The Fed's Reckoning: Part II

money market interlinkages and the coming central bank put

— click here for Part I and here for Pro

The decision facing monetary leaders that could ultimately avert a “plumbing hard landing” grows nearer. Just as most Fed RRPs1 have been unwound, marking the end of an excess cash era2, money markets have faced their first significant hurdle. While the U.S. banking system keeps slowly approaching its lowest comfortable level of reserves (a.k.a LCLoR), market participants have witnessed a mid-month plunge in liquidity from corporations withdrawing cash from MMFs3 to fund tax payments, just as dealer banks4 deployed more reserves into repo markets to clear massive mid-month UST (U.S. Treasury) settlements. Even so, the mid-month funding episode created little fear over a replay of the September 2019 repo spike, i.e. the repocalypse, where repo rates, overnight Fed Funds5 (o/n FF), and FX swaps breached the U.S. central bank’s “upper jaws,” i.e. the top of its local/global target ranges. A near-empty Fed RRP facility, paired with a corporate tax date and large UST settlements, was no match for a system still flush with liquidity.

The mid-month turn also coincided with the end of a much-feared “TGA refill”, a restocking of the U.S. government’s bank account — completed ahead of schedule. Treasury officials’ $850 billion TGA stockpile will now enable the U.S. empire to cover all unexpected threats to its payment flows, but at the expense of banks’ capacity to settle interbank flows, as government revenues lower reserve balances of the largest banks, G-SIBs6, the major U.S. dollar clearers. The antidote will soon be an increase in daylight overdrafts, Fed lingo for intraday credit7 supplied automatically when banks’ reserve accounts hit zero, an upsurge of which (from smaller banks) has become a key covert input8 in the Fed’s reserve scarcity “alarm system”. That, alongside other rising pressures in funding markets, will soon apply upward pressure on interbank rates, observable via a rising EFFR, the “canary in the coalmine” for the Fed to respond with a long-awaited plumbing put.

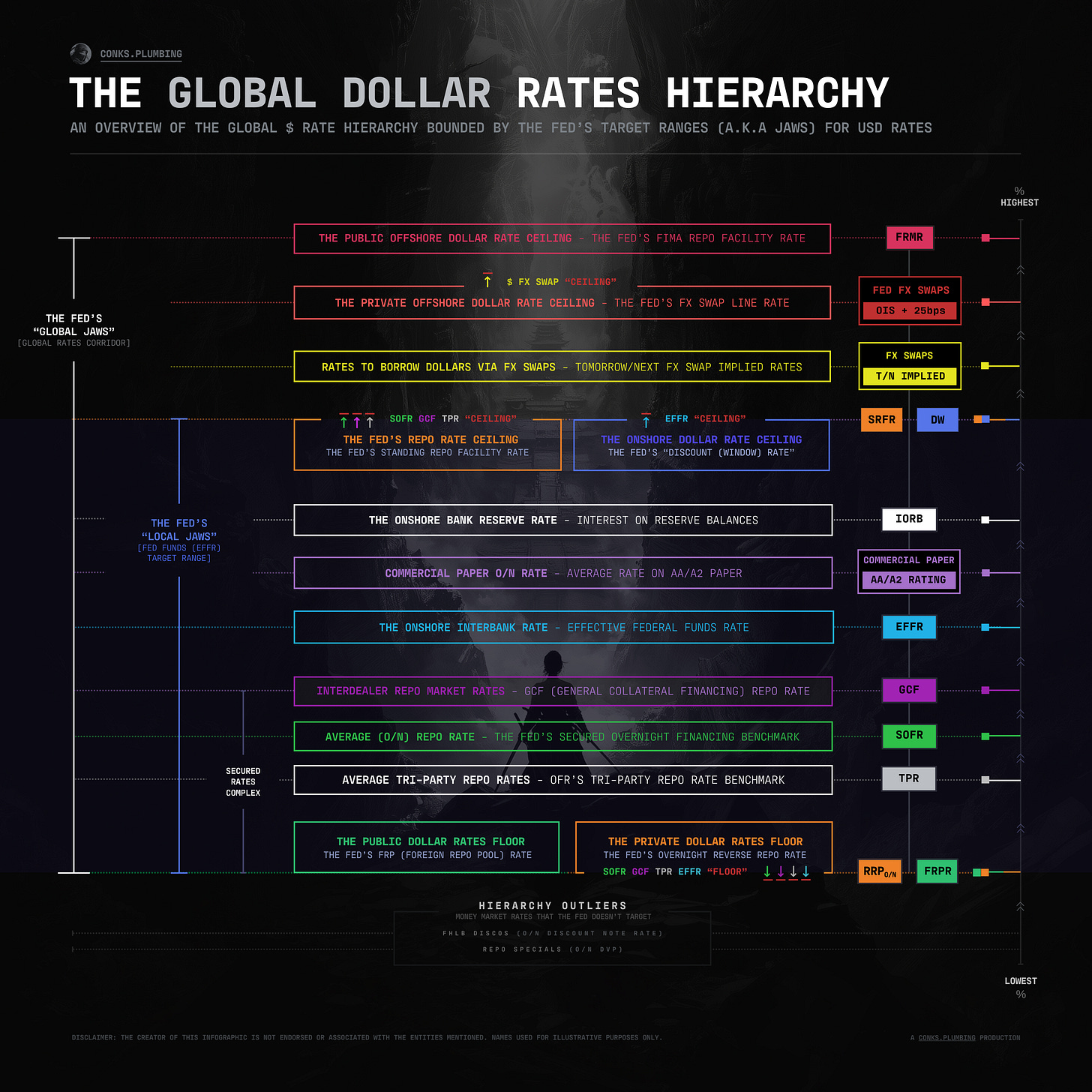

Rising interbank rates, however, are just a few of the Fed’s concerns. Reserves clear all money markets in the global dollar hierarchy, not just repos and o/n FF. As one rising rate pushes other rates higher along with it, the upper levels of hierarchy will likewise soon feel the drag of waning interbank liquidity. For the first time in years, the level at which dollar funding markets clear will rise and remain elevated, lasting until the Fed u-turns and fully initiates a Great Rebalancing9, an attempt to prepare its balance sheet for the next COVID-style event. Nevertheless, officials also remain in pursuit of a max balance sheet reduction, just as a complex web of money market interlinkages grows increasingly volatile. The U.S. central bank’s capacity to avoid another repo upheaval is thus about to be challenged. With its inventory of delay tactics now exhausted, the Fed’s Reckoning — its decision to let money markets “run hot” or prematurely deploy its next plumbing put — is looming, and the intricacies of dollar funding markets may hold the answer.