Money Market Update

while a less hawkish than expected Fed gives a green light to risk assets, money markets hit peak uncertainty as a liquidity mirage approaches

Welcome to another Conks edition. This month, we demystified intraday repo market flows and the TGA drawdown, while laying out our market views and publishing the first part of The Money Market Blindspot, which went live recently.

Part II will be released shortly (another taster below).

But first, a (gradually improving) money market update...

Summary & Brief Commentary

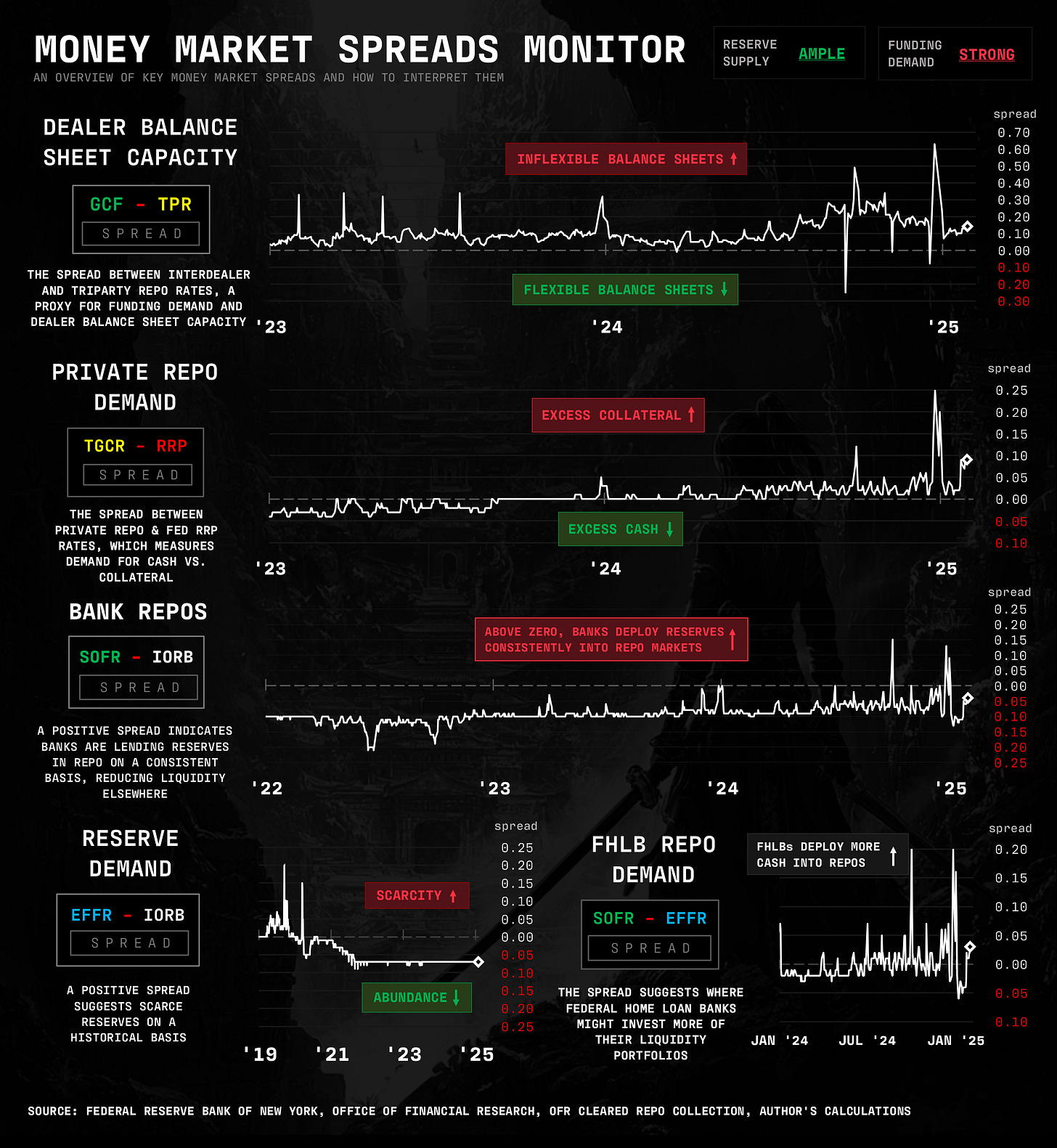

While the Bank of Canada announces the end of its version of quantitative tightening (QT), the Fed has vowed to continue QT for as long as another “repocalypse” can be averted. Fed Chair Powell, at the latest FOMC press conference, reiterated that reserves remain ample while failing to mention a QT cessation date. We expect the Fed’s balance sheet runoff to end by June.

Meanwhile, with Scott Bessent now in office, the February QRA (quarterly refunding announcement) will tell us if he will keep his word by reducing bill issuance. Bessent’s promises, however, align with what you’d expect the Treasury to do under a binding debt limit: reduce the share of bills and issue more coupons (>1y maturities) — a win-win for the new Treasury Sec.

There’s also been talk of reducing the TGA target (currently $850 billion), which will lower issuance and save money for the taxpayer, but only if the Fed preserves QT. Presently, the central bank pays interest to money funds via the RRP and banks on their reserves via IORB (interest on reserve balances), eliminating most cost savings from a reduced U.S. government bank account.

Meanwhile, since our last update, our macro outlook remains unchanged. The Fed has turned less hawkish, and Conks’ liquidity measures (see below) remain bullish. As we implied earlier, despite dollar strength and volatile geopolitics, risk assets should continue to perform well, outperforming bonds, with the odd bout of volatility.

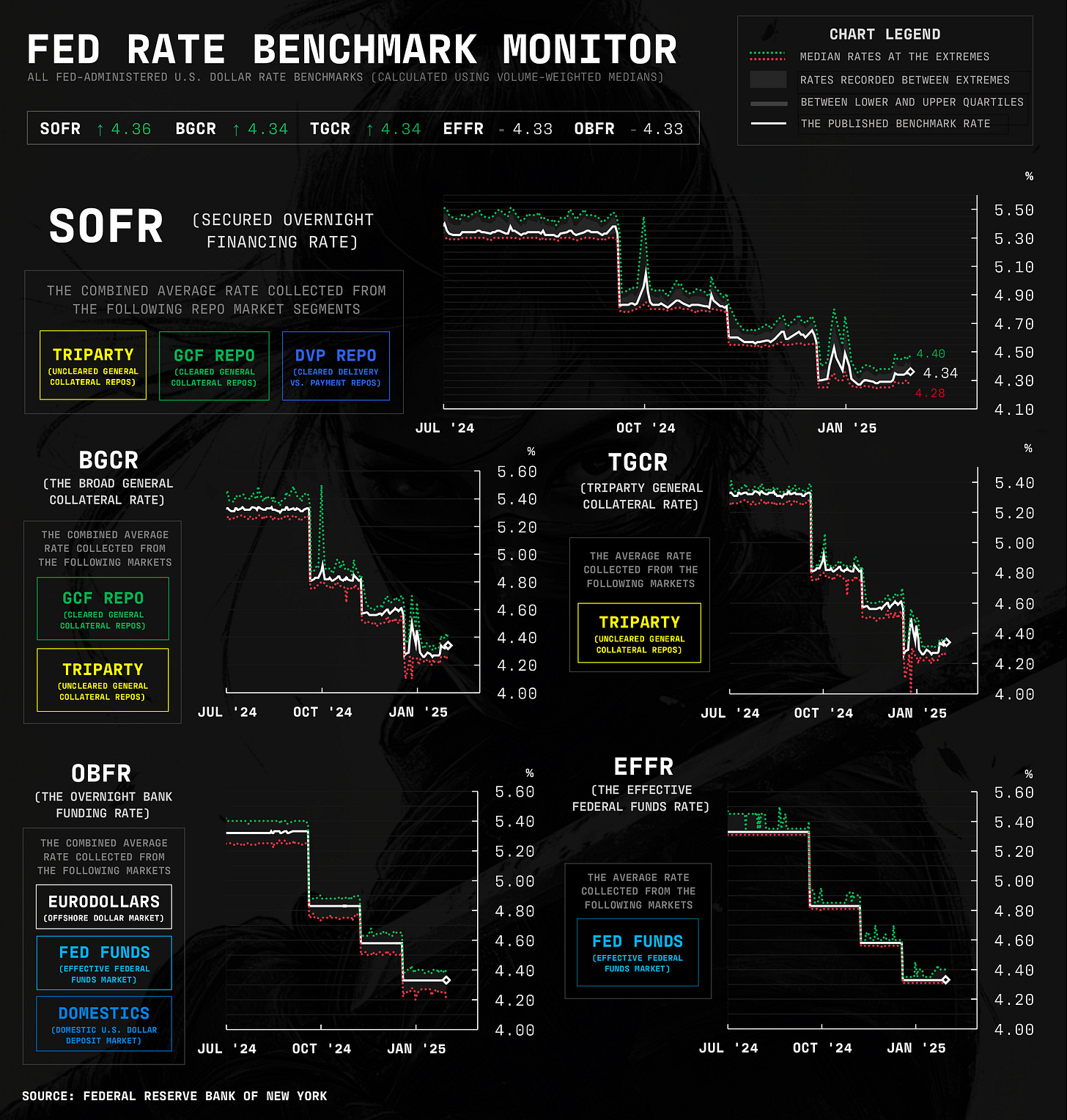

Within STIRs, we like deferring rate cuts into 2026, expressed via a SFRZ5Z6 flattener (short SOFR Dec 2025, long SOFR Dec 2026). Meanwhile, the market does not expect a TGA drawdown to have much tightening effect. As per our TGA drawdown infographic, swap spreads have widened, but SOFR-FF hasn’t tightened significantly. Easier funding conditions have been priced in, so receiving the March SOFR-FF basis — i.e. shorting the SR1-ZQ (SOFR 1-month - Fed Funds) futures spread at the March expiry — could be the play.

Also in STIR, flows from non-centrally cleared to centrally cleared repo markets, A.K.A The Repo Exodus, have failed to empty the RRP. Soon, the TGA drawdown will further delay the Fed’s facility from falling to zero.

Lastly, we now have 25 Fed primary dealers in U.S. Treasuries, with officials approving the Japanese securities behemoth SMBC Nikko as a trading counterparty. Speaking of USTs, the latest flow data suggests that, as the dollar has peaked, foreign official institutions have stopped selling Treasuries. Demand from the private sector remains strong nonetheless.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.