Plumbing Notes: The Excess Collateral Era

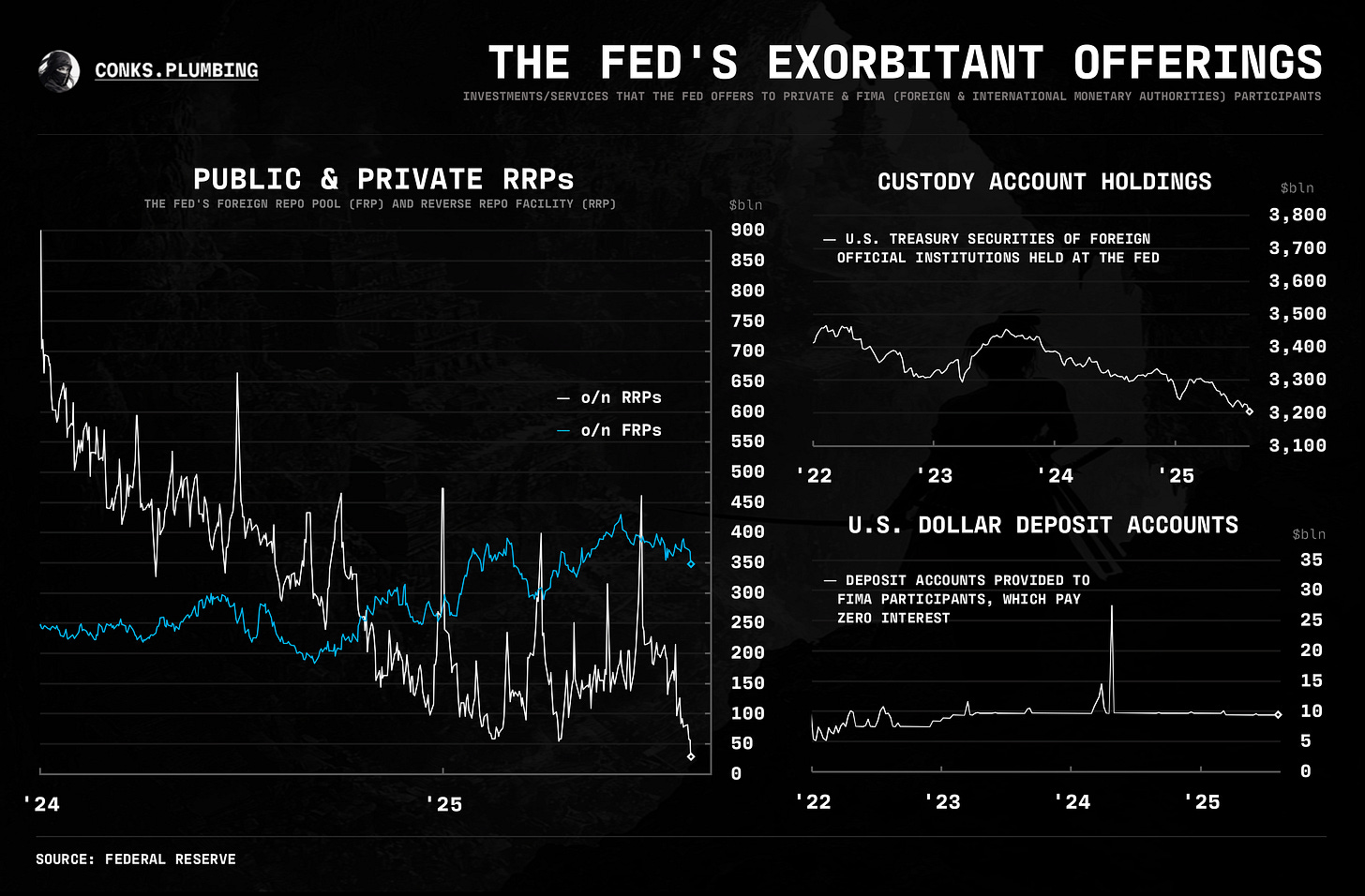

the RRP has reached the zero bound, marking the near-end of a journey toward tight (i.e. no excess) liquidity, but officials have other plans: preventing money market rates from again turning volatile

Welcome to another Conks Money Market Update. In case you missed it, our latest piece, The Shadow Cash Market: Part II, went live recently. In other news, Conks will be in NYC from tomorrow evening until August 26th, so if you’re around, you know what to do...

Next up, a detailed look at the upcoming period of waning interbank liquidity and, consequently, the Fed’s attempt at a plumbing “soft landing”. A small taster below…

But first, another ever-expanding money market update…

Summary & Brief Commentary

Finally, the long-awaited RRP is hovering around zero, a decline documented in our most popular piece, "The Reverse Repo Endgame." Reaching the “zero bound” does not signify impending Armageddon, but instead indicates that every dollar is being utilized or housed in the banking system without the Fed having to absorb “excess” bank cash (i.e., reserves).

With the debt ceiling out of the way, the RRP now faces its old adversary: counterparty limits. Money funds will lend cash to numerous players, but, due to regulatory constraints, can only lend a limited amount to a particular one at any given time. Some funds had allegedly run out of private counterparties to lend to and parked cash in the Fed’s facility. Since last year, however, more borrowers may have become available via sponsored repo, and volumes suggest this is the case.

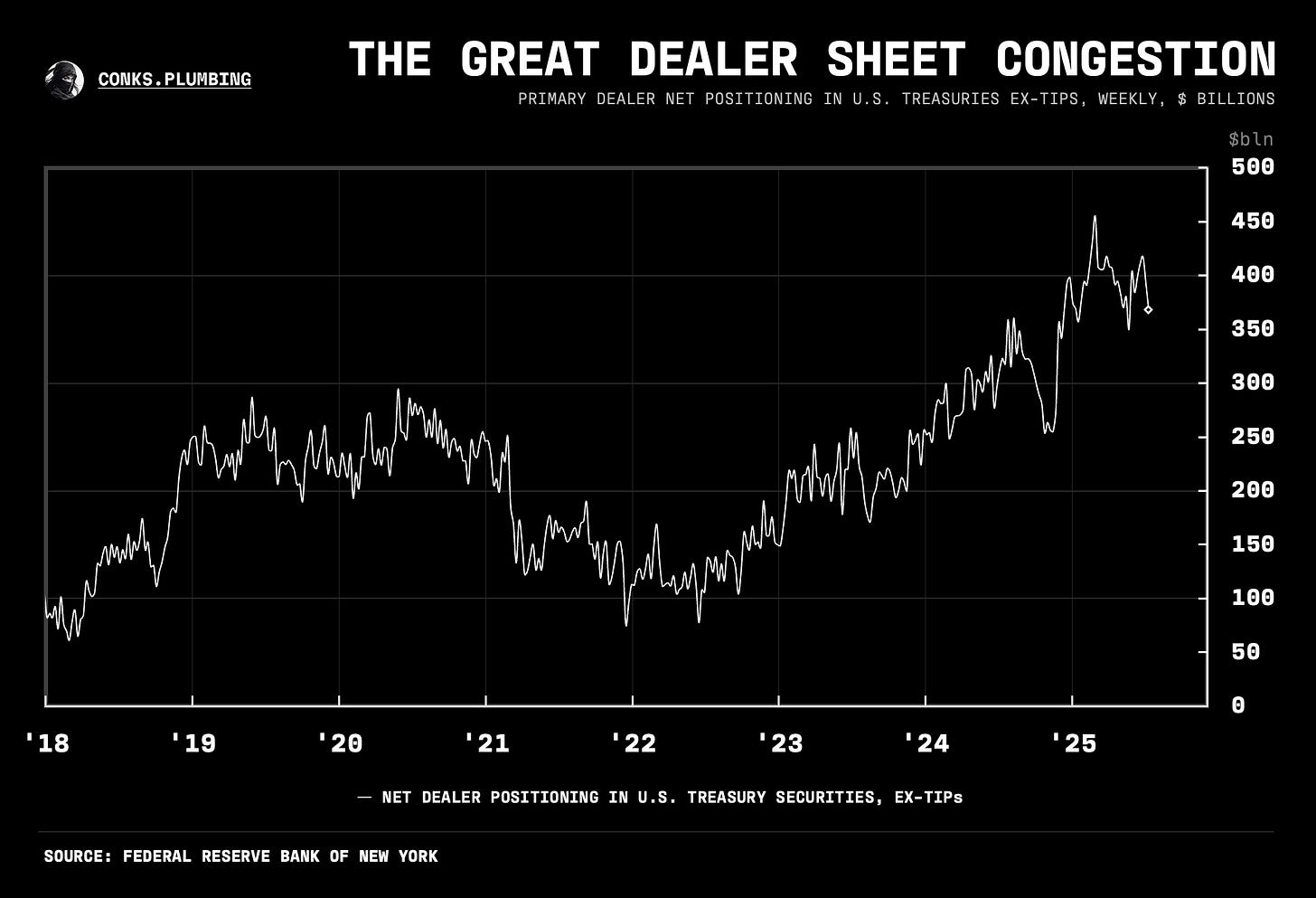

Nevertheless, the layer of reserves preventing any major volatility (ex-quarter ends) — and the end of an “excess cash” era — in money markets remains intact. Dollar liquidity is ample, with cross-currency bases (see chartbook below) having rallied into positive territory (suggesting looser funding conditions and ample dollar supply) and will continue to tighten (grow “more positive”).

Before cash becomes too scarce, where the upper layers of the repo hierarchy start to drag bank liquidity into repo and away from the banking system and interbank markets — such as o/n FF (Fed Funds), interbank liquidity will remain “excess” at least until early ‘26, in Conks’ view.

By then, the next Fed Chair will have apparently been selected by POTUS. Despite our favorite David Zervos (a.k.a Finance Jesus) being suggested, we have stuck with our Waller prediction, which remains the most probable outcome. Polymarket odds had at one stage somehow priced Waller below Hassett and Warsh.

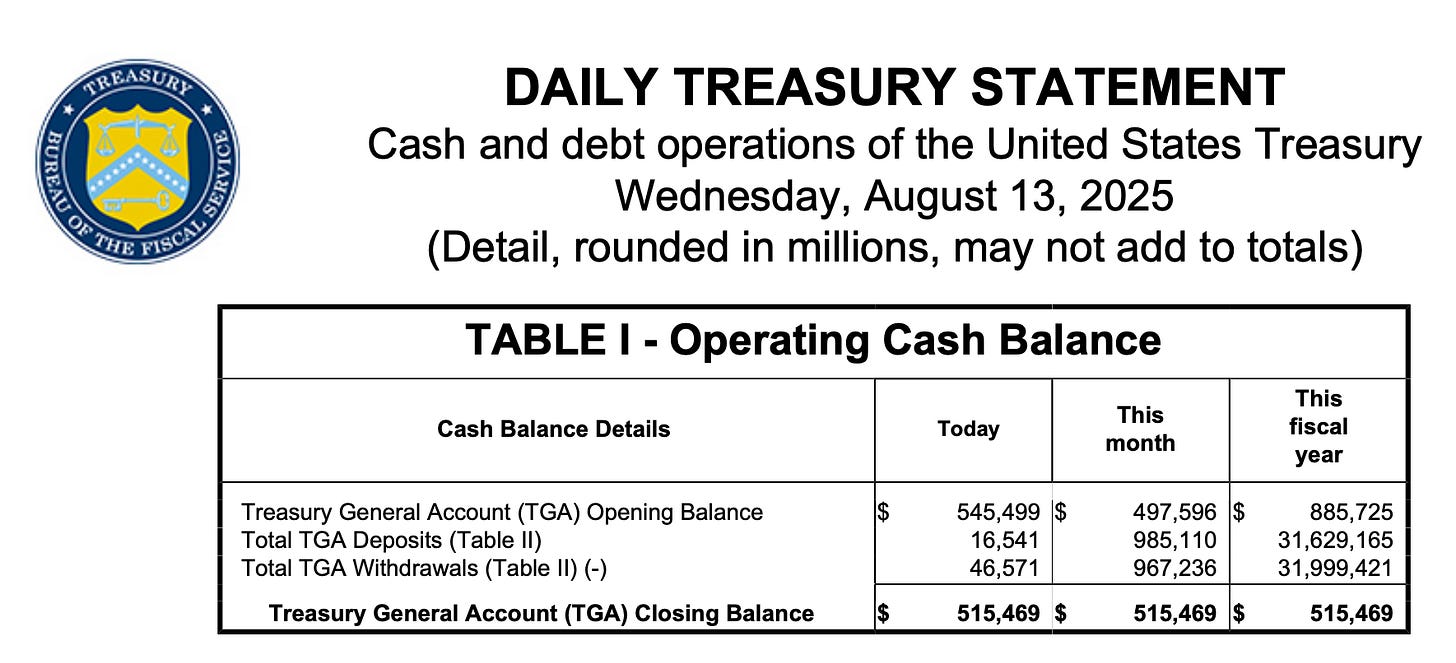

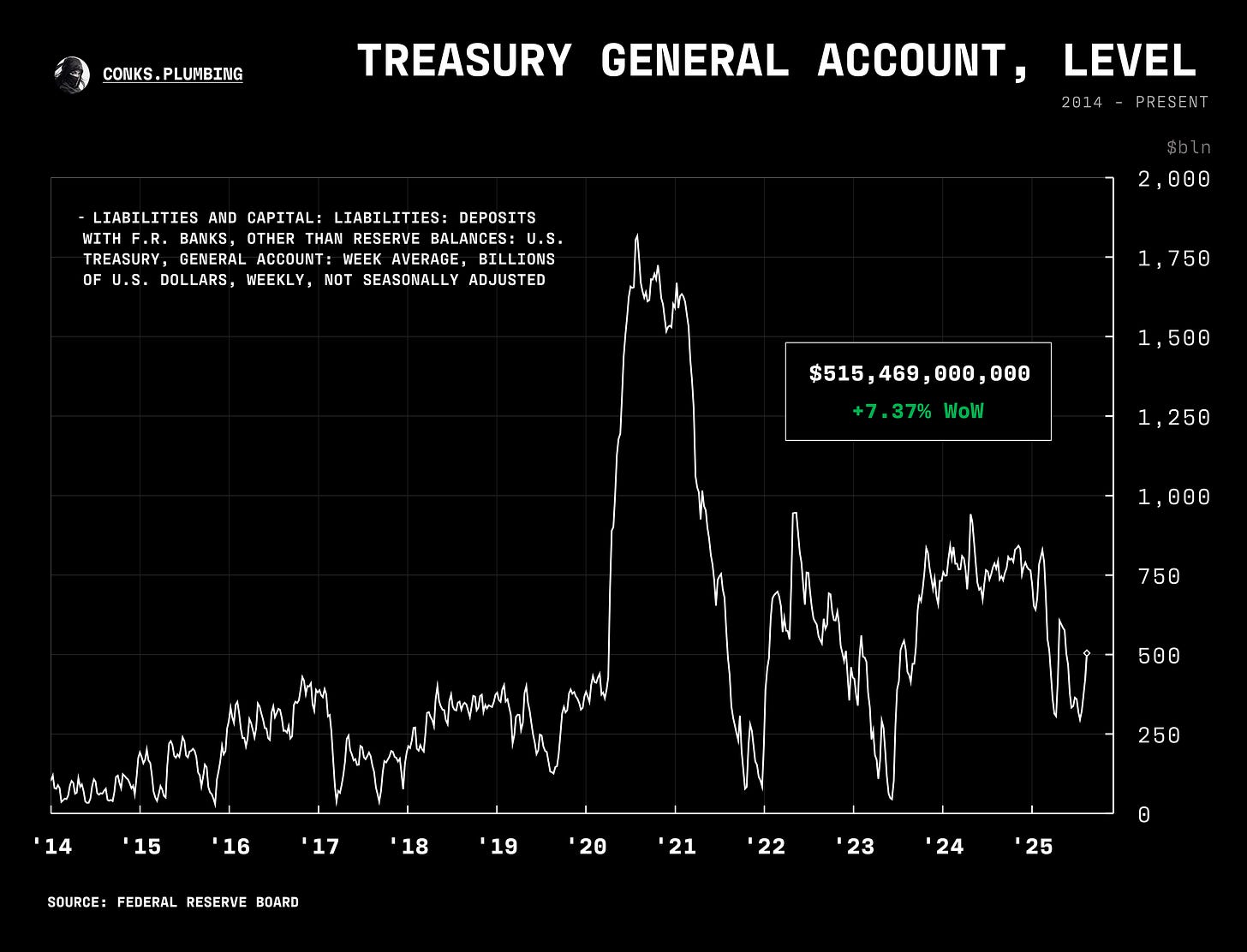

Elsewhere, rate cut fever is in the air while the latest TGA rebuild (the reverse of our TGA drawdown graphic) prevails. We turned bullish again on SOFR-FF (therefore bearish on SERFF:BBG, SR1-ZQ:CME) and expect SOFR to print at 6bps over EFFR (i.e. Fed Funds) by October. Meanwhile, SOFR (three-month) futures are approaching three cuts by year-end, which would be a good time to fade. In classic STIR fashion, an overshoot to nearly three cuts is our base case for Z5 (a.k.a SOFR Dec’25). Doves are out in force, and Conks maintains a “one (September cut) and done” bias. Stagnant growth and sticky(ish) inflation are likely to persist long enough to warrant one insurance cut.

Lastly, Treasury buybacks increased as anticipated, with officials doubling the frequency of operations at the most vulnerable parts of the curve. Even so, to quote a certain investor class, we’re so early. More buybacks are expected to follow as deficits remain at all-time levels.

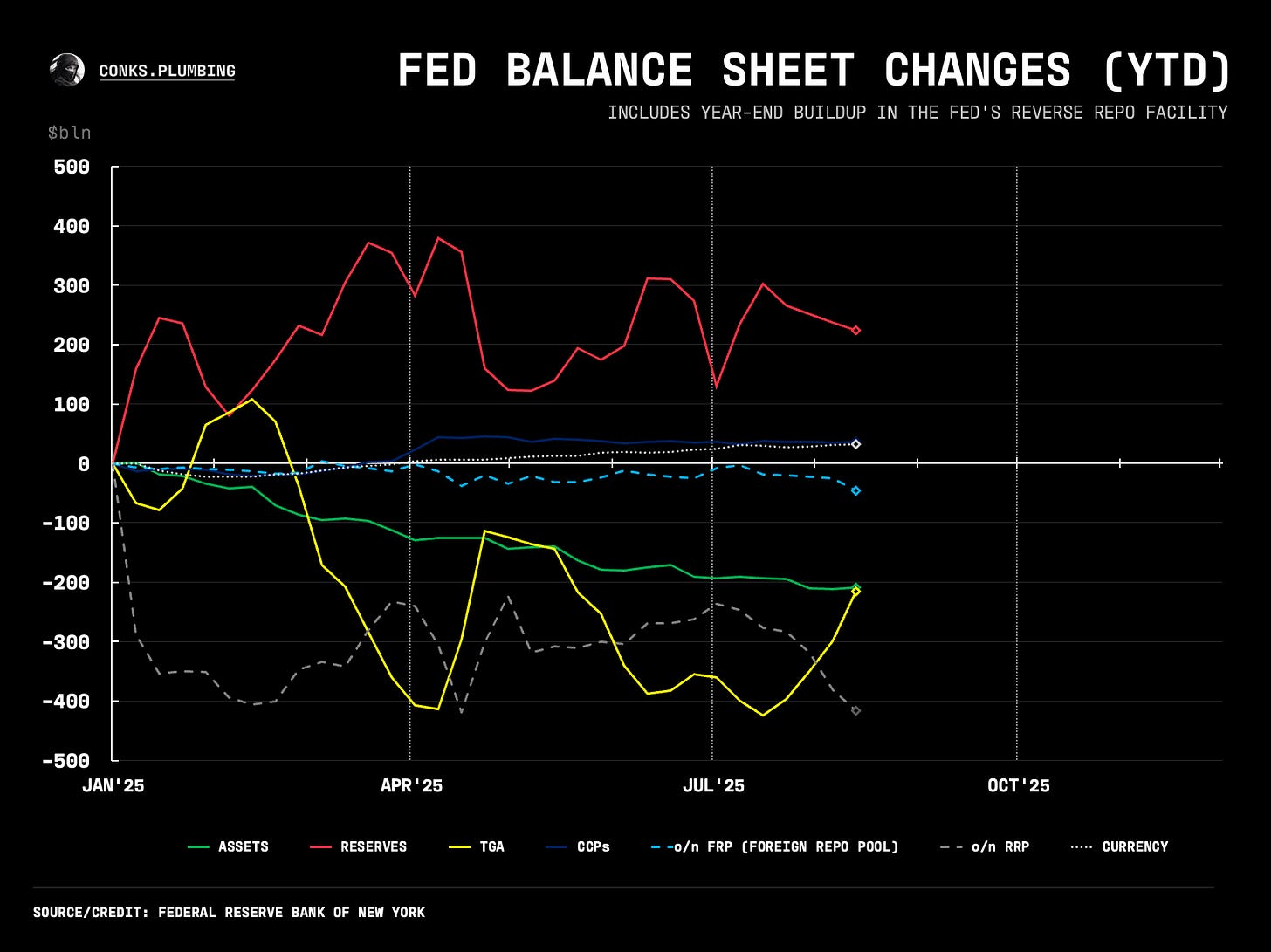

Changelog: Fed Balance Sheet Changes YTD

WIP: a STIR monitor/Treasury monitor to accompany these updates.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.

Love your work. Keep on jamming.