Plumbing Notes: Shadow Cash

while a TGA refill likely won't prompt major money market pressures, plumbing proxies reveal the Fed will need an even bigger "relief valve" to grease the U.S. Treasury market

Welcome to another Conks money market update. In case you missed it, The Great Rebalancing went live recently.

Elsewhere, more infographic prints have been added to the Conks Store — while extended money market commentary is available via Pro. Up next, the belated concluding part of the Shadow Cash Market series is still in the works (due to being infographic-heavy) but should be released by the end of the month. Another sneak peek below…

But before that, another ever-expanding money market update…

Summary & Brief Commentary

The TGA rebuild is underway, with up to $1 trillion in issuance hitting the UST (U.S. Treasury) market during the next quarter. The Treasury will take around two to three months of solid, ongoing issuance to reach its present target balance of $850 billion by September month-end. Speculation that officials will lower their target TGA cash balance by around $200 billion is unlikely to become reality. This was proposed to reduce costs, but those savings are immaterial and not worth the Treasury holding a smaller cash cushion. Now, despite the Treasury having commenced issuing up to a $1 trillion “wall of bills” this year, the market seems to have priced in all the funding pressure it desires. The question now is how much of that pressure materializes. Another era of uncertainty has thus emerged in money markets.

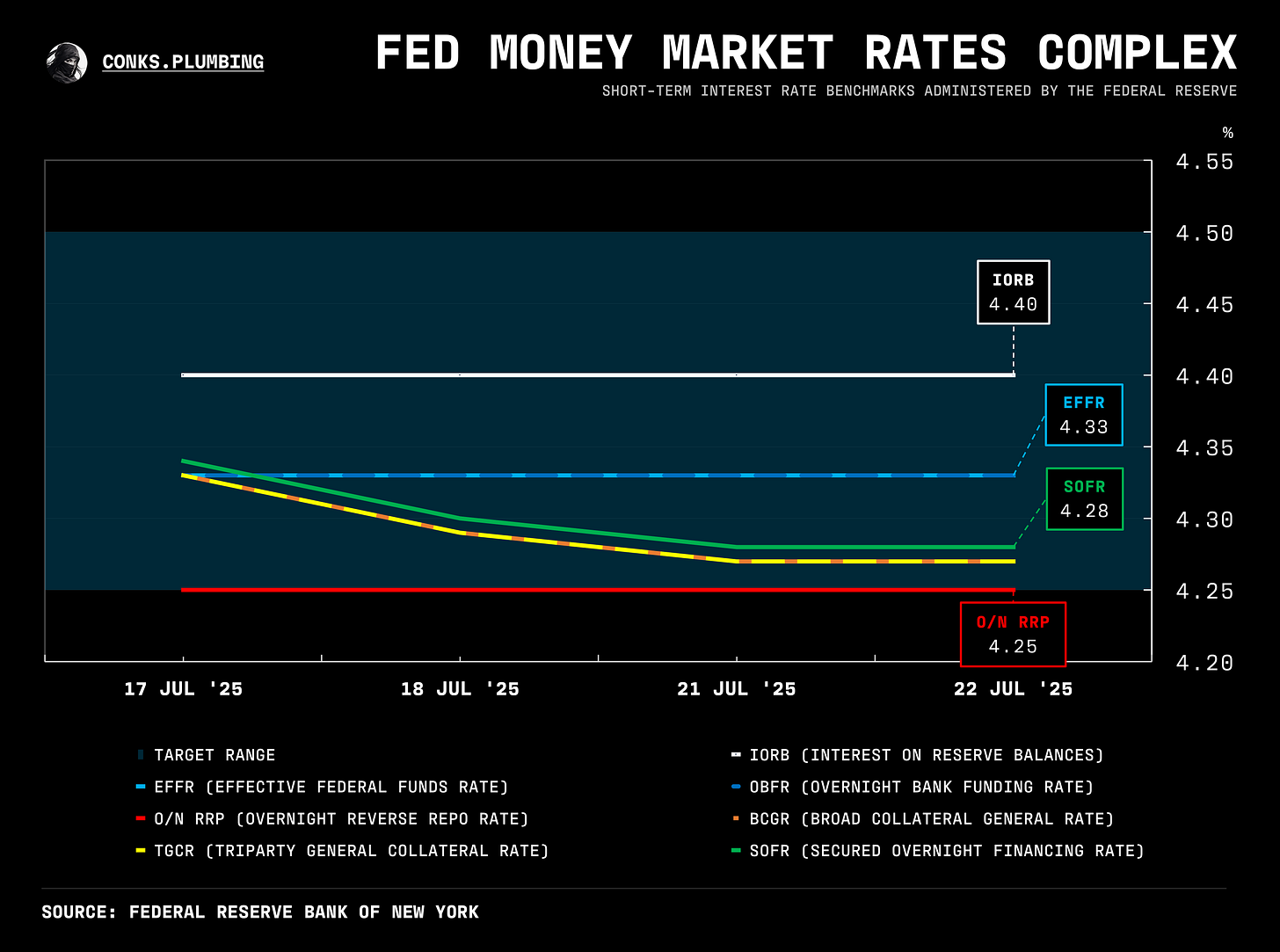

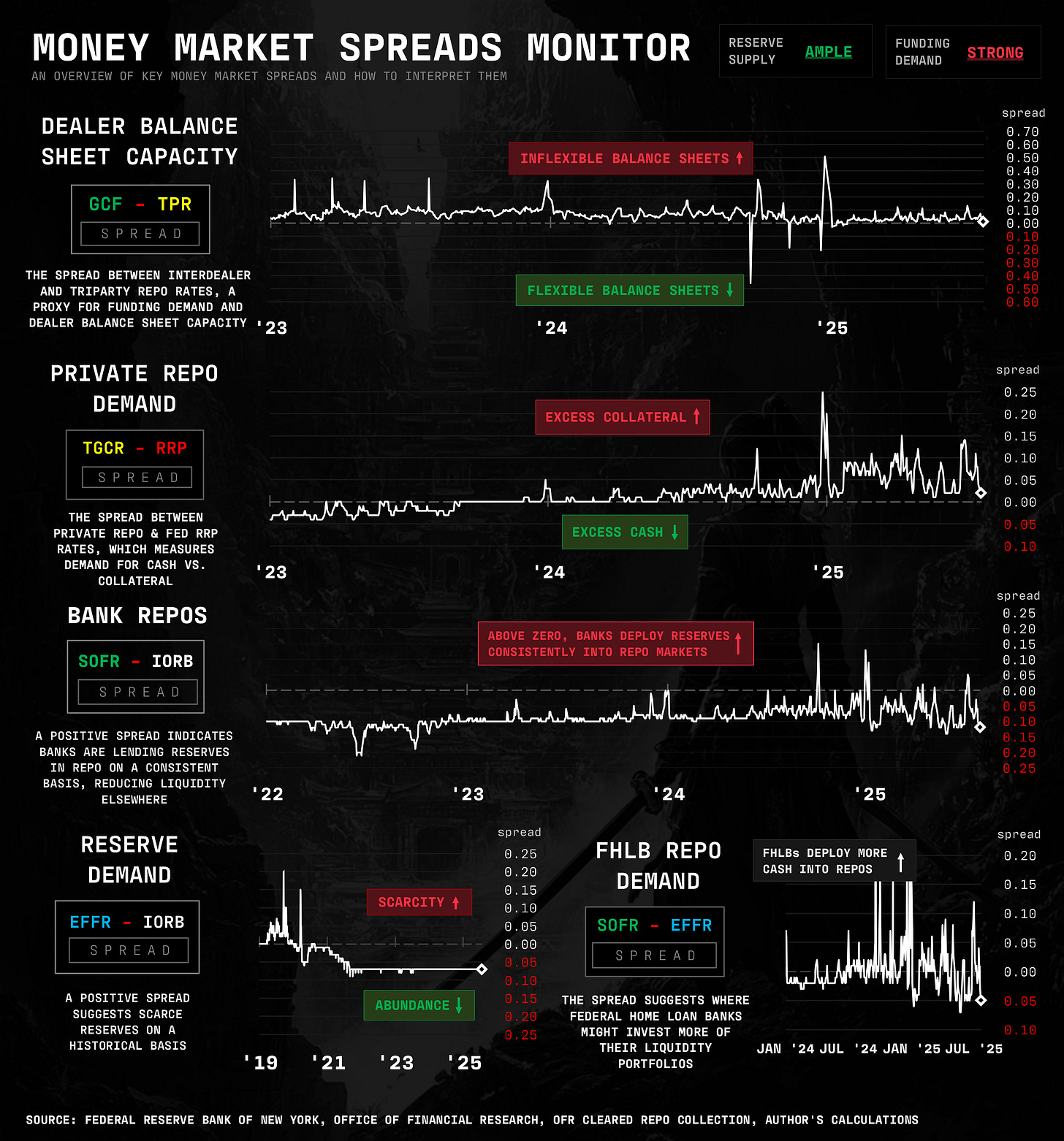

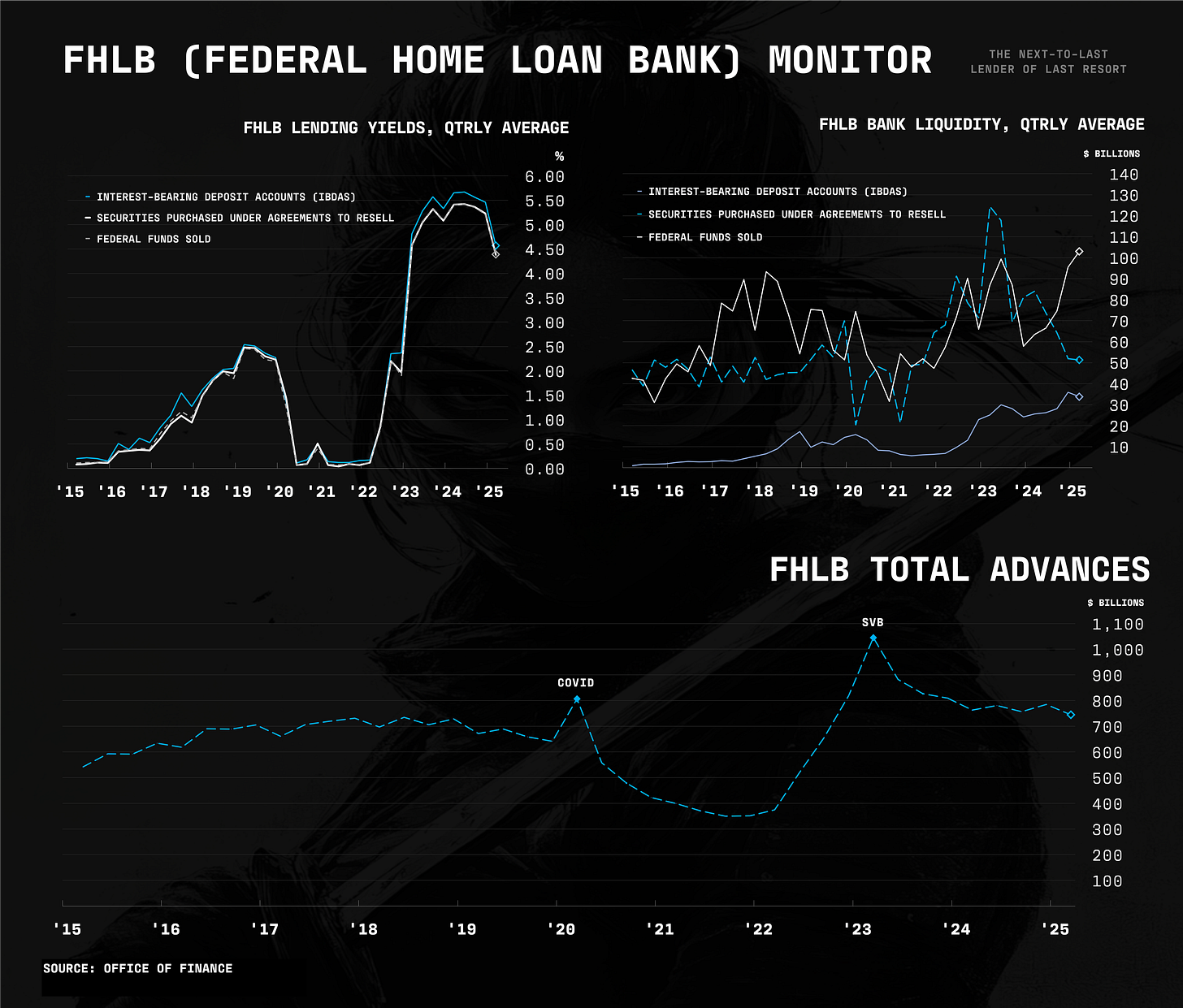

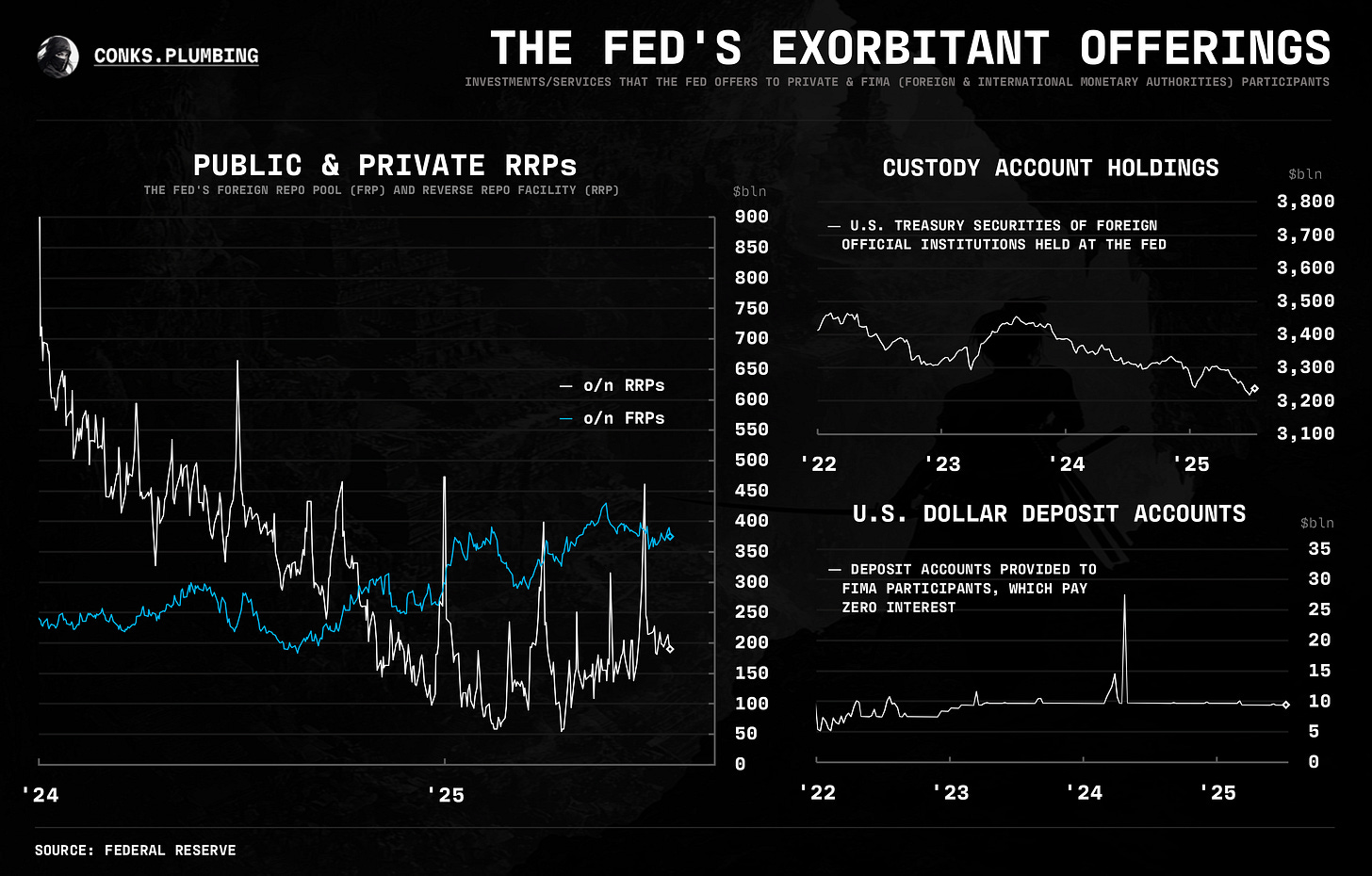

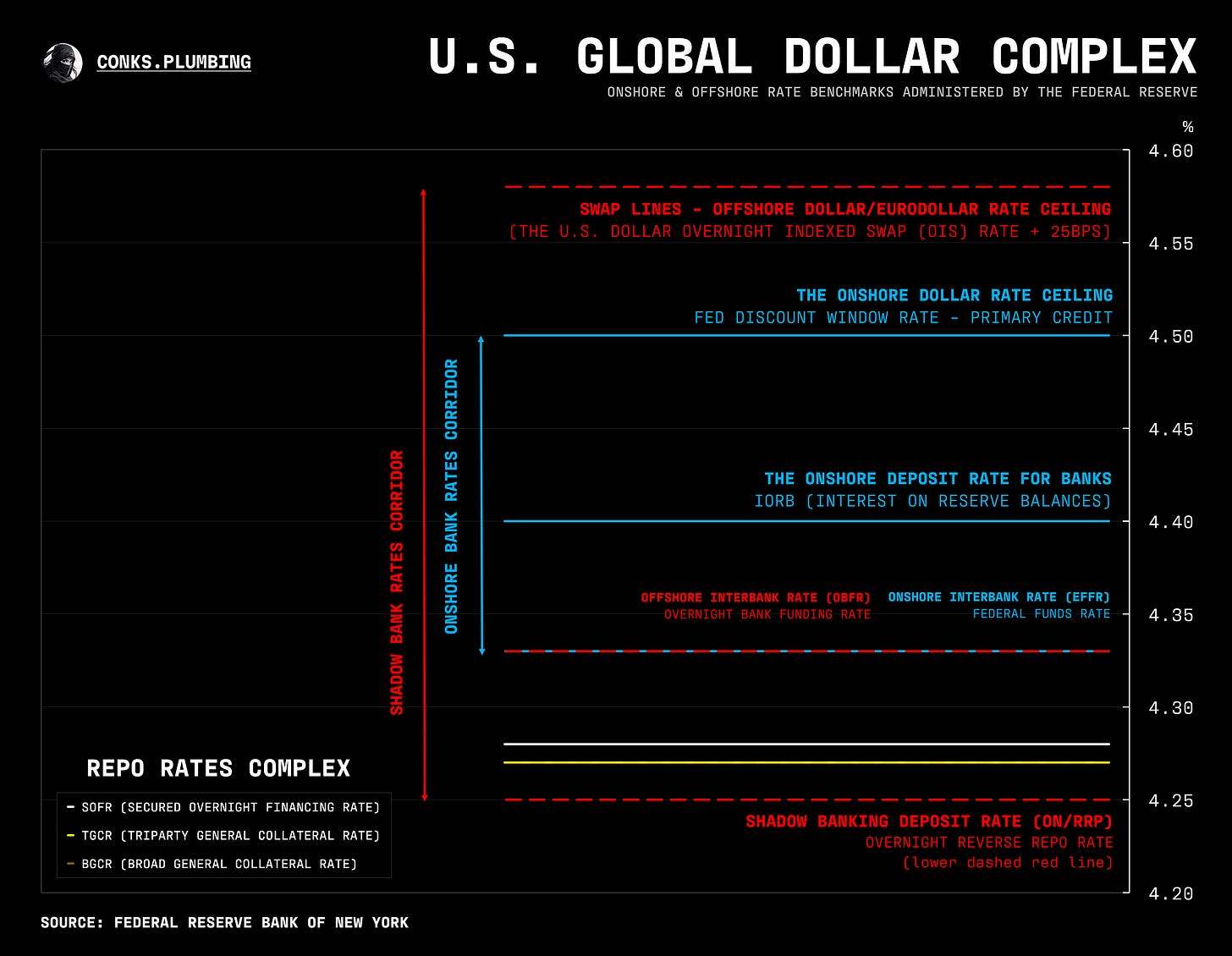

Minus the routine cash injections (such as from FHLBs) pushing down money market rates, SOFR and bill yields will start to rise and disconnect from a stagnant overnight Fed Funds rate (o/n FF). Until reserves (including those “neutralized” in the Fed’s RRP facility) decline by at least another $400 billion, the overnight Fed Funds rate (o/n FF) should remain steady. By then, the Fed’s renewed models on reserve scarcity will be put to the test to intercept another repo spike. The Fed’s arsenal of scarcity measures has intensified, including domestic bank borrowing activity in the interbank market and intraday overdrafts (usually incurred when the “wrong type” of banks run low on reserves).

As mentioned in the Global Put Series, a rising o/n FF remains the “canary in the coalmine” for the Fed to begin adding liquidity (via bill purchases, not full-blown QE) — while officials also initiate a “Great Rebalancing”. The Fed’s Waller recently suggested $2.7 trillion as an estimate for the Fed’s lowest comfortable level of reserves, known as LCLoR. Conks has adjusted our own LCLoR estimates to $2.9 trillion, based on Fed calculations, and then adjusted higher for other “covert” drivers, including banks’ intraday liquidity needs causing more hoarding of reserve balances.

The “doom date”, i.e. when reserves grow so scarce the Fed intervenes, has been pushed back to February or March 2026. But in the meantime, traders will now look forward to the most “eventful” QRA (quarterly refunding announcement) this year: the August refunding. As Bessent is set to postpone increased long-end issuance for as long as possible, another $1 trillion in net bill issuance is expected to hit the market the following year. Healthy money fund demand, along with frontier sources (e.g. stablecoins), will absorb this issuance nicely, with money market spreads (such as bill-OIS) widening “only” a few basis points — up to 6bps in our view. Front-end cross-currency (XCCY) bases (see the chartbook below) will also remain “tight”, which (unlike swap spread “tightening”) indicates looser dollar funding conditions.

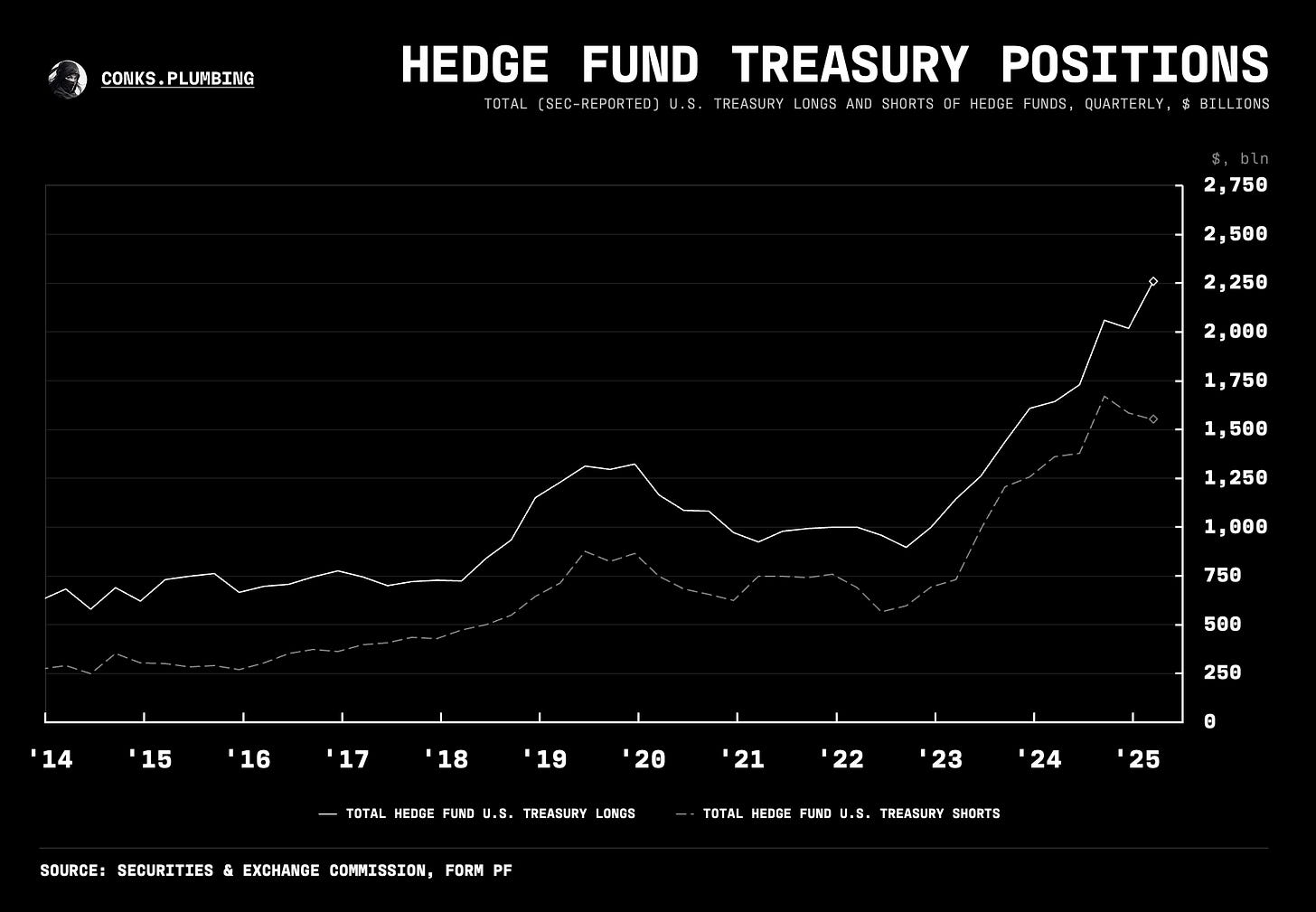

As for swap spreads and thus the state of Treasury plumbing conditions, the latest policy effort to ease dealer balance sheets has not been well received (as expected). Swap spreads have instead tightened (sold off) since our redux call and a proposal passed to (supposedly) ease constraints via reducing the enhanced version of the SLR (supplementary leverage ratio). Monetary leaders will accordingly need a bigger “relief valve” to truly grease the pipes of the UST plumbing. Conks turned neutral on further tightening in (swap) spreads (and SOFR-FF basis), but we could see further pressures build.

Lastly, in equities, unlike certain pockets of the stock market, speculative hype hasn’t reached the levered space. The basis boiz (Conks’ nickname for providers of levered exposure) continue to price equity repos cheaply as demand remains lackluster. Conks expects tame funding rates to persist through July, likely due to the looming August tariff deadlines. Cue the next round of fireworks!

Changelog: Added t-bills outstanding and 3m XCCY basis futures.

WIP: a STIR monitor/Treasury monitor to accompany these updates.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.