Plumbing Notes: Dealer Congestion

while the short-end braces for a switch from a cash flood to a bill deluge, long-end investors have persisted despite trump tariffs, but not enough for dealers to clear inventories

In case you missed it, or you’ve just joined us, the first part of The Shadow Cash Market went live yesterday. What’s more, the first infographic prints are available now in the Conks Store. More will be added when we have time.

As for the next release, Part II is fully in the works…

But first, an ever-expanding money market update…

Summary & Brief Commentary

Bonds have been fully confirmed as “unspooky”, following calls for a sharp long-end selloff flooding in, just as bonds and STIRs started to bottom and rally aggressively.

As indicated by various bank investor surveys, the extreme long position in bonds has been largely wiped out by the recent volatility. The Treasury has shared information on investor participation (by type) for its recent auctions across the curve in June (information that typically becomes available about a week after auctions conclude). The results were unexpectedly positive. Despite the Trump tariff cascade, the lure of UST auctions has remained enticing, with no indication that domestic and foreign investors had fled the U.S. Treasury market. The benchmark 10-year almost reached a record high participation in the latest auction.

Even so, the effort to lower the duration of Treasury debt has persisted (and is only just beginning), confirmed by Treasury Sec Bessent stating it makes no sense to term out U.S. sovereign debt. As bank and foreign official demand for USTs will center on the belly and short-end of the curve, the Treasury will likely target those areas and hold off at the long end when it starts increasing coupon issuance, likely by early (2026) next year.

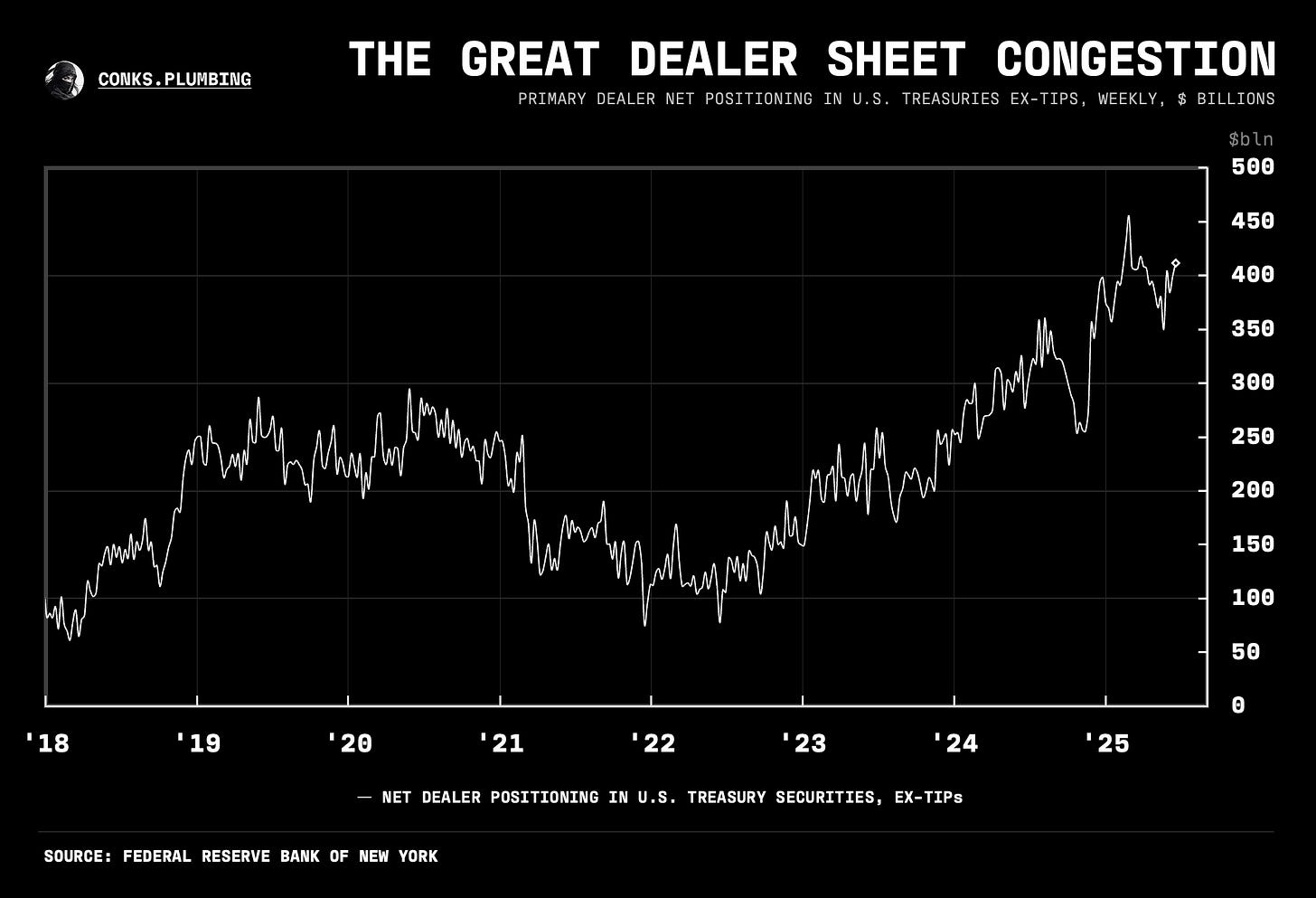

Nevertheless, that won’t ease strains on severely congested dealer balance sheets, yet another reason to remain bearish on (swap) spreads. Duration demand from foreign investors is insufficient to clear inventories while local currency bonds offer a higher yield pickup, particularly for Japanese investors.

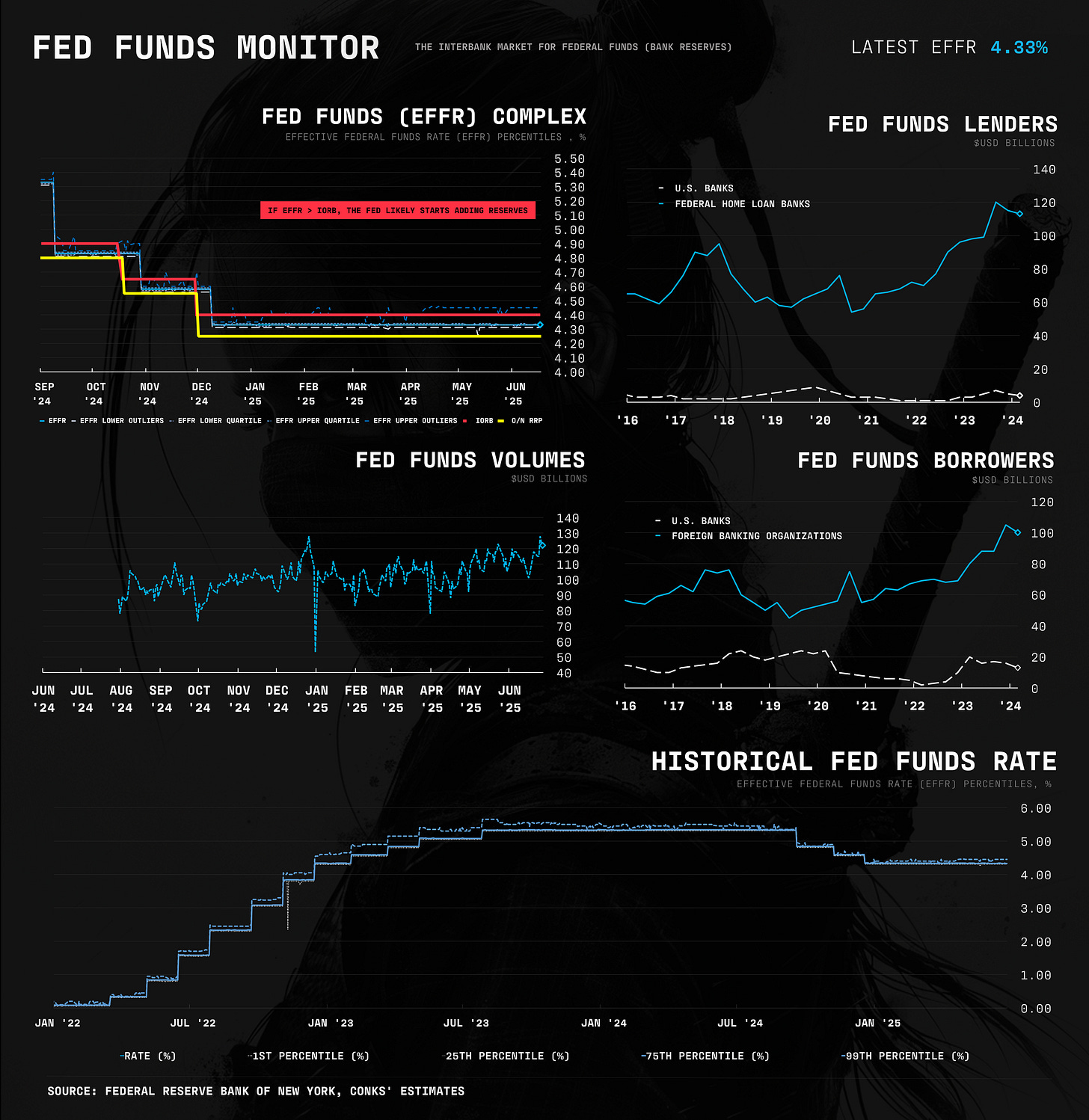

Meanwhile at the ultra-short-end, Conks believes a late-August debt ceiling resolution remains the most likely, while also offering the most upside as priced by the SOFR-FF basis curve. A “prompt” resolve should also help clear remaining RRP balances. After that, only the reserve gap, which still exceeds $400 billion, protects money markets from any turmoil that arises — absent an event of a similar magnitude to the Trump tariff escalation. Reserves should, in the distant future, be drawn down below the dreaded $3 trillion mark, with nothing to offset falling interbank liquidity produced via Fed QT (quantitative tightening). The Fed’s balance sheet reduction will continue at $5 billion per month of USTs (and $35 billion in MBS), causing the Fed little concern to discontinue runoff, at least until September, in our view.

Lastly, Bessent wasn’t fibbing when he said SLR reform was in motion. The FDIC submitted a proposed rule to the Office of Information and Regulatory Affairs (OIRA) this week. Regardless, as Conks has extensively laid out, the Fed’s actions will likely have little impact on UST demand. Deregulatory optimism is set to fade, which will drag swap spreads down with it. Fiscal concerns continue to pressure spreads lower, especially at the long end. We conclude with an unironic “BUCKLE UP”!

Changelog: Bill curve added.

WIP: a STIR monitor coming soon to accompany these updates.

And with that, onto the chartbook…

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

EFFR, OBFR, SOFR, TGCR, and BGCR are subject to the Terms of Use posted at newyorkfed.org. The New York Fed is not responsible for publication of tri-party data from the Bank of New York Mellon (BNYM) or GCF Repo/Delivery-versus-Payment (DVP) repo data via DTCC Solutions LLC (“Solutions”), an affiliate of The Depository Trust & Clearing Corporation, & OFR, does not sanction or endorse any particular republication, and has no liability for your use.