Money Market Update

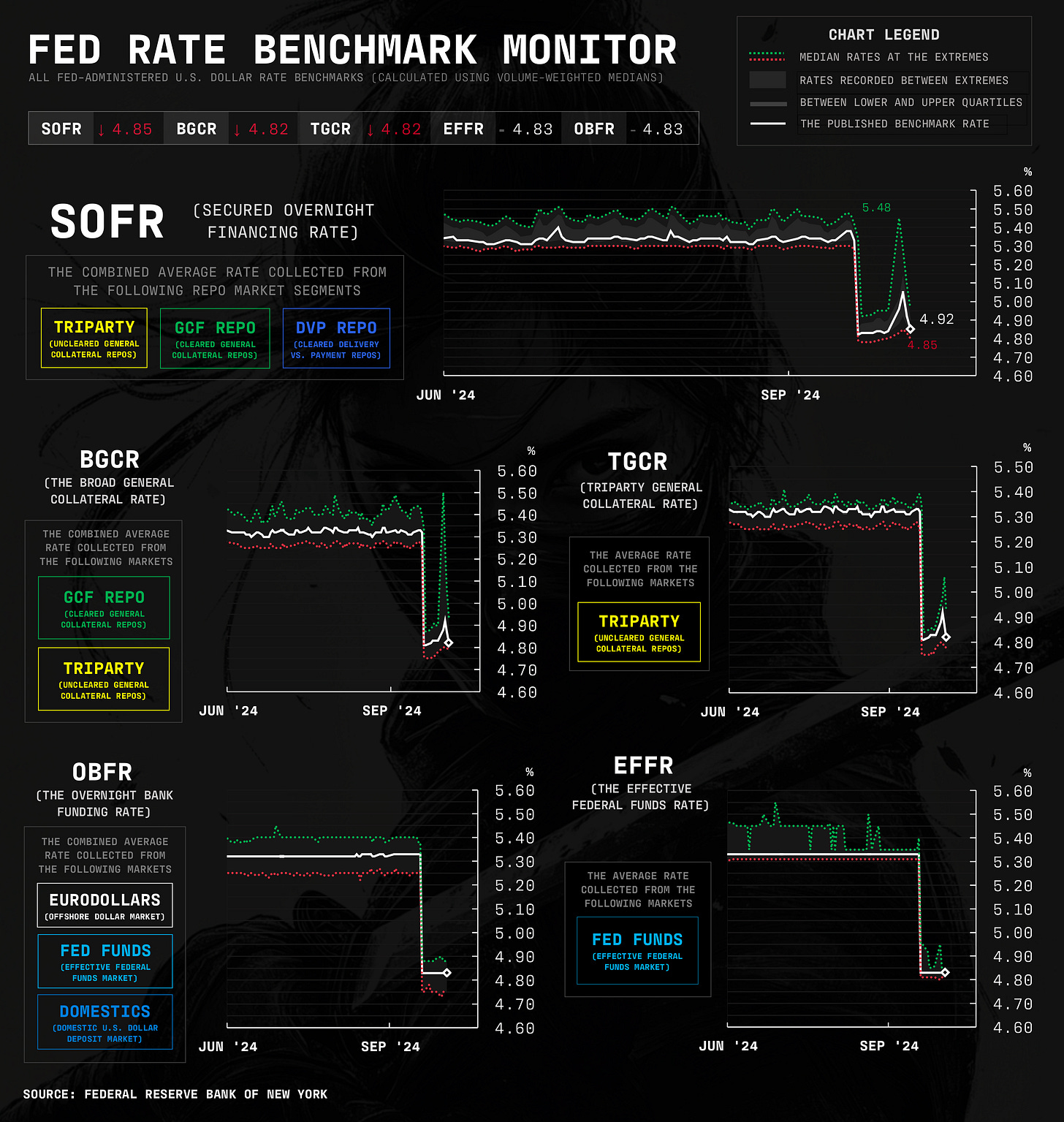

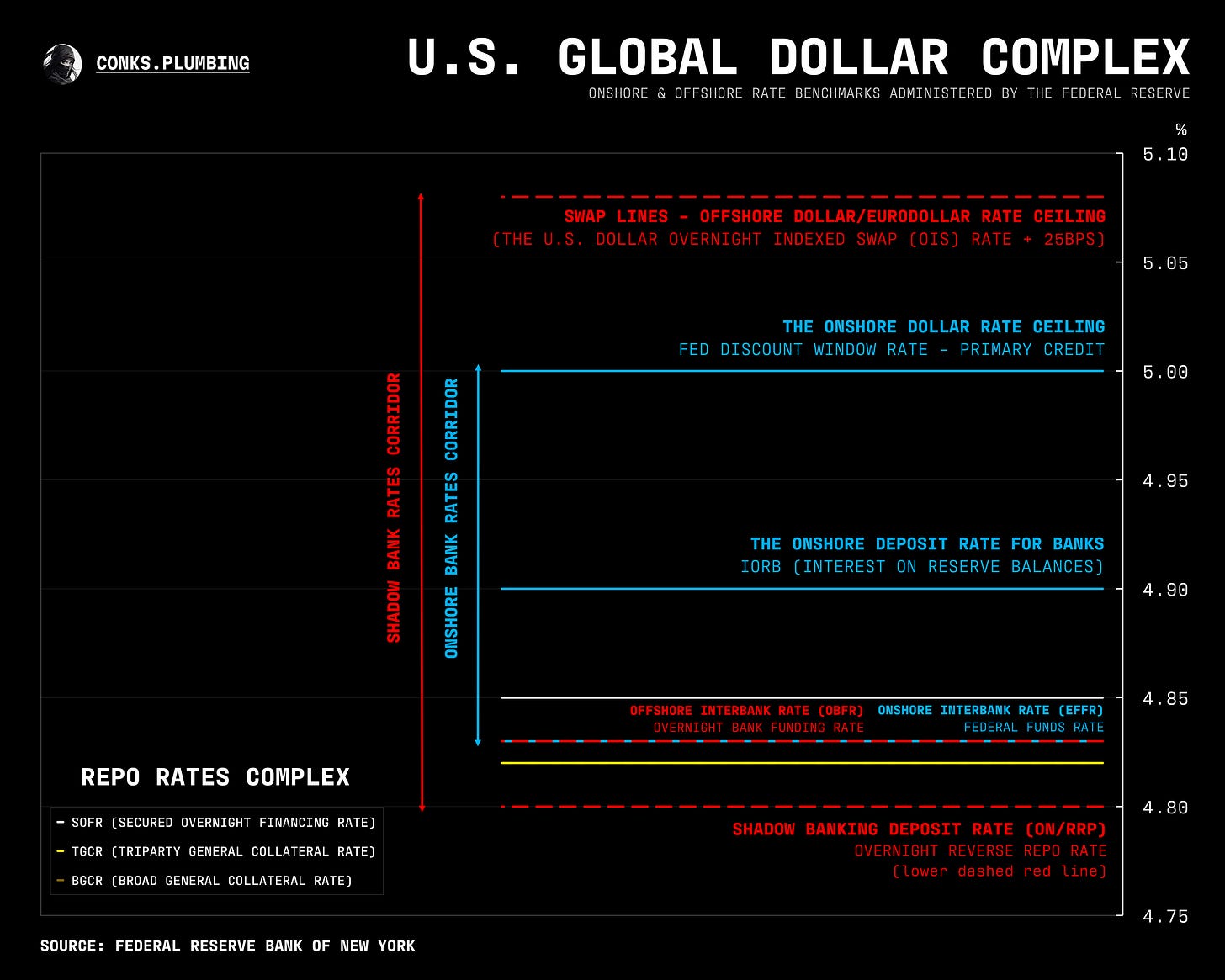

the Fed signals no end to QT just yet, while an uninverted curve coincides with dollar strength and increased hedge fund demand for repos. Money market charts now look goofy, thanks to rate cuts...

In case you missed it — or you’ve just joined us — the concluding piece of the Fed’s Global Put went live recently.

Coming soon, we’ll examine the weaknesses in the Fed’s emergency repo facility (a taster below) and a cross-currency swap market primer. Stay tuned!

But first, a (gradually improving) money market update...

Summary & Brief Commentary

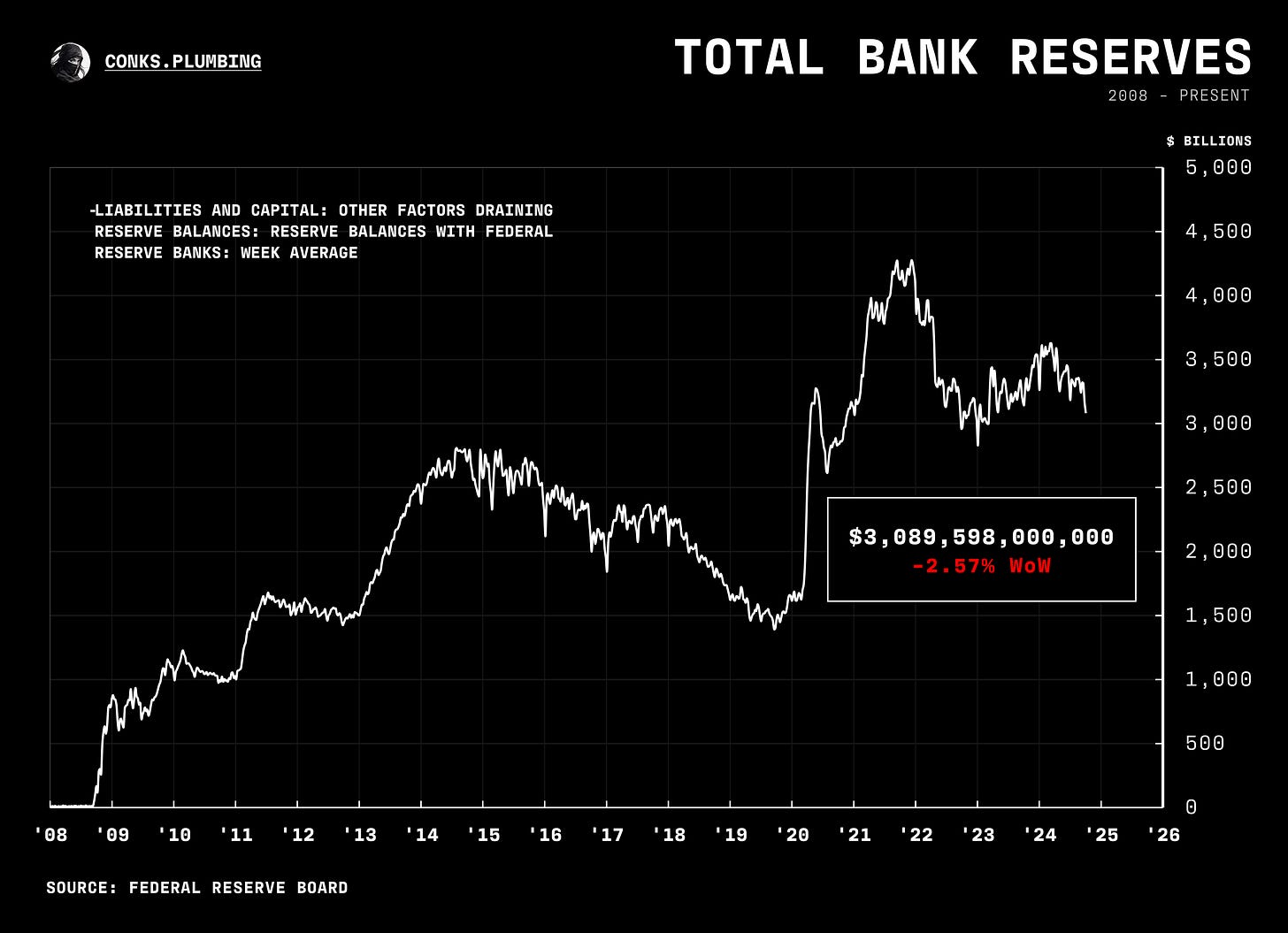

Fed Chair Powell and SOMA manager Perli (the Fed’s “portfolio manager”) appear satisfied with the ampleness of reserve balances. As anticipated in The Fed’s Global Put, they deem upward pressure on rates in the Fed Funds market as a critical sign to end QT.

After recent speeches and the September FOMC meeting, it’s abundantly clear that the Fed wants to see EFFR (Fed Funds) move higher before ending balance sheet runoff. Expect market participants to front-run any Fed response to EFFR moving toward IORB.

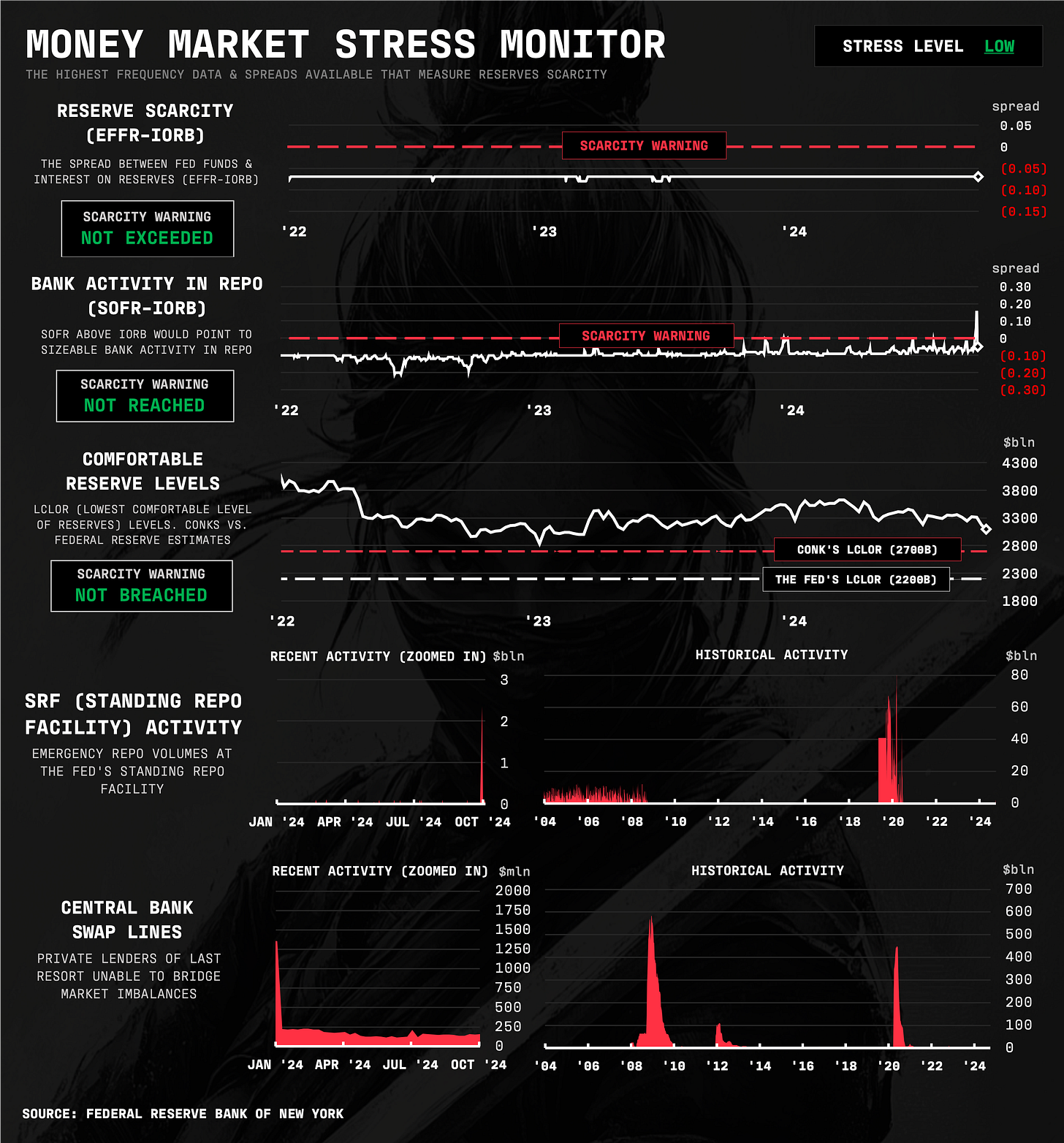

The Fed’s monitors track both repo and interbank (reserves) markets. Fed officials making the call to end QT are closely watching whether too much pressure is building in repo markets and whether it could “spill over” into the Fed Funds market. But as of writing, this is not happening.

Hedge fund repo exposures continue to rise, increasing demand for repo funding. This has caused increased turbulence on quarter-ends, but the Fed is happy for the SRF (standing repo facility) to be used in small amounts on these reporting dates.

RRP usage will persist until more sponsored repo relationships increase the number of potential counterparties in private markets. This is one of the drivers keeping RRP volumes elevated and will take more time to clear.

Liquidity remains ample in money markets and global dollar markets. Reserves have declined but nowhere near dangerous levels, while the Conks money market stress monitor shows no warning signs. Bond volatility, however, is likely to trough during a week with a lot of Fed speakers.

From a macro perspective, equities likely have more near-term upside than bonds and precious metals. We still expect consolidation in DXY, bonds, and precious metals before a continuation of the prevailing trend.

Oh, and the China stimulus is real this time. We’re not fading it.

We’re working on several new monitors that will hopefully be ready by the next update. For now, rate cuts have produced some interesting charts. Look how they massacred my boy(s)!

Anyway, onto the chartbook (additional monitors coming soon)…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Man, I love this. Makes me miss my Bloomberg less.

Is the recenr quarter-end sofr spike concerning?