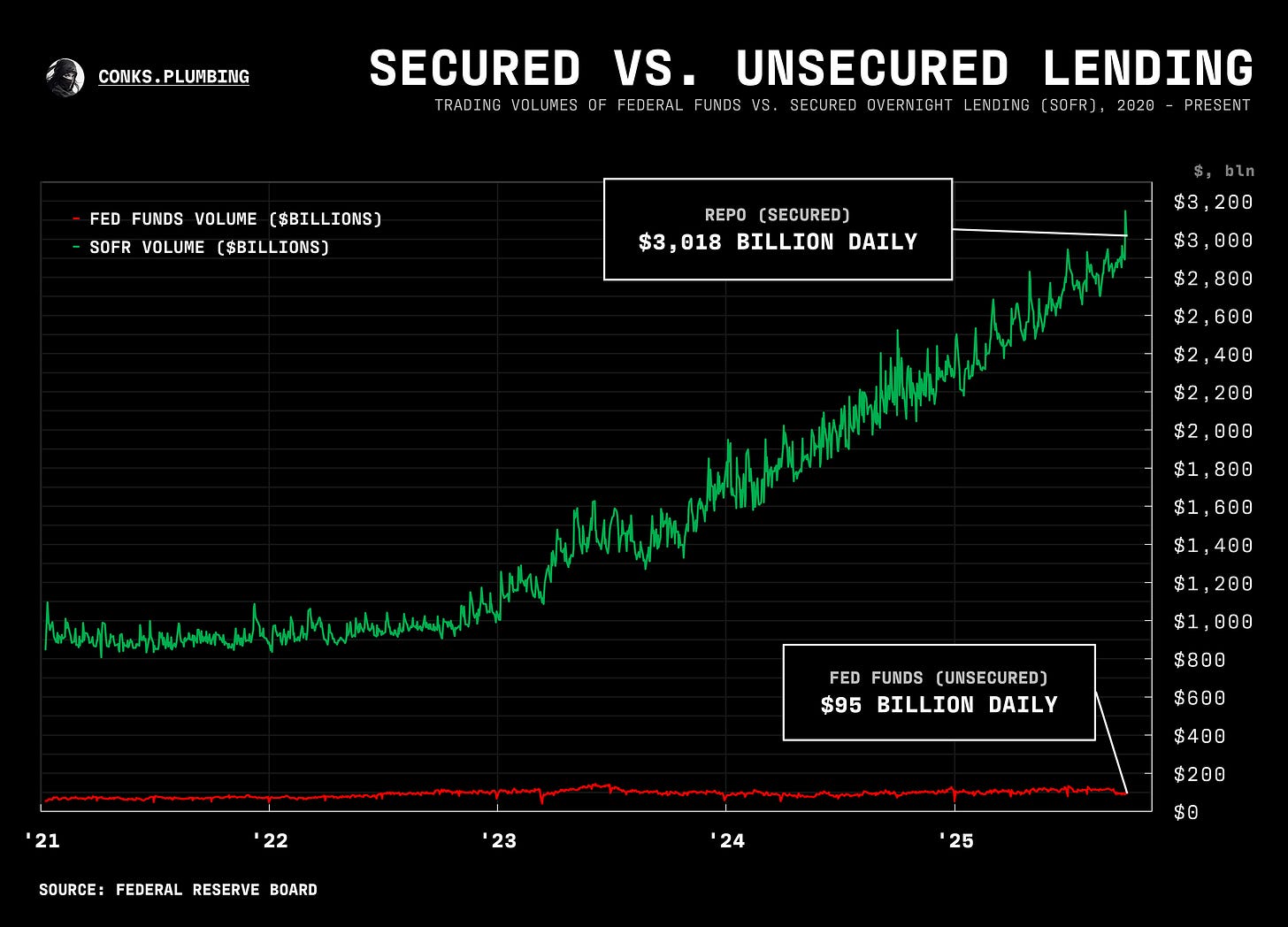

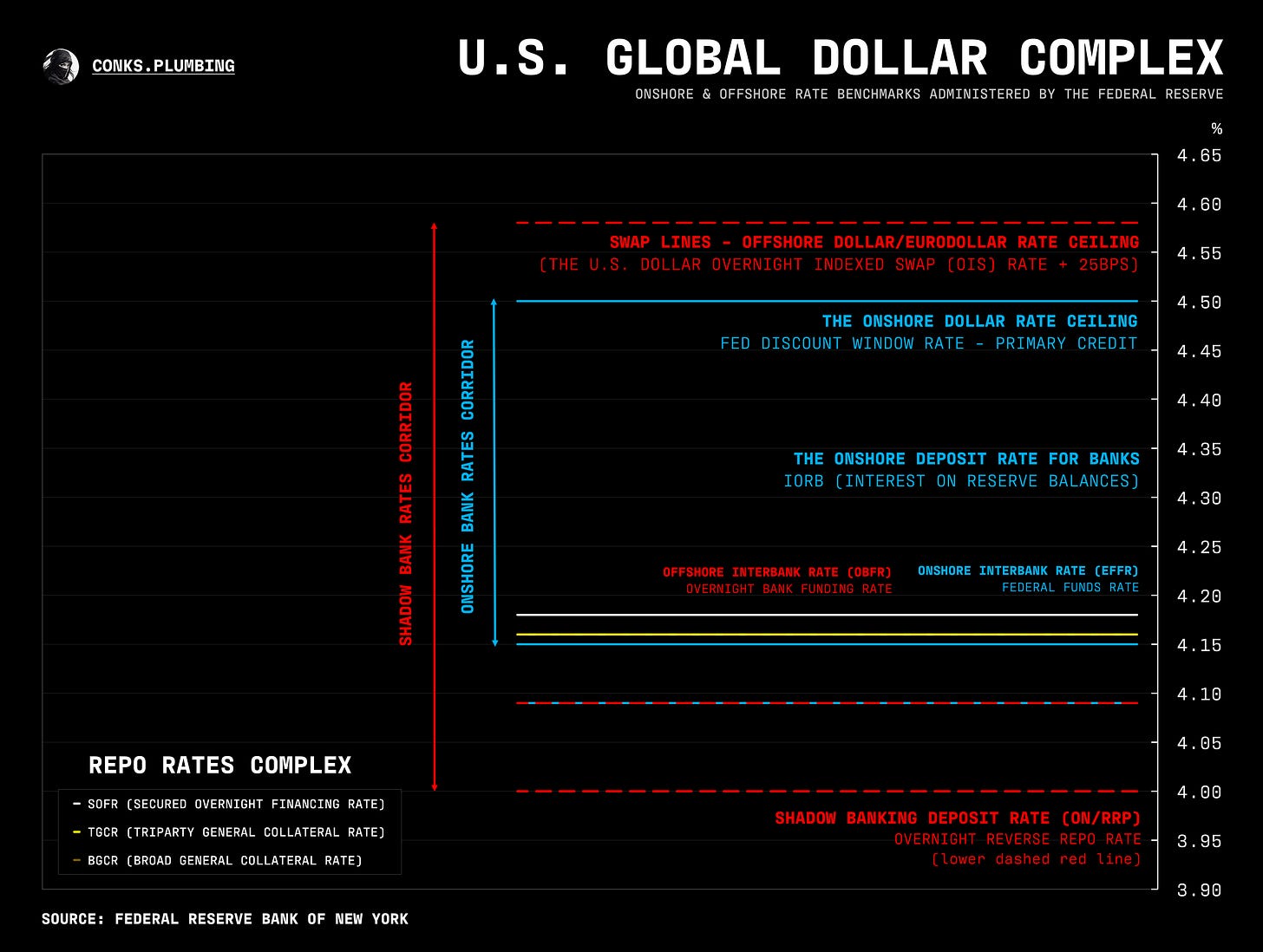

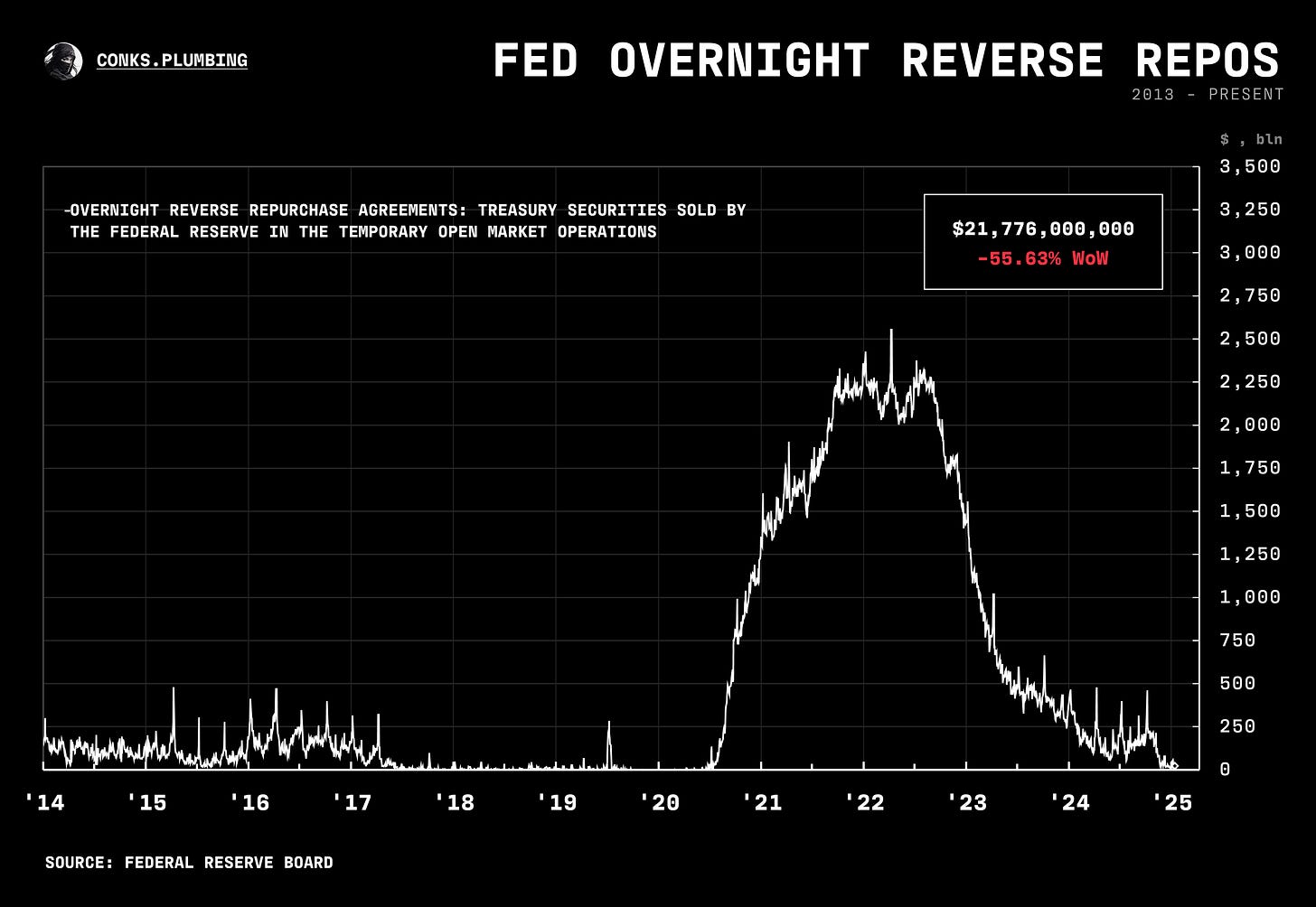

It’s “rates fever” currently in money markets. Dallas Fed President Logan has initiated an (unofficial) shift to a secured Fed target rate, from EFFR (the Fed’s unsecured interbank rate benchmark) to TGCR (the Fed’s measure of secured lending (repos) primarily between dealers and money funds). It’s been over a decade since monetary leaders began expelling LIBOR (an unsecured dollar standard) and replacing it with SOFR (a secured standard). Back then, it was a battle between OBFR (an unsecured global dollar rate) versus SOFR (a secured overnight repo rate) for becoming the next official dollar benchmark. SOFR, with its then-$1 trillion depth, prevailed as the successor, yet the Fed has continued to use EFFR as its target/policy rate. That’s set to change in the near future.

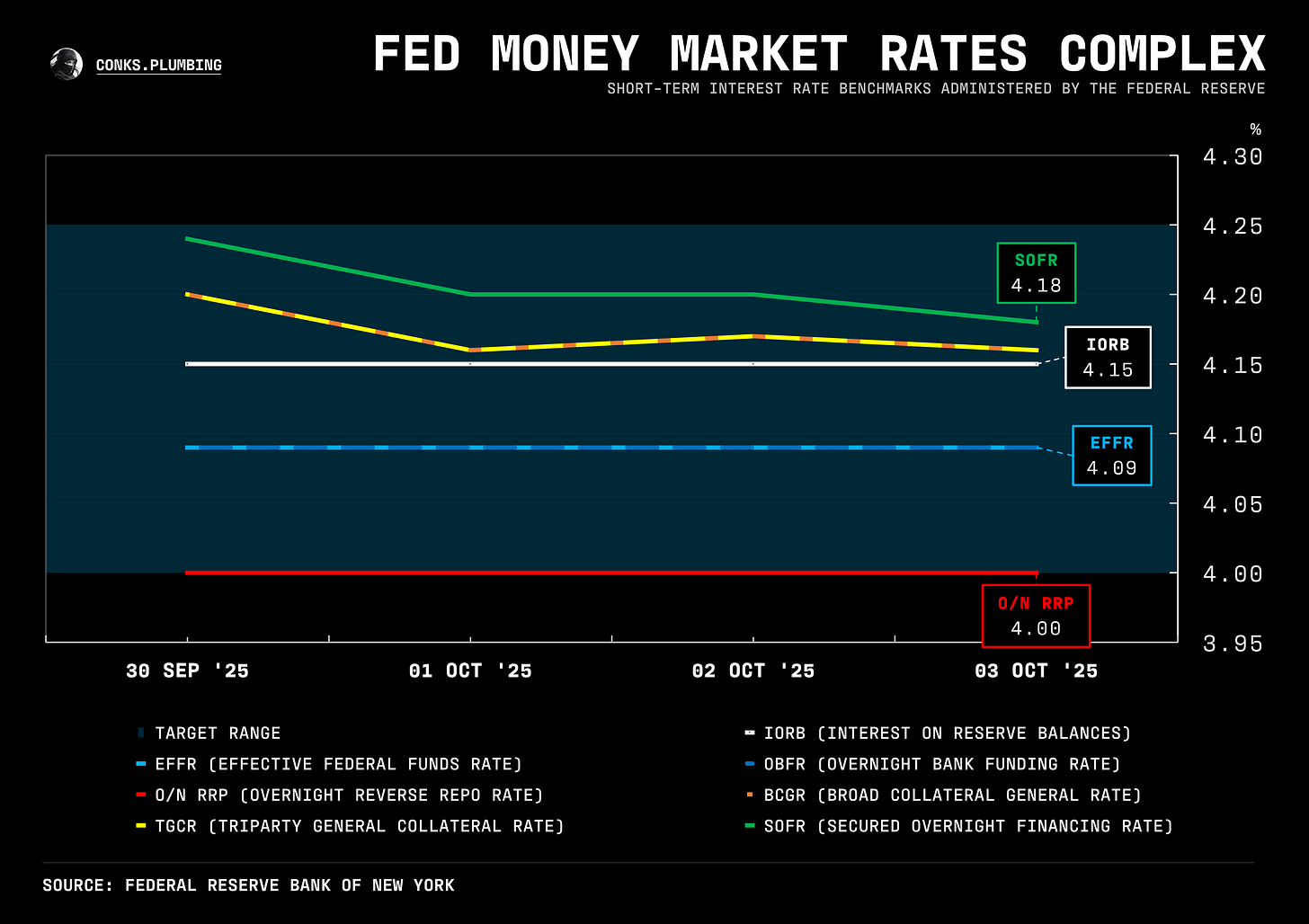

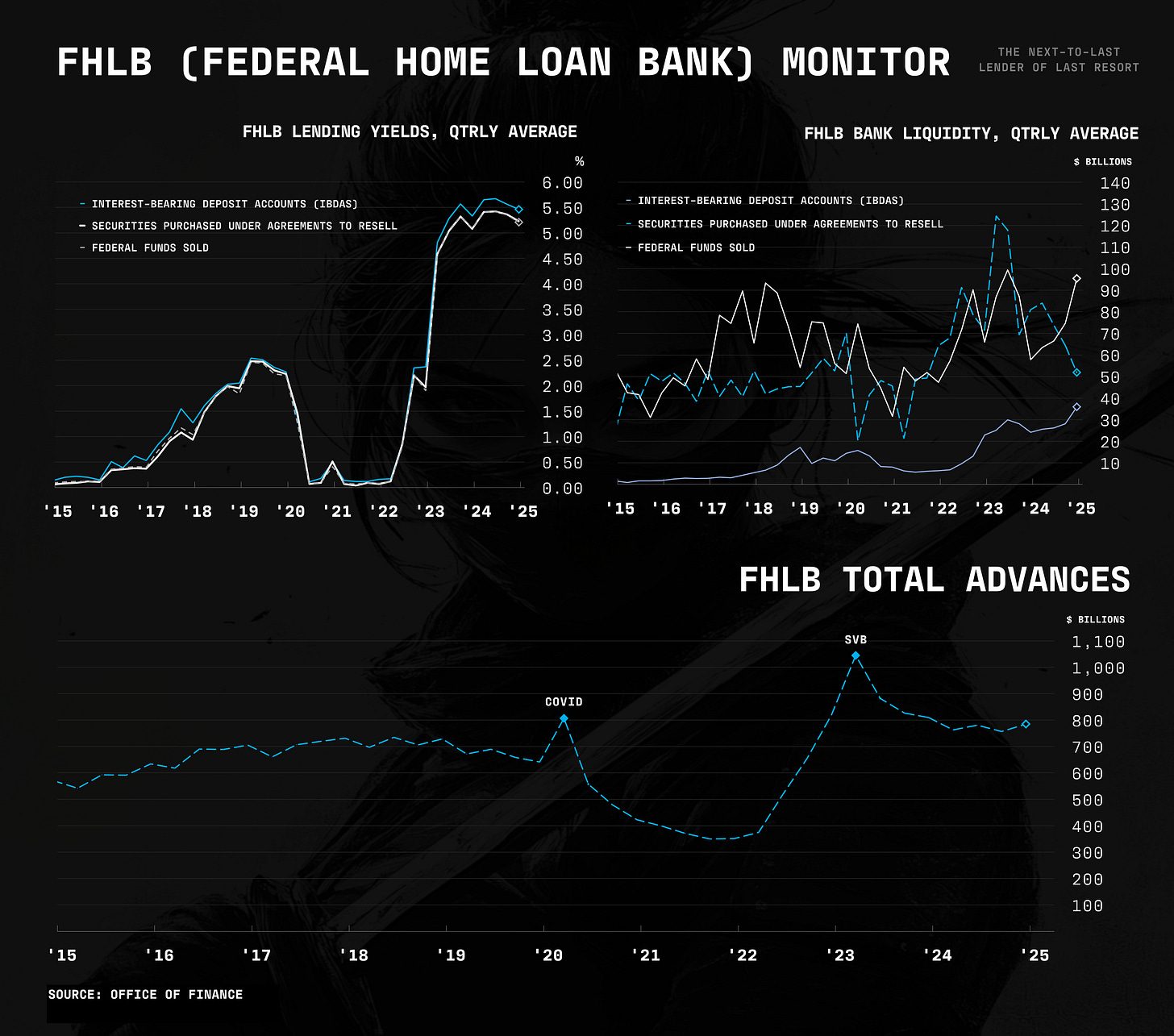

Coincidentally, the Fed Funds rate (EFFR or o/n FF), after many years of flatlining, has moved higher by a “monumental” 1bp (0.01%). Almost all Fed Funds volume originates from arbitrage (i.e. a bank borrows reserves at EFFR from FHLBs (Federal Home Loan Banks) unable to earn IORB (interest on reserve balances) and “lends” at IORB to the Fed for a spread). However, these trades have a minimal impact on the overnight FF rate, and consequently, there was no genuine need to bid up EFFR significantly. Instead, FHLBs — the major lenders of Fed Funds — pulled back from the interbank market, presumably to meet demand for advances on tax day while taking advantage of juicier yields in the repo market.

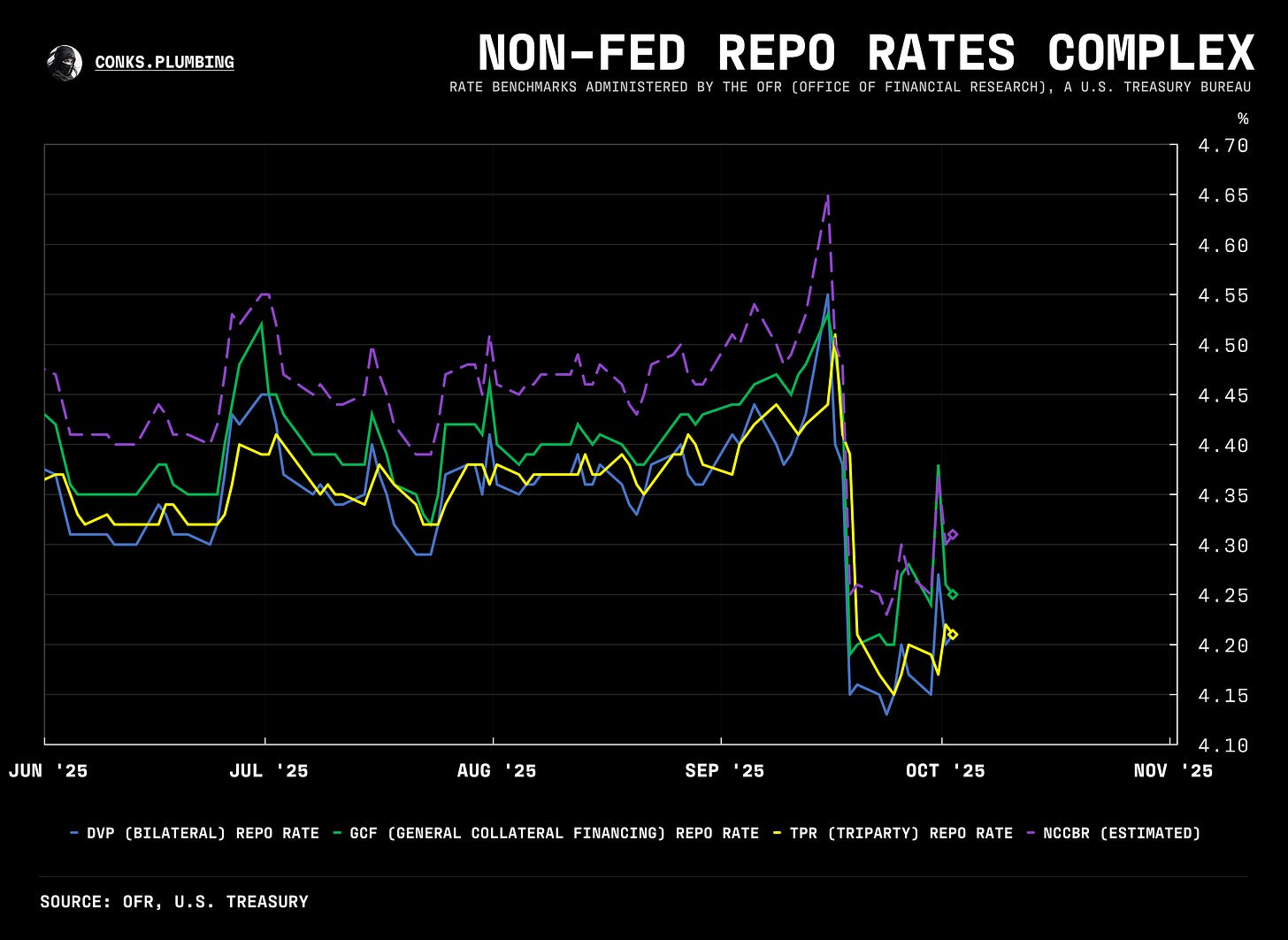

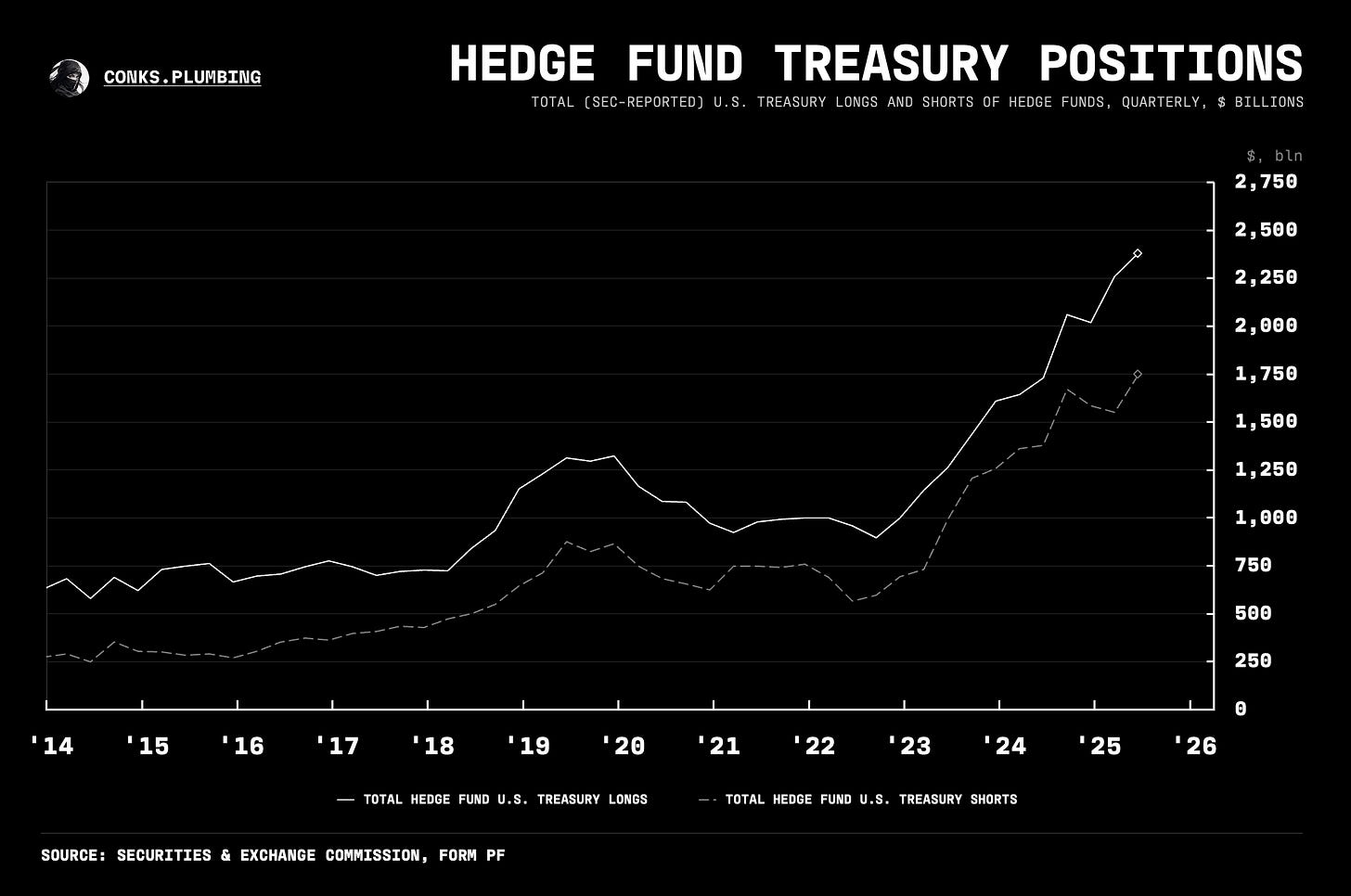

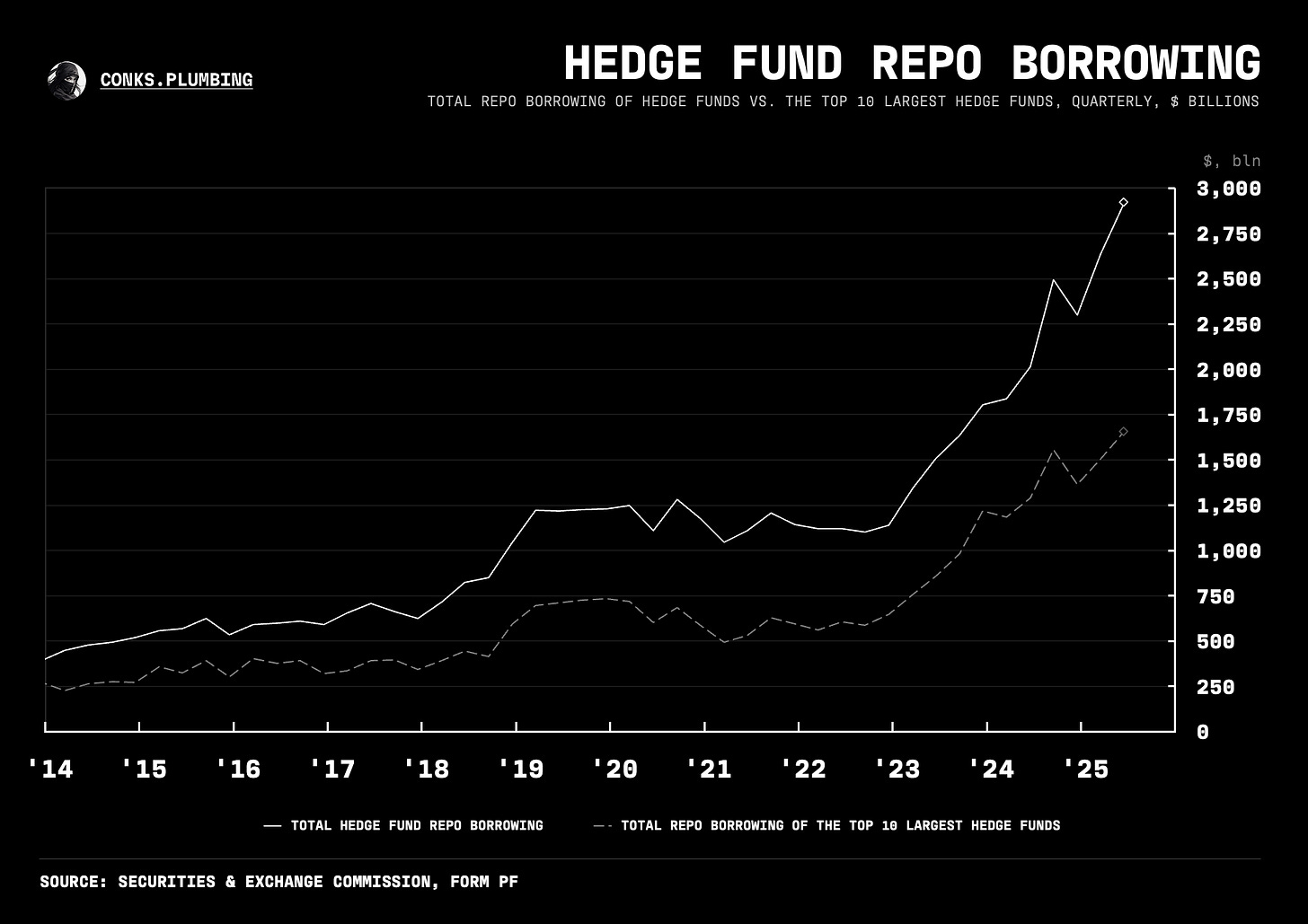

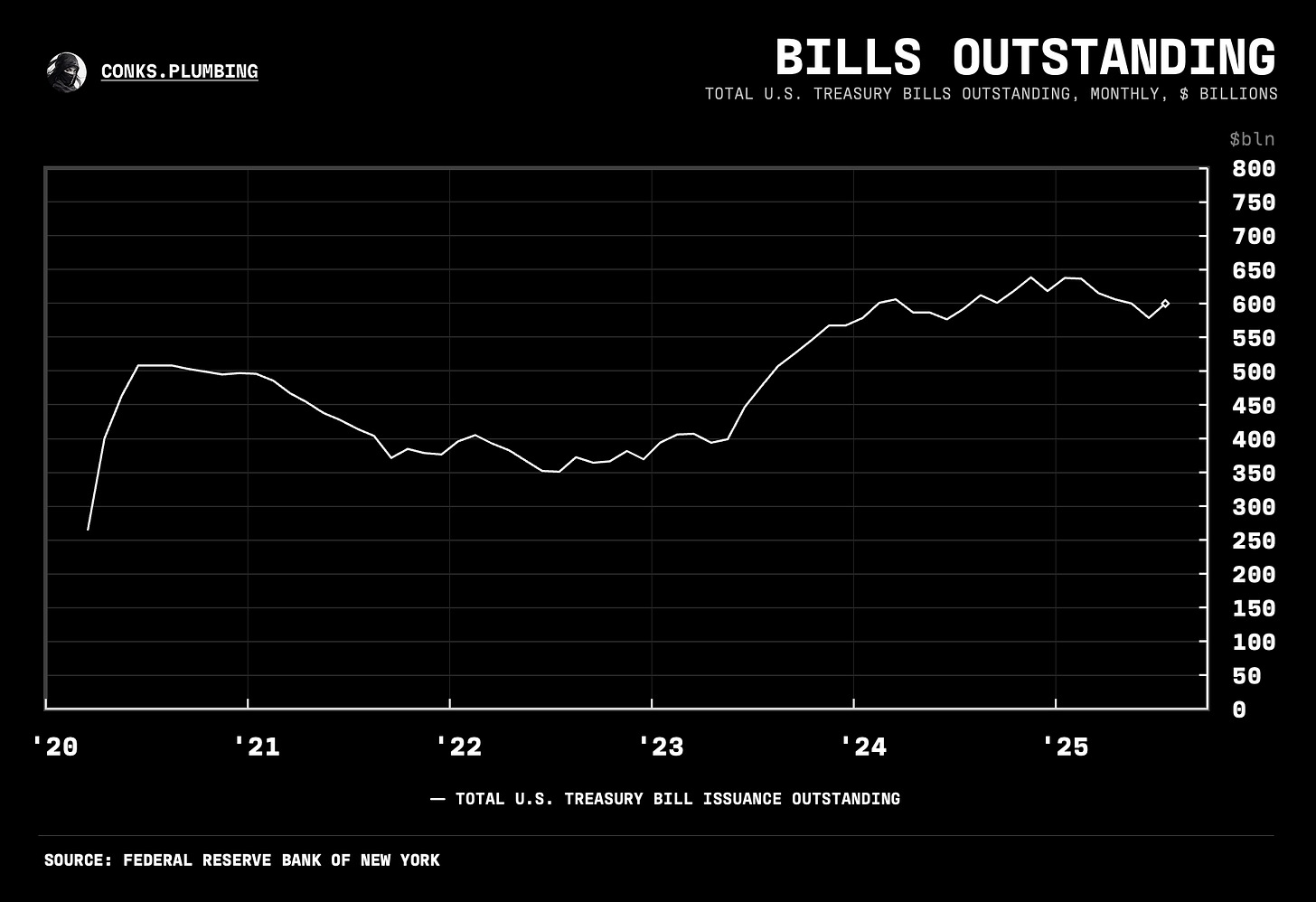

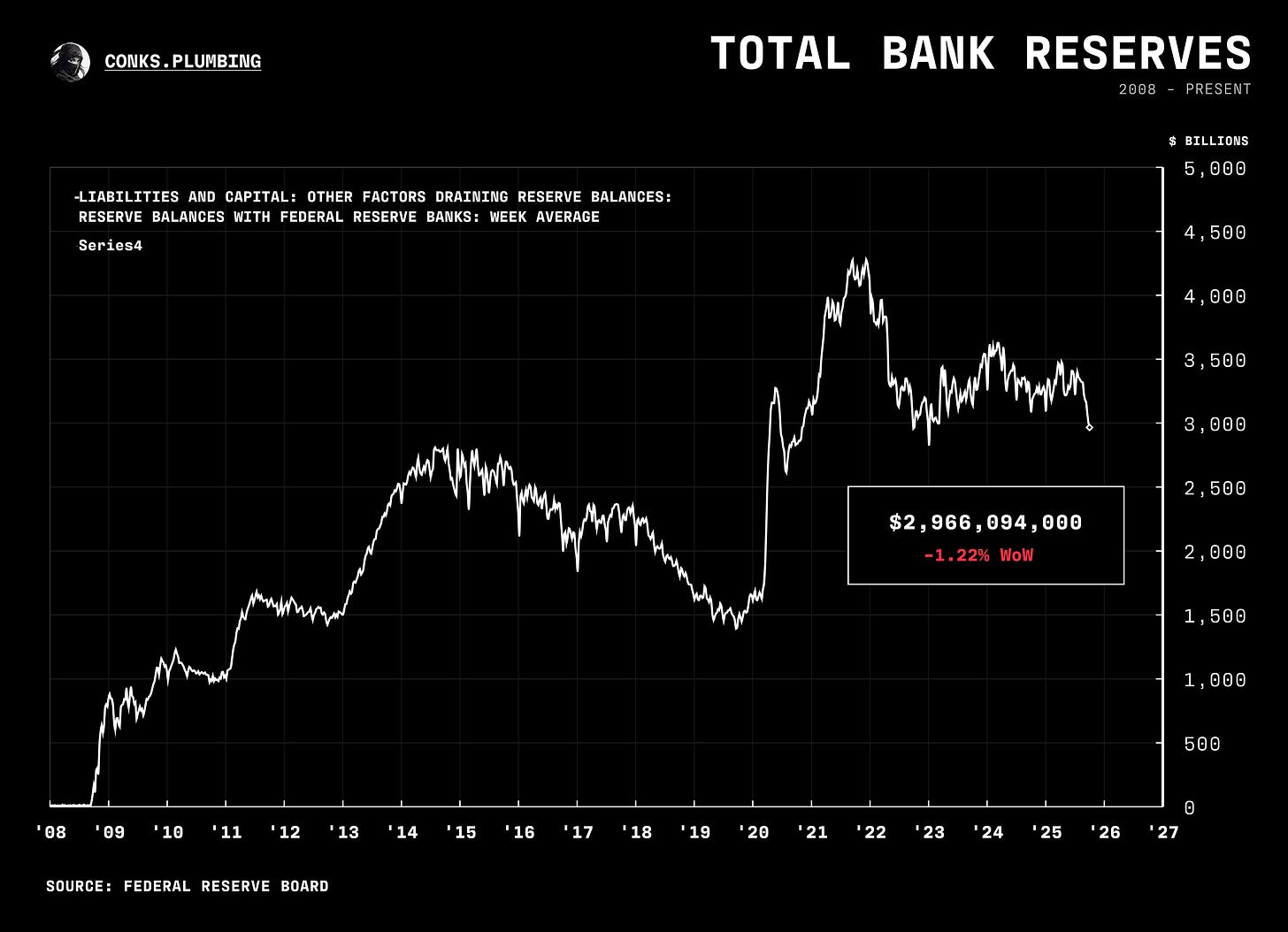

With the Fed’s shock absorber (i.e. its RRP facility) now also unattractive (and empty), money funds have begun targeting repo rates (more specifically, TGCR) as a yardstick for where to invest. Meanwhile, SOFR is trading above IORB (meaning banks will start deploying more reserves into repo and away from other money markets to achieve a higher yield) — but without any imminent hazard, as earlier periods of ample (not scarce) reserves demonstrate. During the rate takeoff (the rise in rates due to less liquidity in money markets), an arbitrage “tug of war” will keep these rates bound together as they continue to ascend — until money markets reach their breaking point.

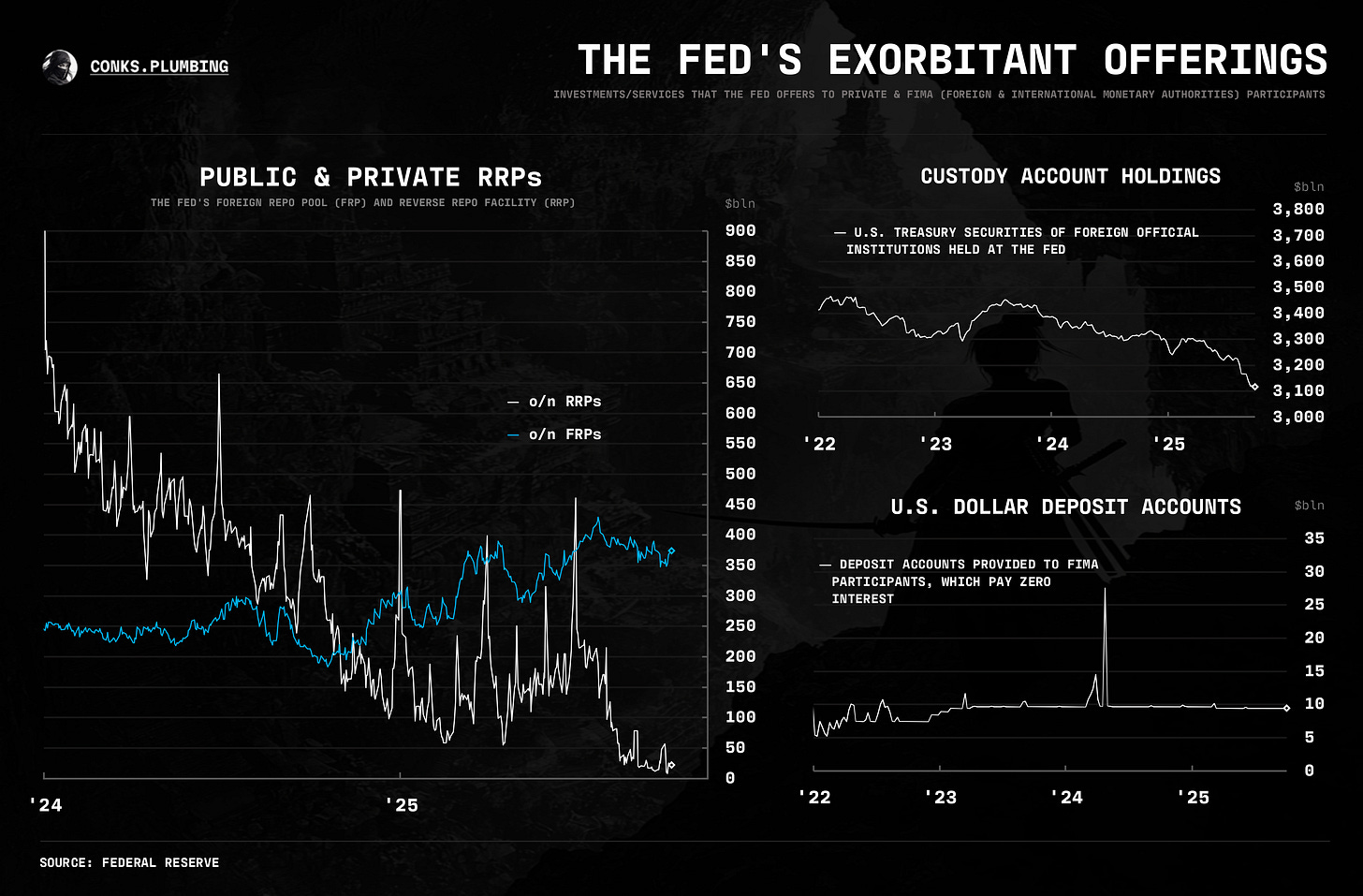

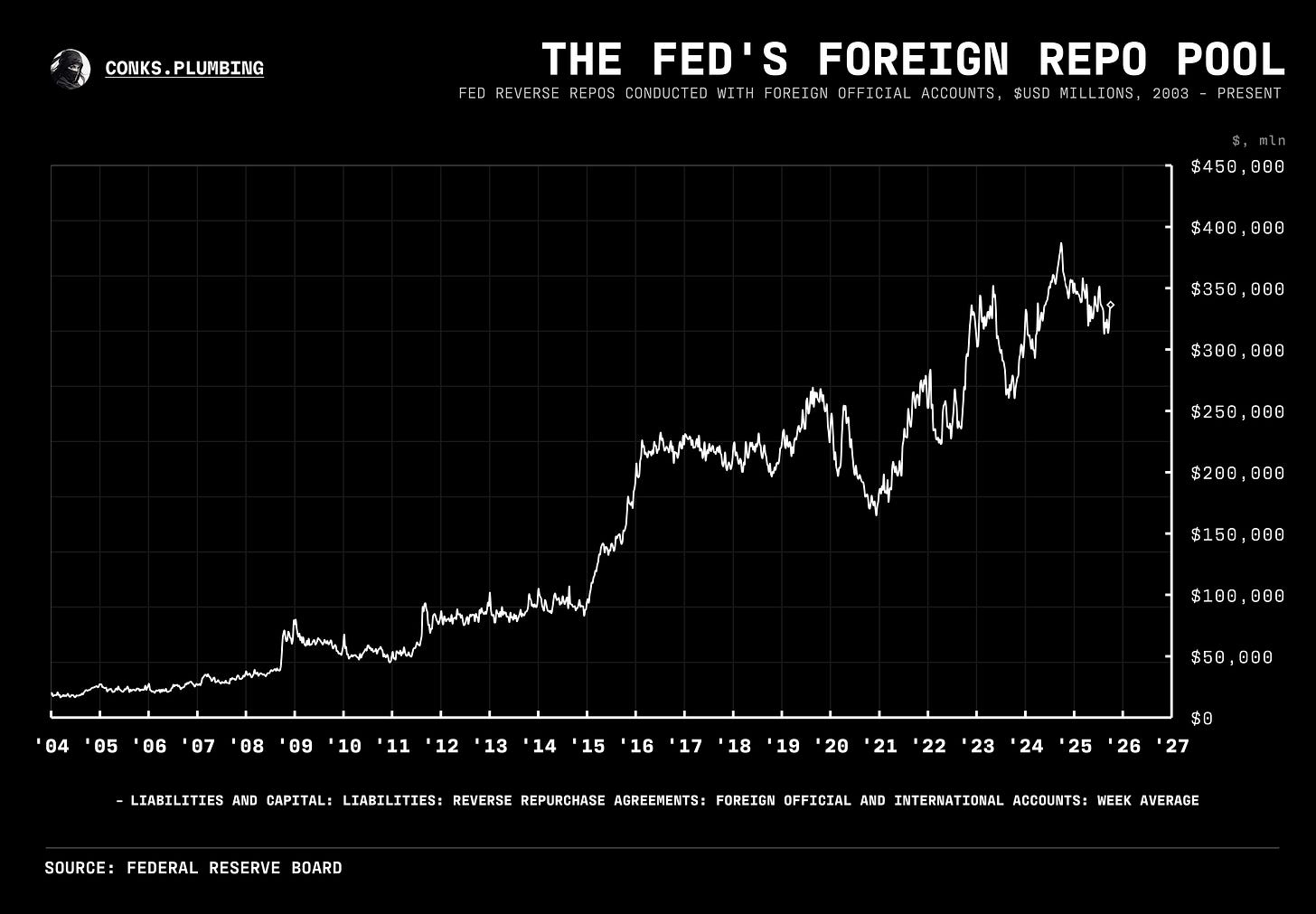

Conks also received some queries from Pro subscribers regarding our view that the Fed won’t use its foreign repo pool (also known as the FRP) to boost reserve balances and delay its landing. The BoJ could even accomplish this for them by unwinding its FRP transactions (thus releasing reserves), but it appears to be doing the opposite and keeping spare cash in the Fed’s foreign facility, where mostly foreign central banks park cash (i.e. conduct reverse repos) with the U.S. central bank. The more FRPs that unwind, the more reserves that will boost interbank liquidity and help dampen money market rates, such as SOFR. However, this is unlikely.

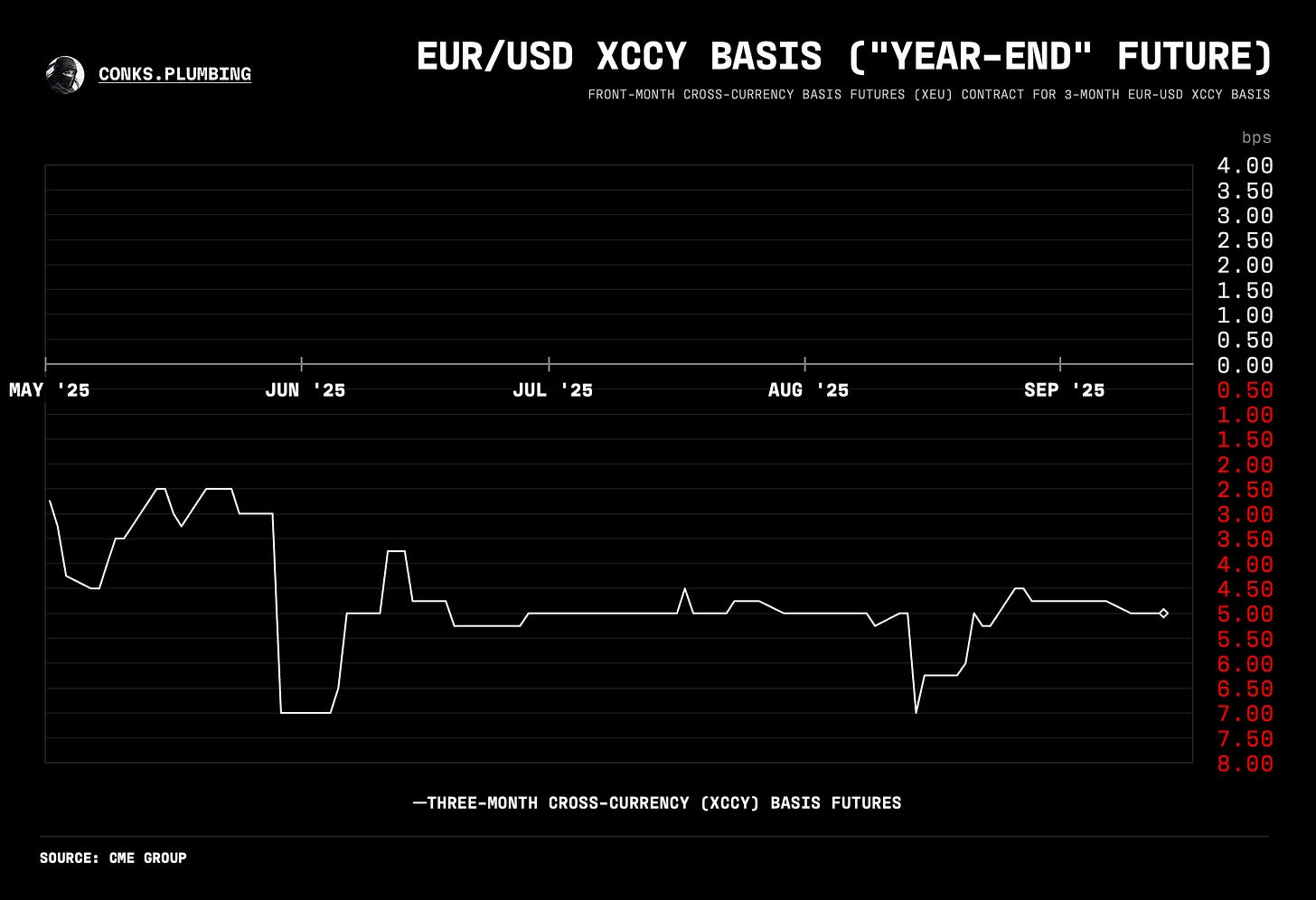

Rather, the big upcoming theme is how traders will start to front-run a plumbing “soft landing”. For equities traders, that means anticipating any Fed speak over ending QT. For STIR traders, that means paying cross-currency (XCCY) bases (i.e. less negative $ XCCY bases) — see XCCY chart below — and betting on a narrower (i.e. going short the) SOFR-FF basis1 around year-end. Intervention before a repo spike will result in repo rates (SOFR) falling faster than a still relatively idle overnight (o/n) FF rate. Conks thinks the Fed will more likely achieve this, but money markets are a maze, as we’ll soon elaborate.

Chartbook (7th, October 2025)

Changelog: added a reserve scarcity monitor (above) + domestic vs. foreign bank Fed Funds (o/n FF a.k.a EFFR) share (at the bottom)

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

SOFR minus Fed Funds, the basis (i.e. difference) between SOFR (the Fed’s repo rate benchmark) and FF (a.k.a EFFR, the Fed’s policy rate and a measure of interbank lending rates) as implied by the futures market. SOFR (CME ticker: SR1) and FF (CME ticker: ZQ) futures are quoted at 100 minus the rate implied by the futures market, meaning a positive SOFR-FF futures spread implies easier conditions. In comparison, a positive “realized spread”, the actual SOFR-EFFR spread of rates published by the Fed, means tighter conditions. futures pricing for the basis in March is viewable by typing “CME:SR1H2025-CBOT:ZQH2025” on TradingView or SERFFH5 on Bloomberg. note: “H” is the CME calendar code for March.

Conks,

You seem to have a high confidence in the Fed ending QT - but wasn't the whole point of slowing Treasury runoff to avoid this?

Also, how does your outlook fit in with the Fed's (stated) desire to shift its balance sheet away from coupons and MBS and into bills? Could MBS runoff continue even if they halt Tsy runoff?

NB: not a solicitation for financial advice, of course.

Epitome:

"Oh what a tangled web we weave when first we practice to deceive."

Sir Walter Scott