Plumbing Notes: The Great Compression

the Fed declares war on money market volatility

Welcome to Plumbing Notes #7. Read our latest primer on SOFR-FF here and glossary to navigate this piece. Major (pending) works: Eurodollar system infographic deck [███▒%], a detailed look at the Fed’s Great Rebalancing [█▒▒▒%], and a new central bank target rate [███▒%]. But first, a Plumbing Notes on the post-December FOMC outlook...

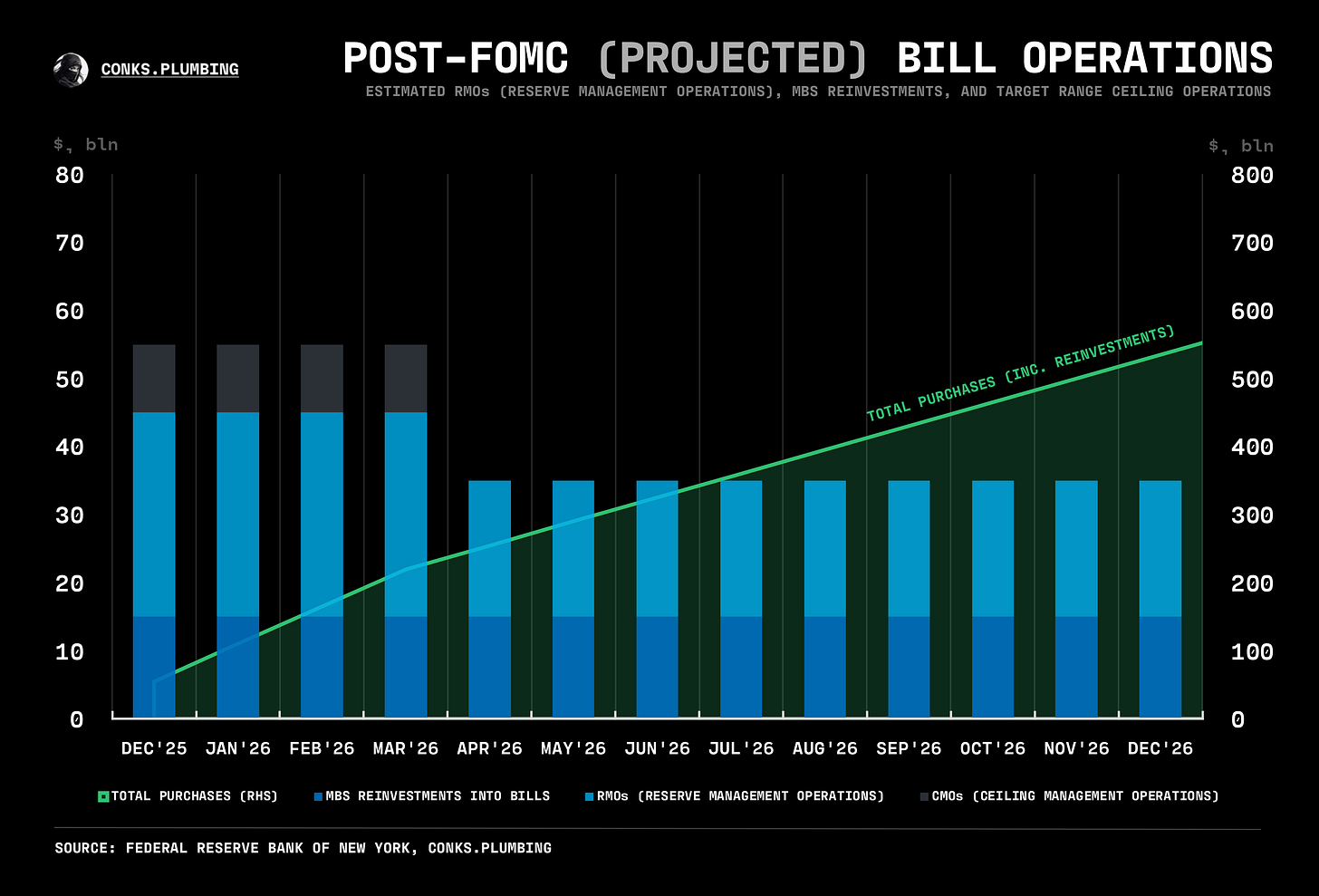

In a rare feat for an FOMC meeting, the plumbing has stolen the limelight from macro. The Fed has not only front-loaded cuts but now reserve injections, announcing a much-earlier-than-expected start to buying USTs (U.S. Treasuries) at the ultra-short end of the curve. QT and QE will be replaced as the most popular acronyms by “RMOs” and “CMOs”: reserve and ceiling1 management operations administered by the U.S. central bank, which involve swapping new reserves for bills in the secondary market2. Flying straight past temporary open market operations (TOMOs), such as lowering IORB (interest on reserve balances), officials have begun absorbing $40 billion a month in UST supply to subdue front-end pressures. With reserve levels about to force the overnight (o/n) rates complex to print well within the Fed’s target range, a Great Compression in money markets has commenced.

A swift return to near-abundant reserves is looming. Yet, the Fed’s post-QT asset purchases will be devoid of any meaningful easing outside money markets. Equities will need to rely on other forces to further climb the wall of worry. Rather than absorbing duration (i.e. interest rate) risk by buying longer-term USTs and slowly unwinding those purchases, the Fed is set to purchase short-term USTs3 to preserve waning interbank liquidity. As revealed by Chair Powell in the latest FOMC presser, officials will imminently deploy reserve injections to build up a cushion against several incoming “blindspots” arising from a volatile TGA4, the big risk centered around April’s infamous tax day5. Following this year’s interbank flows threatening to induce numerous blindspots, the Fed — now much closer to the system’s lowest comfortable level of reserves (LCLoR) — won’t take any chances.