The Fed's New Target: Part I

rising interbank tensions will prompt the next rate evolution

— click here for Pro

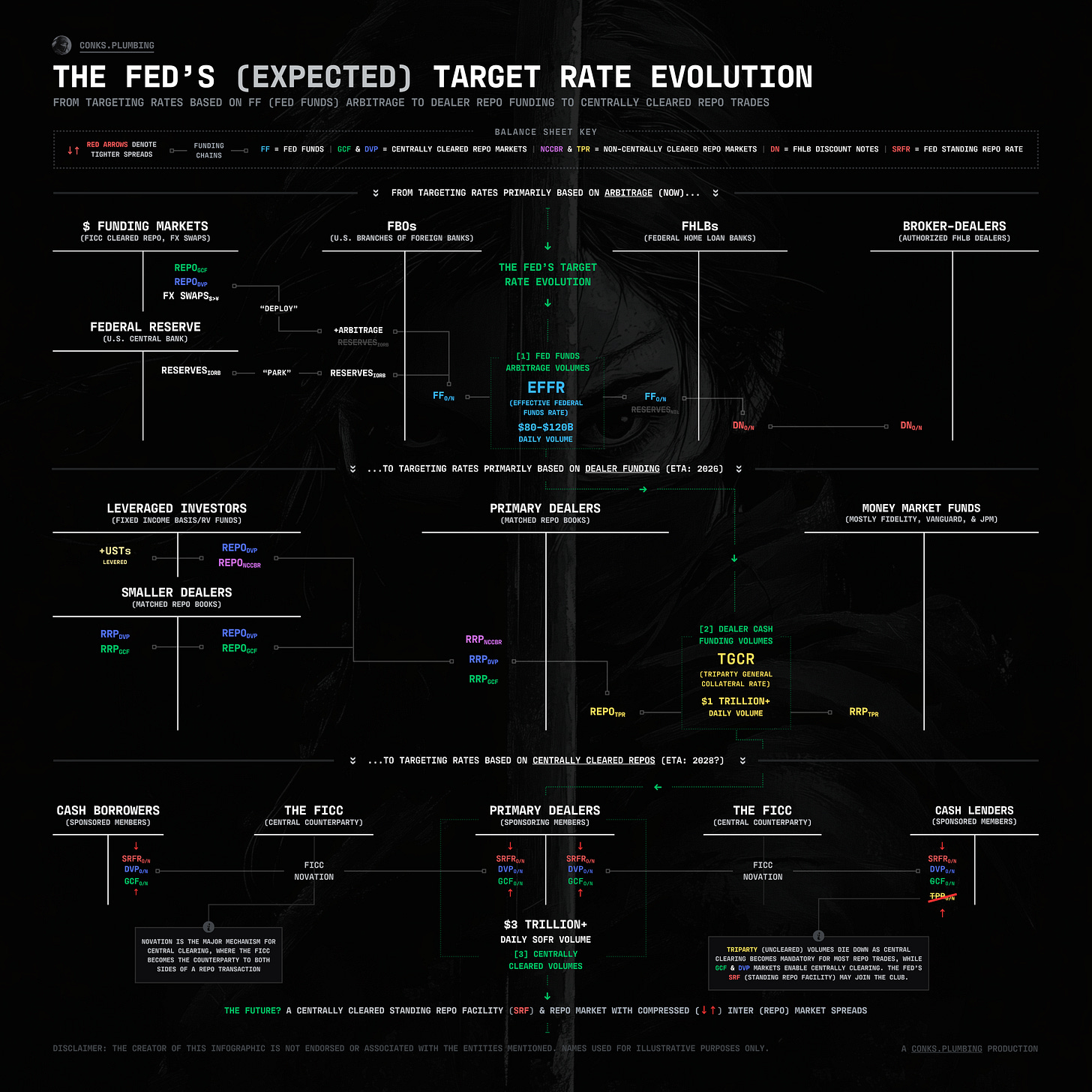

Money markets have experienced yet another quiet year-end. Just a week after ending its balance-sheet taper — where officials shrink the central bank balance sheet via QT1 — the U.S. central bank has commenced an onslaught of reserve injections, marking the start of a Great Compression in money-market rates. Year-end will soon turn into a distant memory, with repo rates (SOFR) set to print well below the Fed’s new fixed SRP (Standing Repo) rate while emergency Fed volumes top out. Large U.S. Treasury (UST) issuance combined with tighter liquidity was destined to make rate spikes a regular feature of the o/n (overnight) rates complex. Yet, the Fed’s RMOs (reserve management operations) have thwarted any chance of a plumbing “hard landing”2. The subsequent Great Compression should not just contain rates within the U.S. central bank’s limits but enable officials to enforce a fully secured standard, no longer targeting overnight Fed Funds (o/n FF) but one of its numerous repo benchmarks. A target rate evolution is looming.

Just as the Fed’s new permanent open market operations (POMOs) have commenced3, a lengthy balance-sheet winter has concluded. Banks' balance sheets, upon the year-end “air pocket” in money markets4, are now destined to expand rapidly, with expected plumbing relief priced in. The lengthy “tug of war” in (swap) spreads, Conks’ real-time gauge for measuring UST market frictions, has ended with an easing of constraints as the victor. This outcome was decided5 in part via one of the most noteworthy6 central bank leaders proposing a shift from targeting an unsecured rate (o/n FF) to targeting a “new-age” secured benchmark (repo) — a move intended to subdue volatility while granting the Fed even greater dominion over money markets7.

Upon delivering a speech at the end of September last year, Dallas Fed President Logan8 has initiated a shift toward the U.S. central bank replacing EFFR — the benchmark for unsecured9 interbank (i.e. o/n FF) rates10 — with a repo benchmark as its “policy rate”, the Fed’s primary mechanism it uses to influence U.S. (hence global) financial and economic conditions. The last prominent evolution, the switch from LIBOR11 to SOFR12, was completed just a few years ago, a decade after private and public-sector behemoths13 sought to oust an unsecured standard, led by LIBOR, from the mainstream. Back then, a potential successor was whittled down to OBFR14, a semi-global unsecured dollar rate, and SOFR, a secured overnight (repo) rate, with the latter crowned as the leading global benchmark for pricing trillions of dollars in financial assets. Yet, despite SOFR becoming LIBOR’s successor, monetary leaders still retained part of the old standard, preserving o/n FF (EFFR) as their desired target rate.

To this day, it has endured. But not for much longer. The near-death of the unsecured interbank market15 has set the stage for monetary leaders to complete the shift away from targeting rates based on unsecured dealings. Central bank officials have grown wary of the frail linkages, primarily opportunistic arbitrage trades, binding the Fed Funds market together.

Even so, rising uncertainty among major interbank players will be just one motivation for Fed alchemists to change targets. A fully secured standard awaits.