— click here for Part I and here for Pro

The latest phase in the fortification of the U.S. Treasury market has achieved even greater levels of pandemonium. Monetary leaders continue to fret over illiquidity, hallmarked by the U.S. Treasury initiating Operation “Delay Duration”, potentially suspending an expansion in long-end issuance until 20271. The latest boost in UST (U.S. Treasury) buybacks will also further stem volatility, neutralizing congested dealer inventories. POTUS, meanwhile, has backtracked on unseating Powell as the central bank chairman after threats to the Fed’s independence dramatically steepened the curve. This occurred just as central bank officials revealed that the Fed’s Relief Valve could include exempting USTs at the dealer level2, providing (supposedly) an extra boost to the plumbing. But while “illiquidity hysteria” continues to capture public attention, private players have been driving a quiet liquidity revolution, one that has bolstered the UST pipes in the most restrictive regulatory climate on record.

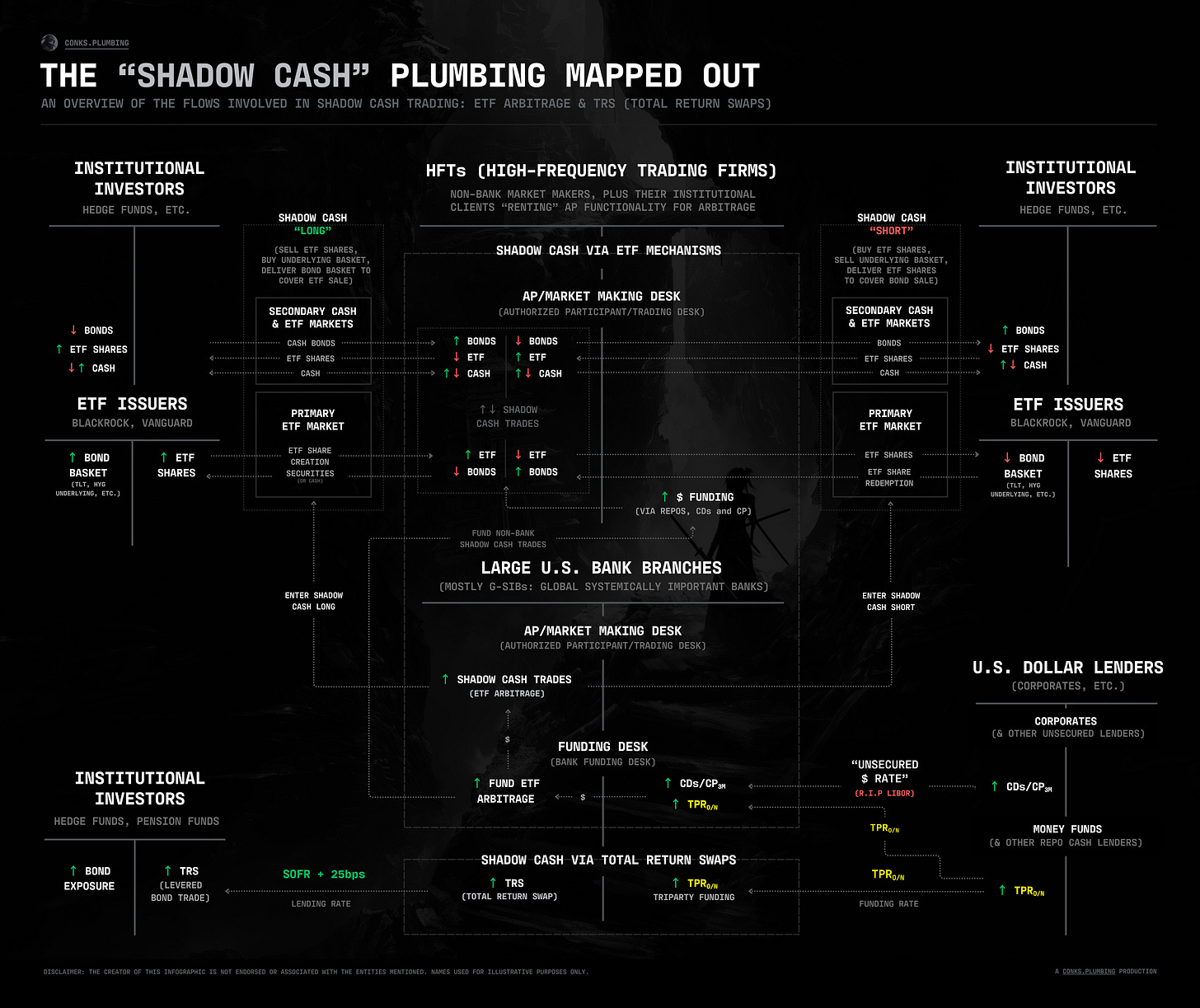

Financial alchemy has reached new extremes. Traditional cash markets, including the secondary U.S. Treasury market3, are now competing with the rise of a new “bond-like” ecosystem still in its early stages of expansion. The post-GFC battle for market-making dominance between top liquidity providers, both traditional and emerging, now involves conquering a rising shadow arena. Much like the shadow banking system and the interplay between banks and shadow banks, the “cash market” has gained a counterpart: the “shadow cash market,” which participants turn to when liquidity can no longer be tapped via traditional flows impeded by post-crisis regulations4.

With fresh market mechanisms, however, come new dangers. Shadow cash trades will expose another inconvenient truth for monetary leaders attempting to prevent further intervention by reinforcing the UST market’s inner workings: in times of crisis, other barriers not enforced or produced via regulation will continue to impede the major market players.